Research Summary

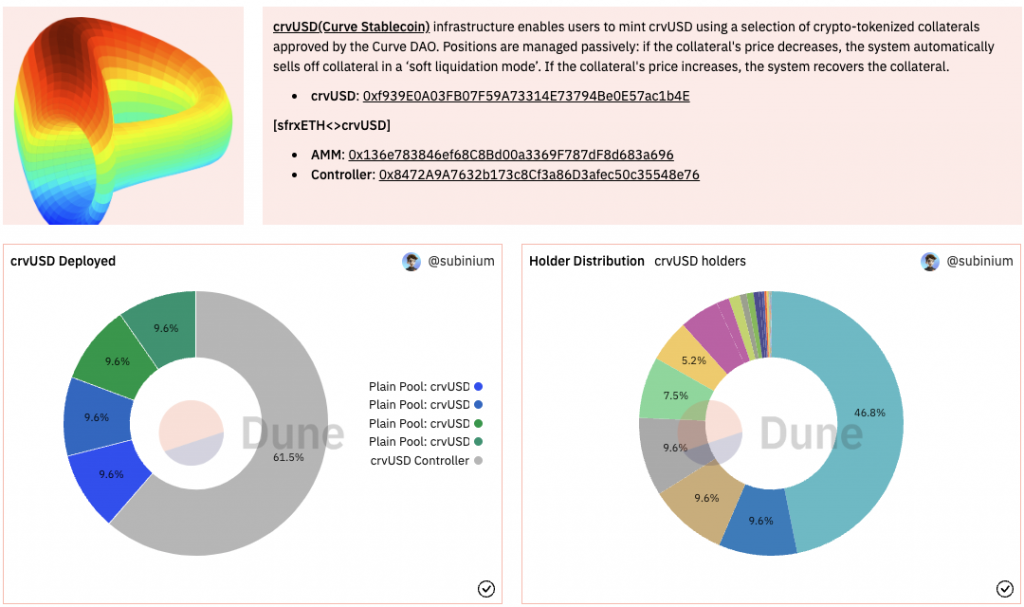

The report discusses the launch of the crvUSD aggregator on Sturdy Finance v2, managed by Llama Risk. It provides an in-depth understanding of the Oracle, which is crucial for borrowers to assess their risk appetite. The report also outlines the Oracle’s calculation process for different markets and announces the upcoming release of a public dashboard with metrics for the crvUSD aggregator.

Key Takeaways

Launch of crvUSD Aggregator

- Introduction of crvUSD Aggregator: Sturdy Finance v2 has launched the crvUSD aggregator, managed by Llama Risk. The aggregator is a Yearn V3 vault that allocates crvUSD deposits to a set of strategies, optimizing yield for its depositors.

Understanding the Oracle

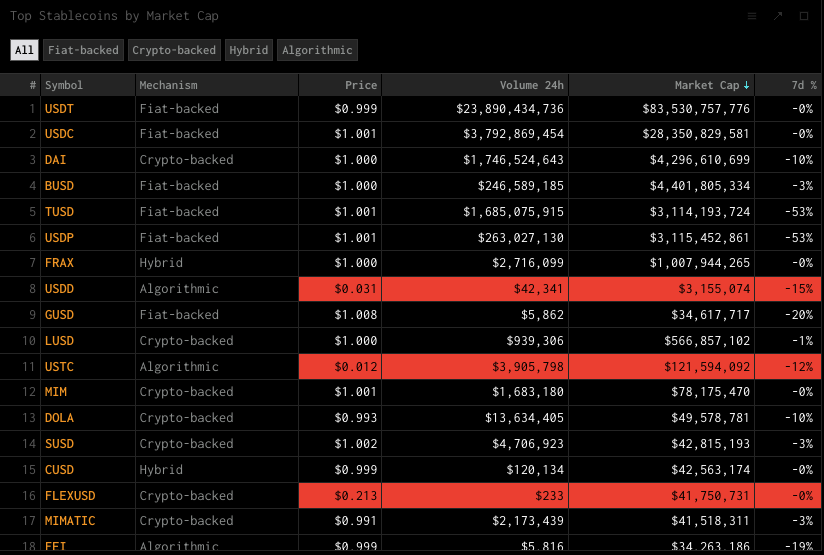

- Importance of Oracle: The Oracle is crucial for borrowers to assess their risk appetite. It calculates prices from multiple sources, including Curve StableSwap EMA Oracle, LLAMMA AMM EMA Oracle, and Chainlink, to derive the final Oracle price.

Oracle Calculation Process

- Oracle Calculation Process: The report provides a detailed explanation of the Oracle’s calculation process for different markets. It fetches and calculates prices from multiple sources, applies these prices to derive the final Oracle price, and returns the final values.

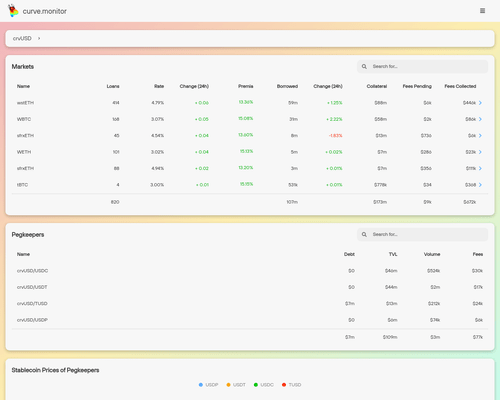

Upcoming Public Dashboard

- Public Dashboard Release: Llama Risk plans to release a public dashboard that includes metrics across the various components making up the crvUSD aggregator. This will provide users with comprehensive information about borrow positions, liquidations, and interest rates.

Legal Rules for Yield Optimizers

- Legal Rules for Yield Optimizers: The report also provides an overview of the legal rules applicable to yield optimizers. It emphasizes the need for a genuine approach to decentralization and the adoption of legal models that support full decentralization.

Actionable Insights

- Monitor the crvUSD Aggregator: Investors should keep an eye on the performance of the crvUSD aggregator on Sturdy Finance v2, as it offers additional yield opportunities.

- Understand the Oracle: Borrowers should gain a thorough understanding of the Oracle and its calculation process to assess their risk appetite effectively.

- Utilize the Public Dashboard: Once released, users should utilize the public dashboard to make well-informed decisions about participating in the crvUSD aggregator and its constituent silos.