Research Summary

The report introduces Reya Network, a trading-optimized Layer 2 solution designed to enhance liquidity, capital efficiency, and performance for DeFi traders and liquidity providers. The network aims to solve issues such as liquidity fragmentation and front-running in DeFi. It features a passive liquidity pool mechanism, a margin engine logic, and a ‘first-in-first-out’ transaction execution model. The report also discusses the network’s future plans, its community, and its funding.

Key Takeaways

Reya Network: A Solution to DeFi’s Liquidity Fragmentation

- Addressing Liquidity Fragmentation: Reya Network is designed to solve the problem of liquidity fragmentation in DeFi, where each new exchange competes for limited liquidity. The network’s design features a novel passive liquidity pool mechanism that allows instant shared liquidity for all exchanges within the Reya ecosystem, improving market depth and user experience.

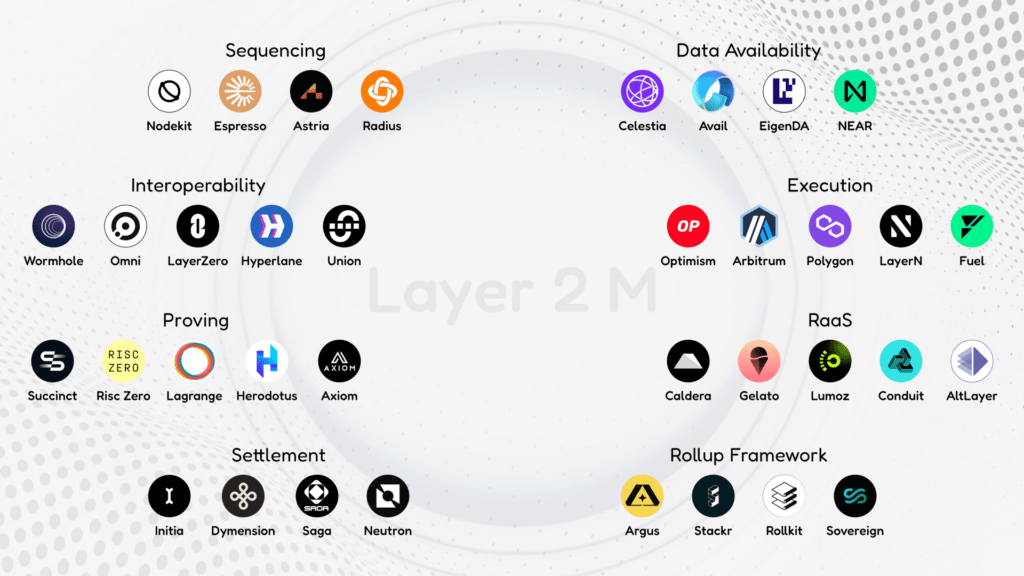

- Preventing Front-Running and MEV: Reya Network aims to prevent front-running and harmful Maximal Extractable Value (MEV) by enabling parallel execution. The network employs a ‘first-in-first-out’ (FIFO) transaction execution model with zero gas fees, leveraging Arbitrum Orbit technology.

- Enhancing Capital Efficiency: Reya Network’s margin engine logic offers up to 3.5x improvements in capital efficiency for traders and up to 6x for liquidity providers (LPs). Users can have a single margin account across multiple exchanges, effectively creating a decentralized clearinghouse.

- Performance and Speed: Reya Network is one of the fastest EVM rollups, with 100ms block times and a throughput of up to 30,000 transactions per second. This performance enhancement could help capture centralized finance (CeFi) volume and bring it on-chain.

- Strong Industry Support: The project has secured nearly $10M in funding from prominent VCs such as Framework, Coinbase Ventures, Wintermute, and others, showcasing strong industry support. Reya Network’s community, comprising members from previous projects, plays a significant role in product development and adoption.

Actionable Insights

- Exploring Reya Network’s Potential: With its innovative solutions to DeFi’s liquidity fragmentation and front-running issues, Reya Network presents a promising opportunity for DeFi traders and liquidity providers. Stakeholders should explore the network’s features and benefits to understand its potential impact on the DeFi ecosystem.

- Understanding the Role of Arbitrum Orbit Technology: Reya Network leverages Arbitrum Orbit technology to prevent front-running and harmful MEV. Understanding how this technology works and its implications for transaction execution could provide valuable insights into the network’s operations.

- Assessing the Impact of Enhanced Capital Efficiency: Reya Network’s margin engine logic significantly improves capital efficiency for traders and LPs. Stakeholders should assess the potential impact of this enhanced capital efficiency on their trading strategies and operations.

- Monitoring Reya Network’s Performance: As one of the fastest EVM rollups, Reya Network’s performance could have significant implications for the DeFi ecosystem. Stakeholders should monitor the network’s performance to understand its potential to capture CeFi volume and bring it on-chain.

- Considering the Role of Community and Industry Support: Reya Network’s strong community and industry support could play a crucial role in its development and adoption. Stakeholders should consider the potential impact of this support on the network’s growth and success.