Research Summary

The report provides a comprehensive analysis of ApeCoin DAO’s Q3 performance, governance, and future prospects. It highlights key financial metrics, governance activities, token dynamics, and the role of different trader categories. The report also discusses the potential impact of upcoming projects like the Otherside game on APE’s token velocity and the DAO’s ongoing efforts to enhance decentralization.

Key Takeaways

ApeCoin DAO’s Q3 Performance

- Increased Grant Allocation: ApeCoin DAO approved $20.3 million in grants during Q3, marking a 974% increase QoQ. Despite a 51% decline in APE’s price and a 23% drop in unique voters, the DAO remained active, voting on 49 proposals, a 44% increase from Q2.

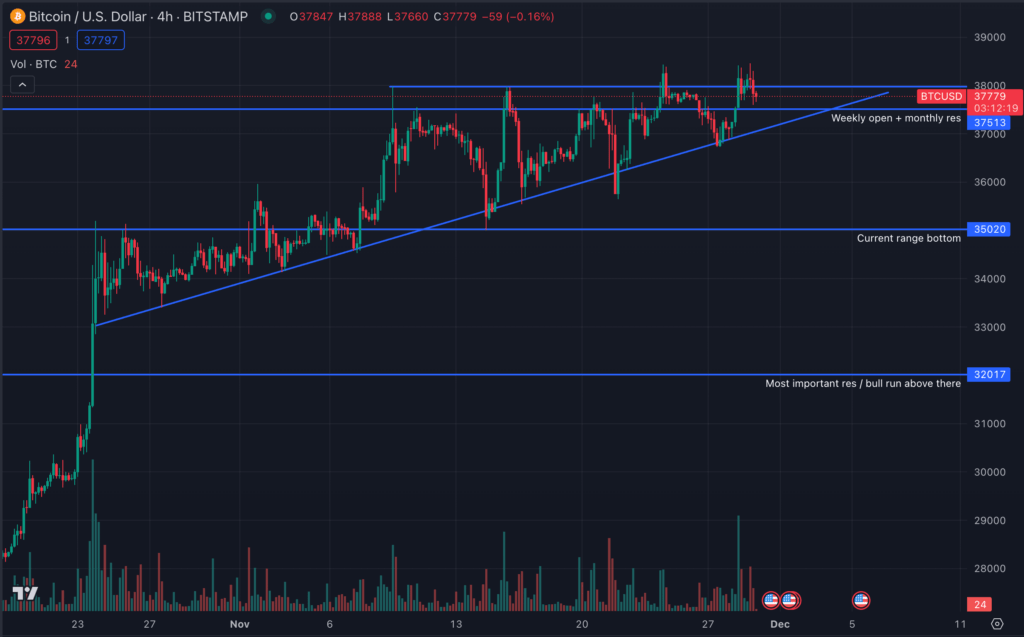

- Token Dynamics: Approximately 49.8 million APE tokens were unlocked to non-DAO entities, adding sell pressure to the APE token and potentially contributing to the steeper decline in price and FDV in Q3. However, the inflow of new APE holders increased by 31% QoQ in Q3.

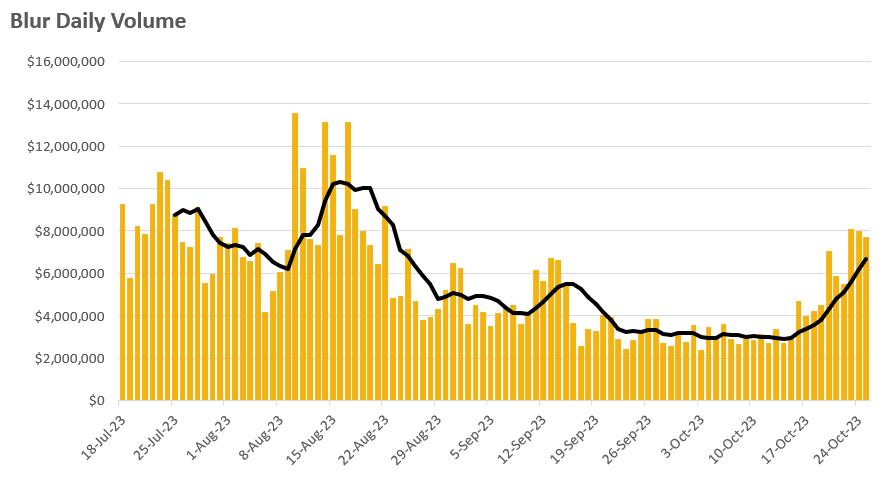

- Trader Influence: Sharks (traders with $1 million to $10 million in daily trading) accounted for 55% of APE DEX trade volume, reducing the influence of whales (traders with over $10 million in daily trading).

- Future Prospects: The launch of the Otherside game using APE as an in-game currency may increase the token velocity of APE. However, increased excitement may also lead to a decrease in token velocity as more holders become interested in managing the DAO and hold the asset for governance participation.

- DAO Governance: ApeCoin DAO plans to move more of the voting process onchain to enhance decentralization but may face gas fees as a barrier to participation. The DAO also approved several proposals, including the creation of an NFT collection and the production of a feature-length documentary.

Actionable Insights

- Monitor the Impact of Token Unlocks: The unlocking of APE tokens to non-DAO entities has added sell pressure to the APE token. Stakeholders should monitor the impact of these unlocks on APE’s price and FDV.

- Assess the Influence of Different Trader Categories: The influence of sharks on APE DEX trade volume has increased, reducing the influence of whales. This shift in trader influence should be assessed for its potential impact on APE’s market dynamics.

- Investigate the Potential of Upcoming Projects: The launch of the Otherside game could potentially increase the token velocity of APE. Stakeholders should investigate the potential impact of this and other upcoming projects on APE’s token dynamics.

- Consider the Implications of DAO Governance Changes: ApeCoin DAO’s plans to move more of the voting process onchain could enhance decentralization but may also introduce barriers to participation. Stakeholders should consider the implications of these governance changes.