Research Summary

The report discusses the current state of the cryptocurrency market, focusing on Bitcoin (BTC) and Ethereum (ETH), and the activities of large entities such as the German government and Genesis. It also highlights the performance of Hyperliquid spot tokens and the potential of Hyperliquid as a decentralized exchange.

Key Takeaways

Bitcoin’s Market Stability

- Bitcoin’s Resilience: Despite the German government and other large entities offloading their Bitcoin, the price of BTC has remained stable around $57k. This suggests that the market is becoming less sensitive to negative news.

Ethereum Whale Activity

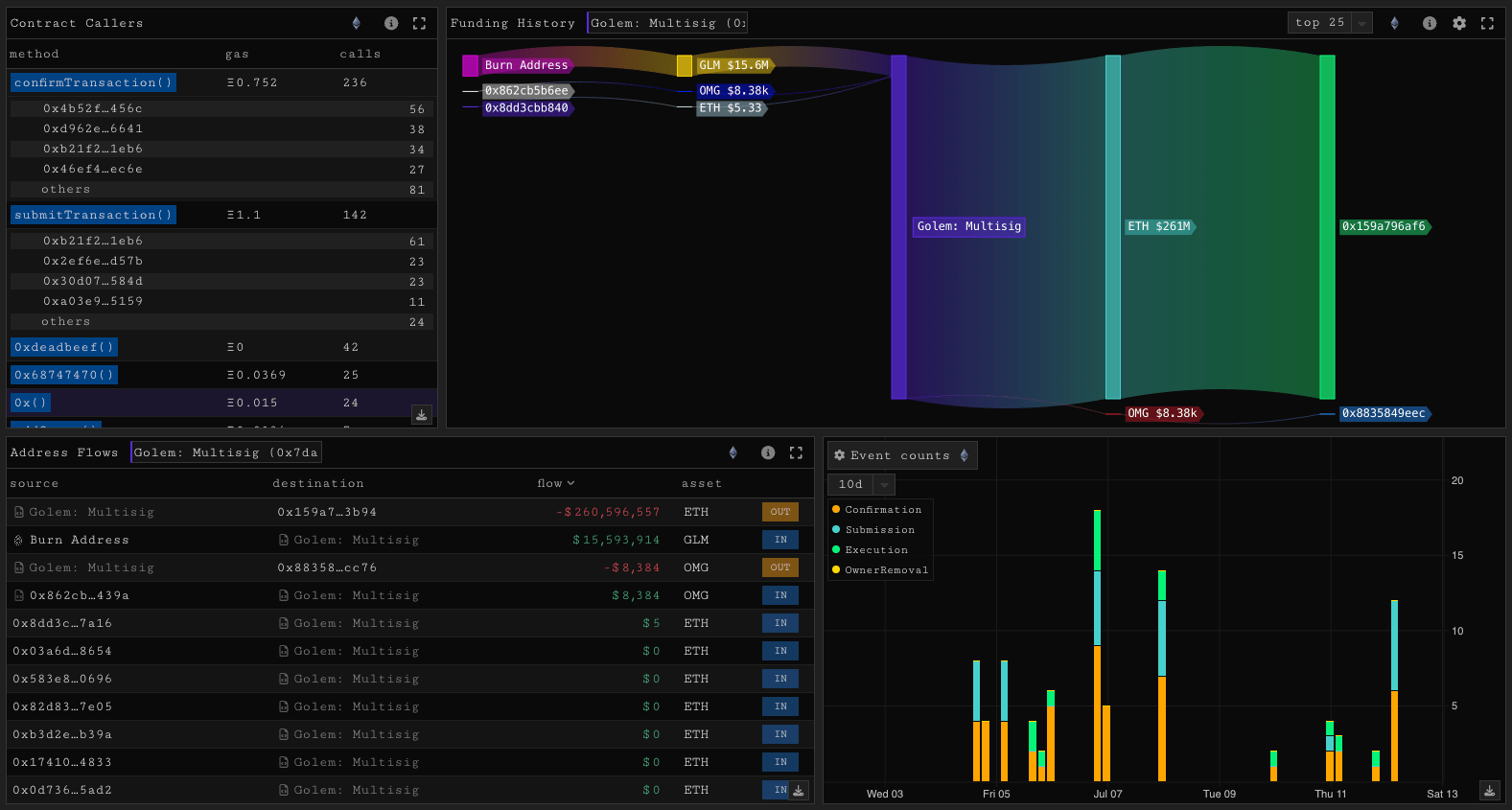

- Large-scale ETH Selling: Golem, an ICO era whale, has started selling its large stack of ETH. In the last 10 days, they have sent 71,000 ETH ($260m) to exchanges, which is nearly half of what remained from their initial 820,000 ETH raised in 2016.

Genesis’s Bitcoin Transfers

- Genesis’s BTC Offloading: Genesis, a subsidiary of DCG, has been transferring large amounts of BTC to Coinbase since mid-June. They have sent out 12,000 BTC, although these amounts are smaller than those offloaded by the German government.

Hyperliquid’s Growing Attention

- Hyperliquid’s Potential: Hyperliquid, a decentralized exchange, is gaining attention due to its potential to take significant market share from centralized exchanges. It is building towards a whole chain that challenges the likes of the parallelised EVM narrative, and its spot tokens are outperforming while the rest of the market trades sideways.

Hyperliquid’s Volume and User Activity

- Hyperliquid’s Performance: Hyperliquid generally does between $500m and $2b in volume per day, holds just under $400m in USDC, and has had 150k users since inception. This suggests a high level of activity and user engagement on the platform.

Actionable Insights

- Monitor Bitcoin’s Market Reaction: Given the resilience of Bitcoin’s price despite large entities offloading their holdings, it may be beneficial to monitor how the market reacts to future negative news.

- Track Ethereum Whale Activity: The large-scale selling of ETH by Golem could impact the market. Keeping an eye on such whale activities could provide insights into potential market movements.

- Observe Genesis’s Bitcoin Transfers: Genesis’s ongoing transfers of BTC to Coinbase could have implications for the market. Tracking these transfers could offer valuable insights.

- Assess Hyperliquid’s Growth: Hyperliquid’s growing attention and its potential to challenge centralized exchanges make it a platform worth assessing for its impact on the broader cryptocurrency market.

- Examine Hyperliquid’s User Activity: The high volume and user activity on Hyperliquid suggest a thriving platform. Examining these metrics could provide insights into user behavior and market trends.