Research Summary

The report discusses the growth of Liquid Restaking Protocols (LRT) and the increasing amount of Ethereum (ETH) being invested in these protocols. It highlights the recent reshuffling of funds, with over $1.5bn of weETH and ezETH being freed from Pendle and Zircuit pools. The report also notes EtherFi’s dominance in the LRT space, with its Liquid ETH Vault being a significant factor in its success.

Key Takeaways

Growth of Liquid Restaking Protocols

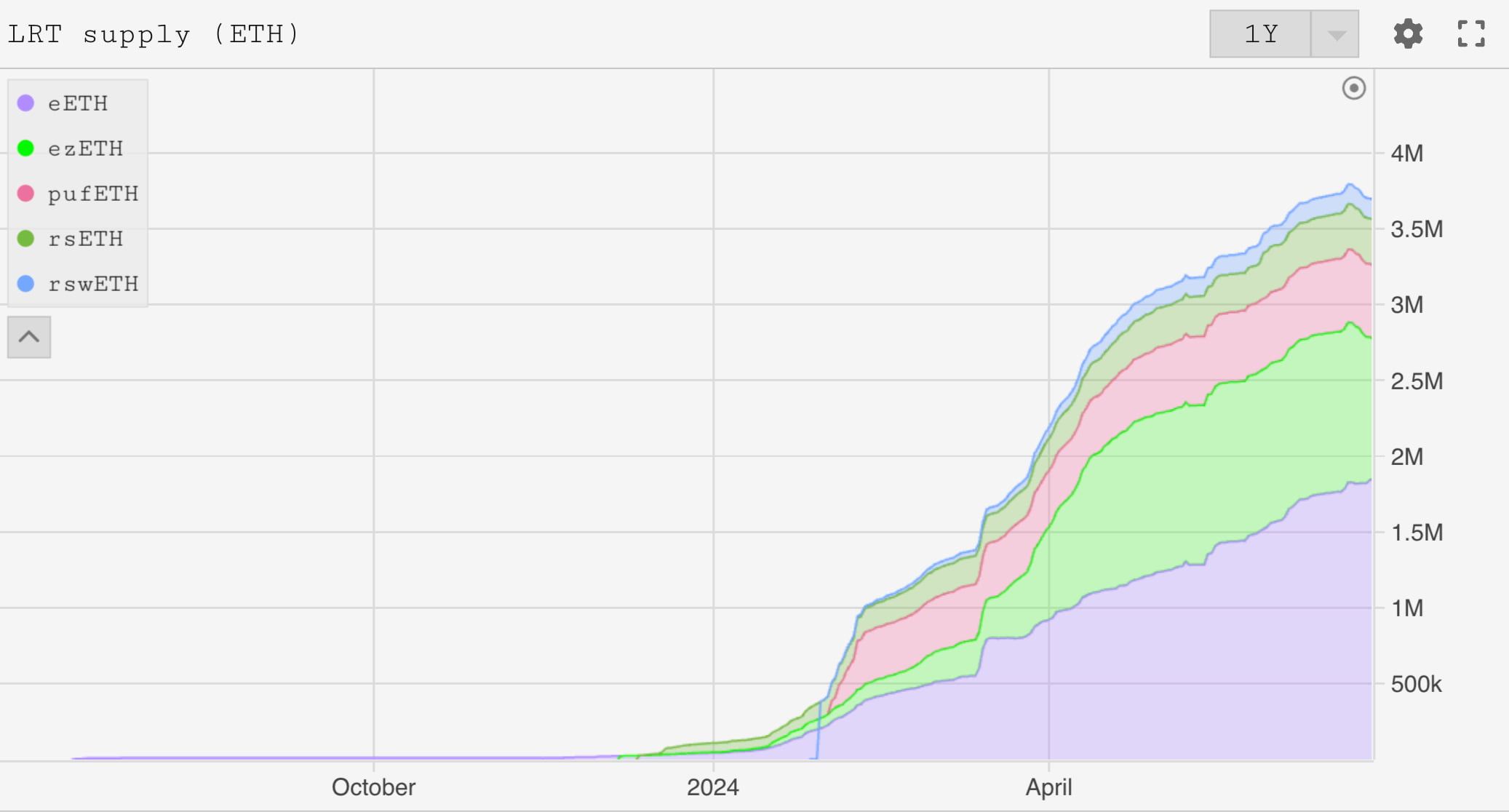

- Increasing ETH Investments: The report notes a significant increase in the amount of Ethereum (ETH) being invested in Liquid Restaking Protocols (LRT). The total LRT supply is currently around $13 billion or 3.7 million ETH.

Reshuffling of Funds

- Capital Movement: Over $1.5bn of weETH and ezETH has been freed from Pendle and Zircuit pools, with around $330m currently moving through the eETH and ezETH withdrawal queues. This represents roughly 1.5% of EtherFi and 6% of Renzo’s TVL being withdrawn.

EtherFi’s Dominance

- Leading in LRT Space: EtherFi is emerging as the category winner in the LRT space. Their multi-season airdrop and products like their Liquid ETH Vault have contributed to EtherFi being No.1 in terms of TVL in this category by quite some margin.

Liquid ETH Vault

- Managed Fund for weETH: EtherFi’s Liquid ETH Vault is like a managed fund for weETH, a one-stop shop for a variety of yield strategies. It currently holds around $700m of ETH and a large Aave V3 position.

On-chain Flows of weETH

- Capital Distribution: Despite some capital flowing into withdrawals, the majority of the Pendle outflow has flowed back into EOAs/multi-sigs, Aave, and EtherFi’s liquid vault.

Actionable Insights

- Monitor EtherFi’s Strategies: EtherFi’s success in the LRT space, particularly with its Liquid ETH Vault, suggests that their strategies and products could be worth monitoring for future developments in the DeFi sector.

- Understand LRT Dynamics: The reshuffling of funds and the growth of LRTs indicate that understanding the dynamics of LRTs could be beneficial for those interested in the DeFi space.

- Track On-chain Flows: The report highlights the importance of tracking on-chain flows of weETH and other assets, as these can provide insights into the movement and distribution of capital in the DeFi sector.