Research Summary

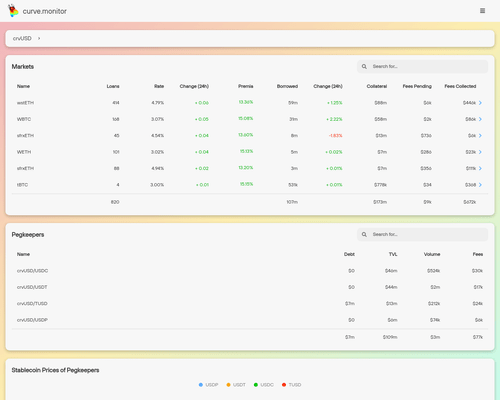

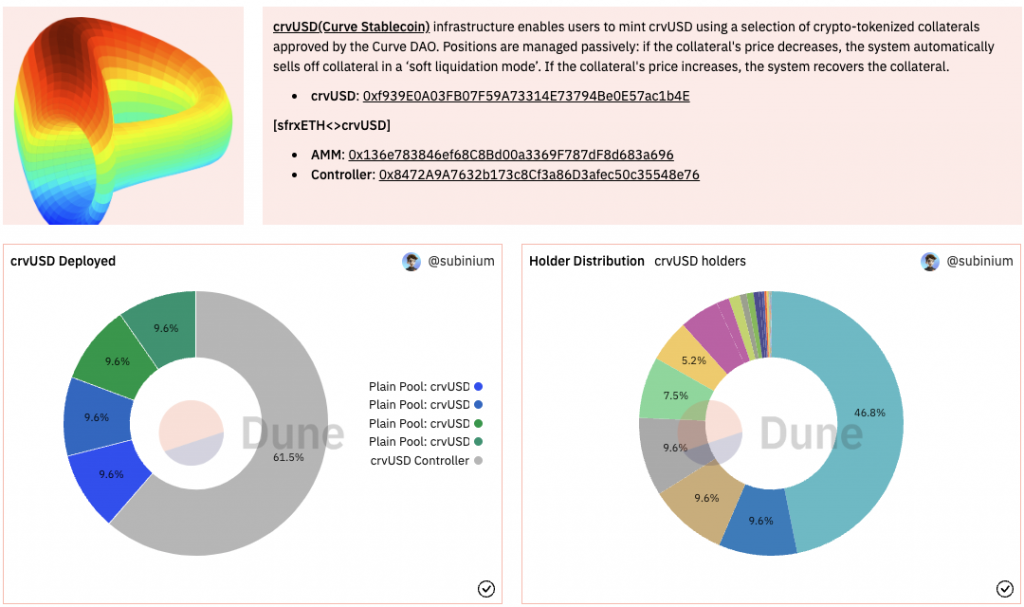

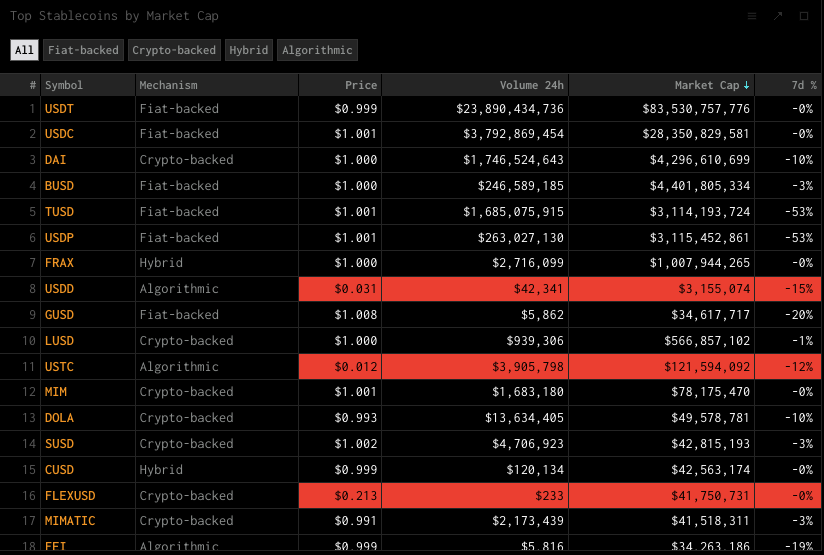

The report discusses the imminent upgrade to the interest rate models of the crvUSD Aggregator on Sturdy Finance v2, managed by Llama Risk. The upgrade aims to improve adaptability to market trends and optimize rates for lenders and borrowers. The report also details the parameters of the new model and its potential impact on the market.

Key Takeaways

Introduction of a New Interest Rate Model

- Adapting to Market Behaviors: The current static linear rate model used by the crvUSD Aggregator is suboptimal as it cannot adequately adapt to changes in market behaviors. The new model aims to optimize a market equilibrium by adjusting the interest rate based on market utilization.

Parameters of the New Model

- Time-Based Mechanism: The new model introduces a time-based component that shifts the curve based on utilization rates. The mechanism is inactive within a min and max target utilization and shifts the curve when the market utilization is greater than the max target or lower than the min target.

- Rate Half Life: This parameter defines how quickly the curve will adjust when utilization is outside the target range. The further current utilization is from the target utilization range, the faster the time-based mechanism will react.

Impact on Borrowers and Lenders

- Benefit to Borrowers: The new model will reduce rates down to its minimum full utilization rate of 5%, providing more favorable conditions for existing borrowers and incentivizing additional borrowers to open positions.

- Impact on Lenders: While the reduction in rates may impact yields for lenders, the majority of yield currently comes from STRDY rewards. The new model targets the vertex utilization rate, which will optimize yields for lenders and create a more sustainable market.

Implementation of the New Model

- Upgrade Process: The Sturdy team will handle the upgrade by assigning a new rateContract within each SturdyPair market. These contracts will be identical to the current IRM contracts with the parameter modifications described in the report.

Comparison with FraxLend Markets

- Similarities and Differences: The parameters used in the new model are consistent with presets used in FraxLend markets, with a notable deviation in the RATE_HALF_LIFE, which is set to 4 days rather than Frax’s standard of 2 days. This is believed to be a better compromise between accommodating leisurely action by users in case of shifting market dynamics, without being so accommodating that lenders risk prolonged illiquidity.

Actionable Insights

- Understanding the New Model: Stakeholders should familiarize themselves with the parameters and mechanisms of the new interest rate model to understand its potential impact on the market.

- Monitoring Market Behavior: Market participants should closely monitor market utilization rates and the corresponding adjustments in the interest rate curve to make informed decisions.

- Assessing Impact on Yield: Lenders should assess the potential impact of the new model on their yields, considering that the majority of yield currently comes from STRDY rewards.