Research Summary

The report discusses the current market trends, focusing on the resilience of the bull market, the breakout in Qs, and the potential for a contrarian long in soybeans. It also highlights the improving trends in real estate and miners, the short positioning of speculators in the soybean complex, and the potential of asset-heavy businesses and building materials stocks.

Key Takeaways

Resilience of the Bull Market

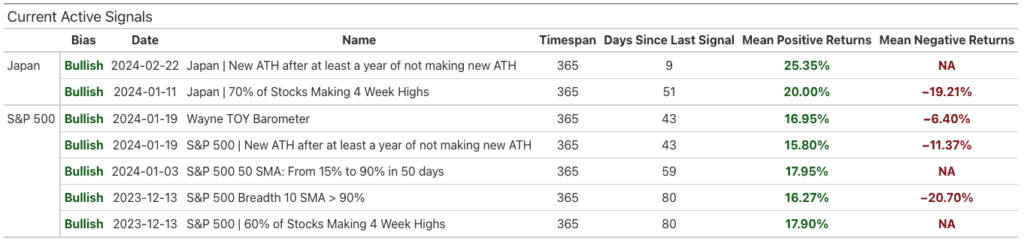

- Continued Bull Market: The report notes the ongoing strength of the bull market, which has surprised many pundits. This resilience is attributed to the major technical signals that have been tracked over the past few months.

- Global Market Returns: The report presents a heatmap of global market returns, showing that most of the world is trending in a bull regime. Notable developments include an improving trend in real estate and miners.

Breakout in Qs

- Qs Breakout: The report mentions a predicted breakout in Qs, which occurred on Friday, triggering an addition to the long position. The market internals oscillator shows that internals remain supportive of the broader uptrend.

Speculators Shorting Soybeans

- Short Positioning in Soybeans: Speculators are reportedly very short the entire soybean complex. The report suggests a potential contrarian long position in soybeans, with soybean meal entering its strongest multi-month period of seasonality.

Asset-Heavy Businesses Set to Outperform

- Asset-Heavy Businesses: According to Goldman Sachs, asset-heavy businesses now trade at the largest valuation discount to asset-light peers. However, earnings growth expectations are higher in asset-heavy businesses, suggesting they offer better earnings growth for a cheaper price.

Building Materials Stocks Making New Highs

- Building Materials Stocks: The report notes that building materials stocks are making new highs, with 116 such stocks making new highs last week. This suggests that these stocks have a lot of room to run higher.

Actionable Insights

- Monitor the Bull Market: Given the ongoing strength of the bull market, investors should continue to monitor major technical signals and global market returns for potential investment opportunities.

- Consider the Qs Breakout: The recent breakout in Qs suggests potential opportunities for investors. However, they should also consider the market internals oscillator to assess the broader uptrend.

- Assess Soybean Complex: With speculators shorting the entire soybean complex, investors might consider a contrarian long position in soybeans, particularly as soybean meal enters its strongest multi-month period of seasonality.

- Research Asset-Heavy Businesses: Given the valuation discount and higher earnings growth expectations for asset-heavy businesses, investors should research these businesses for potential opportunities.

- Explore Building Materials Stocks: With building materials stocks making new highs, investors should explore these stocks for potential opportunities.