Research Summary

The report provides a detailed analysis of Polkadot’s financial status, marketing strategies, and network activity for the first half of 2024. It highlights the platform’s asset categorization, expenditure, income sources, and the challenges it faces due to market volatility and network underperformance.

Key Takeaways

Polkadot’s Financial Status and Asset Categorization

- Asset Distribution: Polkadot’s total assets include cash and cash equivalents, non-liquid custodial supply, designated assets, and receivable loans. The majority of the cash and cash equivalents are held in DOT, posing financial risks due to market volatility.

- Asset Management: AssetHub and Hydration are integral parts of Polkadot’s network, managing assets and ensuring network health. The non-liquid custodial supply is tied up in the Hydration Omnipool as single-sided liquidity.

- Designated Assets: Polkadot Treasury has earmarked a significant amount of DOT for specific initiatives, indicating a planned future investment in the ecosystem’s growth and development.

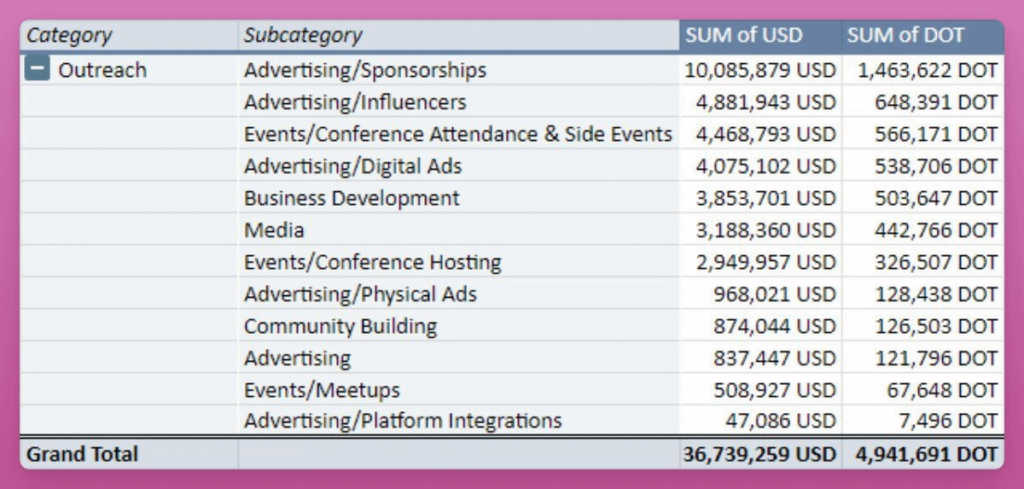

Polkadot’s Expenditure and Marketing Strategies

- Outreach Expenditure: Polkadot’s total expenditures for the first half of 2024 reached 11,327,316 DOT, with outreach, including marketing and community development, being the largest at 4,941,691 DOT.

- Marketing Collaborations: Polkadot engaged in several advertising collaborations with EVOX and Lunar Strategy, achieving significant reach through Key Opinion Leaders (KOLs) and digital advertising campaigns.

- Event and Media Outreach: Polkadot’s outreach expenses for events and media were significant, highlighting the importance of these strategies in their outreach efforts.

Polkadot’s Network Activity and Performance

- Staking Rate: Polkadot’s staking rate is currently at 58.18%, below the ideal rate of 60%, resulting in additional funds being allocated to the Treasury due to the inflation mechanism.

- Network and Social Activities: Despite high marketing and advertising spending, Polkadot’s network and social activities have not seen a corresponding increase in engagement.

Polkadot’s Financial Challenges

- Treasury Deficit: Polkadot’s Treasury is currently operating at a deficit, with a half-year net loss of 8,440,314 DOT, against revenues of 2,887,002 DOT.

- Liquidity Risk: The Treasury’s liquidity is at risk, with only 29,336,487 DOT in cash and equivalents, which at the current monthly loss rate of 1,406,719 DOT, will last approximately 20.85 months.

Actionable Insights

- Assess Polkadot’s Financial Stability: Given Polkadot’s current financial status, it is crucial to assess its financial stability, especially considering the market volatility and the risks associated with holding a majority of assets in DOT.

- Examine Polkadot’s Marketing Strategies: Polkadot’s marketing strategies, including collaborations with EVOX and Lunar Strategy, and its event and media outreach efforts, should be examined for their effectiveness in boosting network activity and engagement.

- Monitor Polkadot’s Network Performance: Polkadot’s network performance, including its staking rate and network activity, should be closely monitored to understand its long-term viability and utility.

- Consider Polkadot’s Financial Challenges: Polkadot’s financial challenges, including its treasury deficit and liquidity risk, should be taken into account when considering its future prospects.