Research Summary

The report provides a comprehensive analysis of ApeCoin DAO’s Q4 2023 performance, focusing on the APE token’s market dynamics, governance activities, and the DAO’s financial decisions. It highlights the token’s price surge, the DAO’s strategic funding choices, and the changing behavior of APE traders.

Key Takeaways

APE Token’s Market Performance

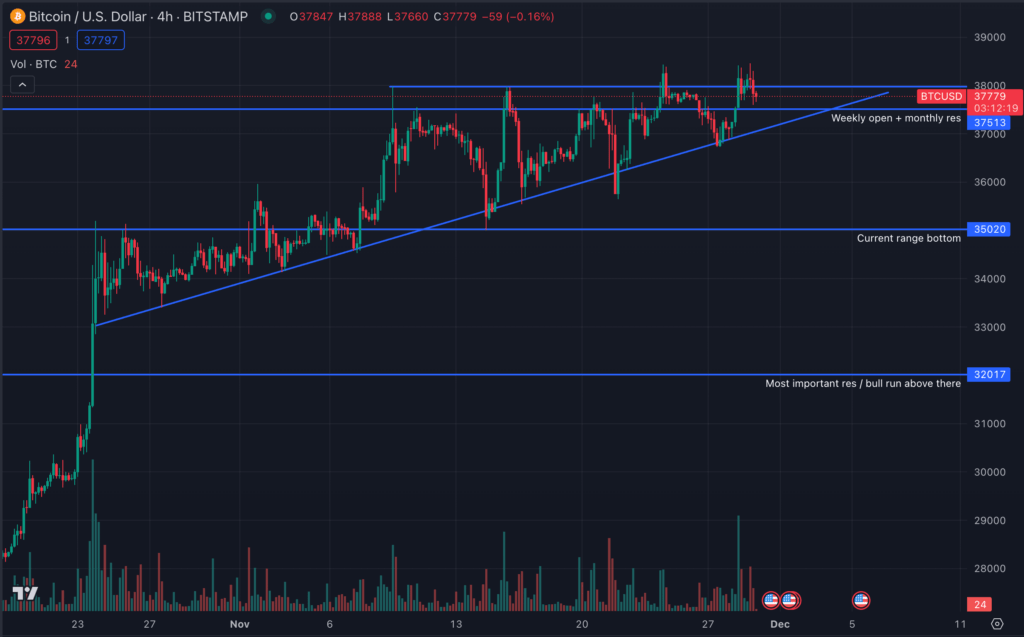

- Price and Market Cap Surge: APE token’s price saw a significant 41% QoQ increase, while its market capitalization rose by 53% during the same period. This growth occurred despite the unlocking of an additional 24.8 million APE to non-DAO entities, which was expected to increase sell pressure and potentially lower the price.

- Decrease in Token Transfers: The frequency of APE token transfers dropped by 30% QoQ, reaching the lowest point in the past year. This suggests a trend of holders retaining their tokens rather than trading them.

- Shift in Trader Behavior: ‘Dolphins’ and ‘seals’—traders with daily trading volumes between $100,000 to $1 million—increased their share to 43% in the DEX trading volume, surpassing ‘whales’ who trade over $10 million daily. This shift reduces the influence of whales on APE’s DEX trading volume.

ApeCoin DAO’s Governance and Financial Decisions

- Reduction in Special Council Pay: ApeCoin DAO members voted to reduce the Special Council’s pay by 50% for incoming members, leading to a projected savings of approximately $375,000 in 2024.

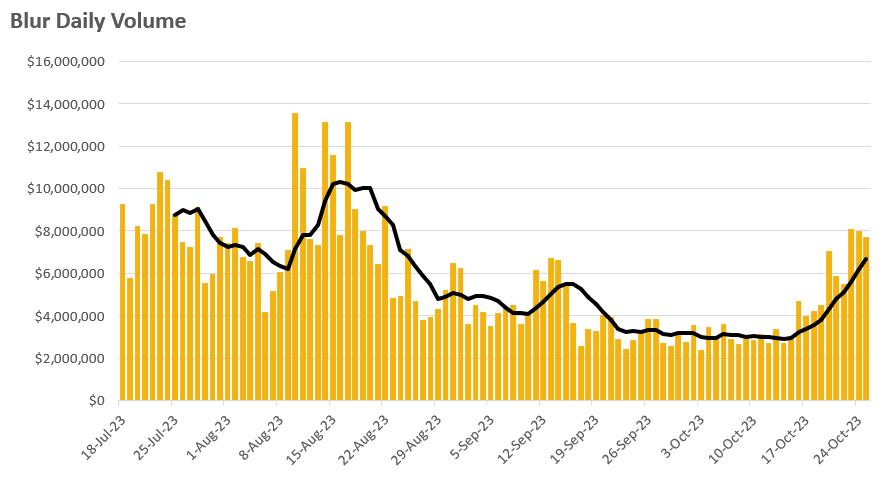

- Decrease in Funding for Grants: The DAO’s funding for grants in Q4 saw a dramatic decrease of 92% QoQ, amounting to $1.6 million. This reflects a more selective approach to treasury expenditure.

- Active Governance Engagement: During Q4 2023, ApeCoin DAO voted on 53 proposals, with 11 passing, 32 failing, and 10 being elections or multiple choice. This shows active governance engagement despite a decrease in average unique voters to 306 in Q4, a 34% fall QoQ.

Actionable Insights

- Monitor APE’s Market Dynamics: The significant increase in APE’s price and market cap, despite the unlocking of additional tokens, suggests a strong market sentiment. Stakeholders should keep a close eye on these dynamics for potential opportunities and risks.

- Understand Trader Behavior: The shift from whale-dominated trades to medium-sized traders indicates a change in the market structure. Understanding this behavior could provide insights into future market trends and trading strategies.

- Assess Governance Decisions: The DAO’s decision to reduce Special Council pay and decrease funding for grants reflects a more conservative financial approach. Stakeholders should assess these governance decisions for their potential impact on the DAO’s future operations and financial health.