Research Summary

The report provides an in-depth analysis of QiDao, a decentralized finance protocol, focusing on its performance, key metrics, and developments in Q1 2024. It highlights the protocol’s recovery from the Fantom bridge hack, its total value locked (TVL) growth, and the challenges it faced in generating revenue.

Key Takeaways

QiDao’s Recovery and Growth

- Overcoming the Fantom Bridge Hack: Despite the setback from the Fantom bridge hack in 2023, QiDao managed to grow its TVL by 11% in Q1 2024, indicating a successful recovery.

- TVL Growth Led by Polygon: The growth in TVL was primarily driven by Polygon, where QiDao cleared all bad debt and stabilized the ecosystem.

Revenue Generation Challenges

- Significant Drop in Revenue: Despite the growth in TVL, QiDao’s demand-side revenue dropped significantly, indicating a need for recalibrating the fee structure or enhancing user engagement strategies.

- Decrease in Fees Paid by Users: Fees paid by users continued to fall on the five chains measured, with users paying only $16,200 in Q1 2024, a significant decrease from the previous year.

Key Developments and Strategic Moves

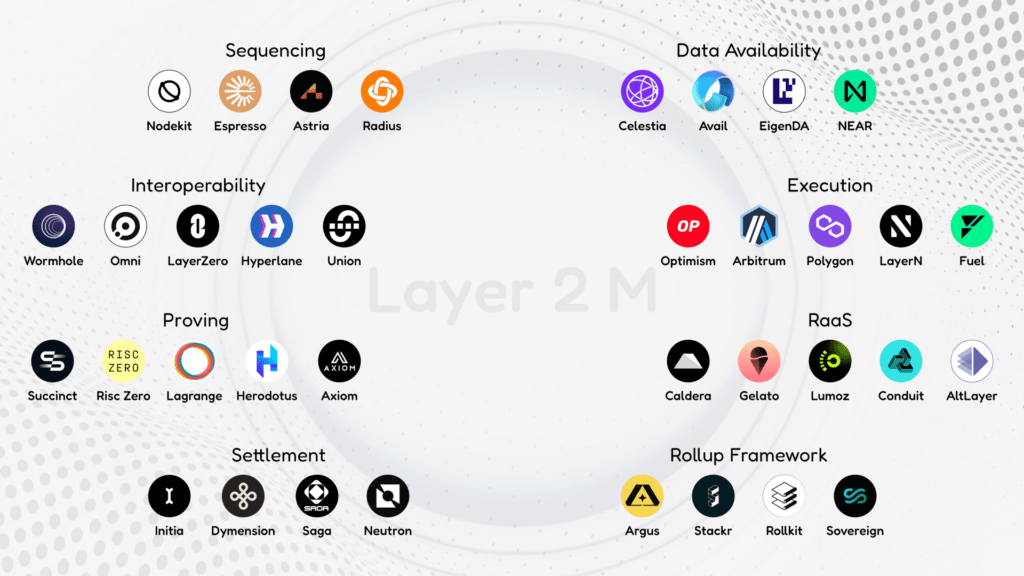

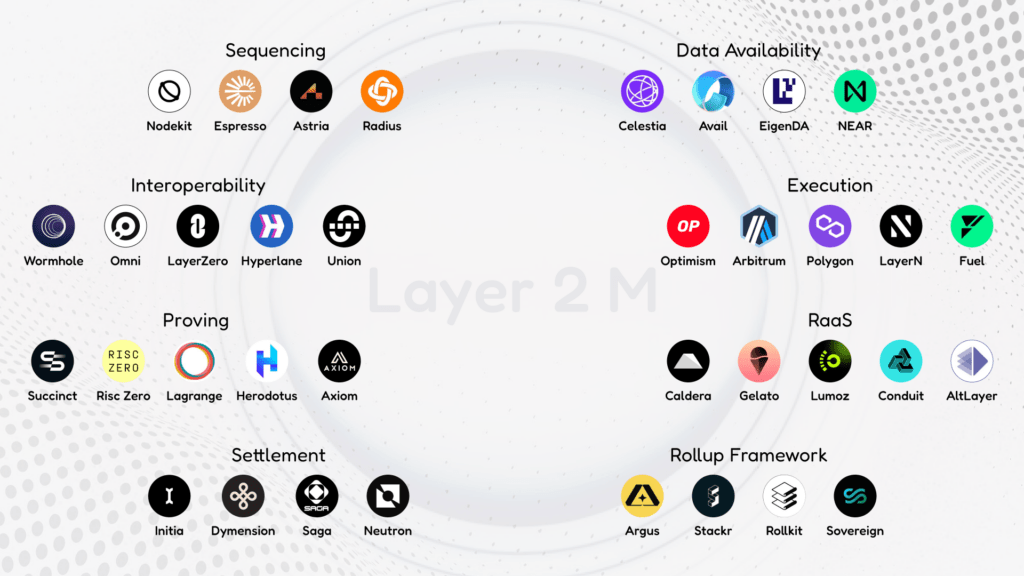

- Technological Upgrades: QiDao introduced technological upgrades such as deployments on zkEVM and integrations with new oracle services, demonstrating its commitment to maintaining a competitive edge in the DeFi space.

- Strategic Decisions: QiDao made several strategic decisions, including adding a Peg Stability Module (PSM) vault, deprecating certain collateral types, and aligning borrowing costs to the Federal Funds rate.

Actionable Insights

- Monitor QiDao’s Revenue Generation Strategies: Given the significant drop in revenue despite the growth in TVL, it would be beneficial to closely monitor QiDao’s strategies for boosting protocol earnings, such as recalibrating the fee structure or enhancing user engagement strategies.

- Assess the Impact of Strategic Decisions: QiDao’s strategic decisions, such as adding a PSM vault and aligning borrowing costs to the Federal Funds rate, could have significant implications for its performance. Therefore, it would be worthwhile to assess the impact of these decisions on QiDao’s operations and financial health.

- Understand the Implications of Technological Upgrades: QiDao’s technological upgrades, such as deployments on zkEVM and integrations with new oracle services, could enhance its competitive edge in the DeFi space. Therefore, understanding the implications of these upgrades could provide valuable insights into QiDao’s future prospects.