Research Summary

The report provides an in-depth analysis of the operational strategy of BLAST, the valuation of the $BLUR token, and predictions for airdrops. It highlights BLAST’s disruptive strategies, substantial market size, and demonstrated capability, making it a top-tier ecosystem worth attention and participation.

Key Takeaways

BLAST’s Operational Strategy

- Disruptive Approach: BLAST’s strategy, including its scoring system and cross-chain lock-up, has been widely replicated by peers, indicating its success. The team’s innovative token distribution has also significantly impacted the industry.

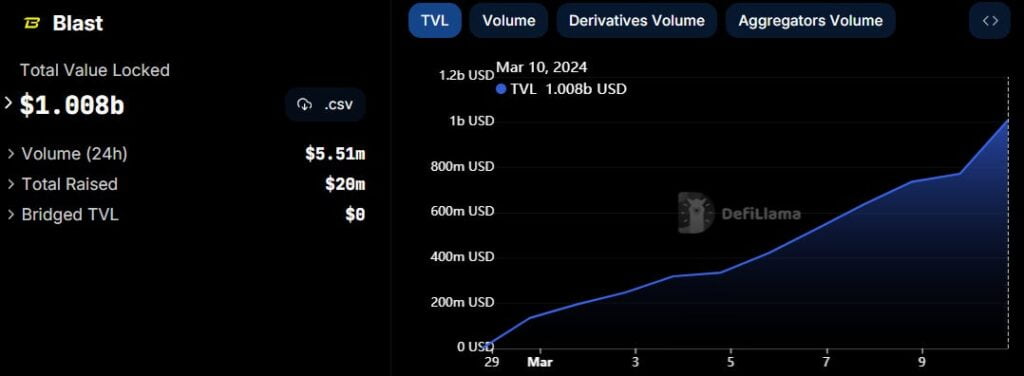

- Strong Market Presence: BLAST has a substantial market size, supported by a network of Key Opinion Leaders (KOLs) and over $1 billion in capital accumulation.

- Demonstrated Capability: The BLAST team has shown successful experiences, strong execution, excellent understanding of market demand, and top-tier VC support.

BLUR’s Market Position

- Leading NFT Platform: BLUR leads the NFT platform market on Ethereum. Despite OpenSea’s primary market valuation reaching $13.3 billion during the 2022 bull market, BLUR’s fully diluted valuation (FDV) is currently only $2 billion.

- Cost-Effective Tool: Over 30% of BLAST’s implied airdrop value is embedded within BLUR, making it a cost-effective tool for users.

BLAST’s Valuation and Airdrop Calculation

- Estimated Valuation: The report conservatively estimates BLAST’s valuation at $5 billion, with an implied market cap of $600 million.

- Airdrop Calculation: There are four ways to obtain the Blast airdrop: rewards for developing projects on Blast, scoring on BLUR, staking BLUR, and cross-chain locking on Blast.

BLAST’s User Count and TVL

- High User Count: BLAST has attracted 120,000 users and is likely to become the L2 platform with the most daily active users.

- Significant TVL: BLAST’s TVL is currently $1.3 billion, ranking it 6th worldwide and 2nd among L2s.

Risks Associated with BLAST

- Multi-signature Wallets: The risk of multisignature wallets in Blast’s cross-chain bridge is highlighted.

- Potential for Rugs: The risk of rugs occurring on Blast may be higher, as projects receiving airdrops may be more short-sighted and exit after receiving airdrops.

- Dependence on Innovative Applications: If Blast cannot enlarge the cake through innovative applications, the token price will inevitably decline due to excessive selling pressure, with no new players entering.

Actionable Insights

- Monitor BLAST’s Operational Strategy: Given BLAST’s disruptive approach and strong market presence, it’s worth keeping an eye on its operational strategy and potential impact on the market.

- Consider BLUR’s Market Position: With BLUR leading the NFT platform market on Ethereum and serving as a cost-effective tool, it could be beneficial to consider its market position and potential growth.

- Assess BLAST’s Valuation and Airdrop Calculation: Given the estimated valuation of BLAST and the various ways to obtain the Blast airdrop, it could be useful to assess these factors for potential opportunities.

- Examine BLAST’s User Count and TVL: With a high user count and significant TVL, it’s worth examining these metrics to understand BLAST’s market position and potential growth.

- Consider Risks Associated with BLAST: Given the risks highlighted in the report, it’s important to consider these when assessing BLAST’s potential.