Research Summary

The report discusses key developments in the crypto and DeFi space, including the unlocking of $400M worth of $DOT tokens, FTX’s potential liquidation of its $3.4B crypto portfolio, and the successful use of Chainlink’s CCIP by a major Australian bank. It also highlights the growth of on-chain real-world assets and the increase in NEAR activity, along with the latest developments in DeFi.

Key Takeaways

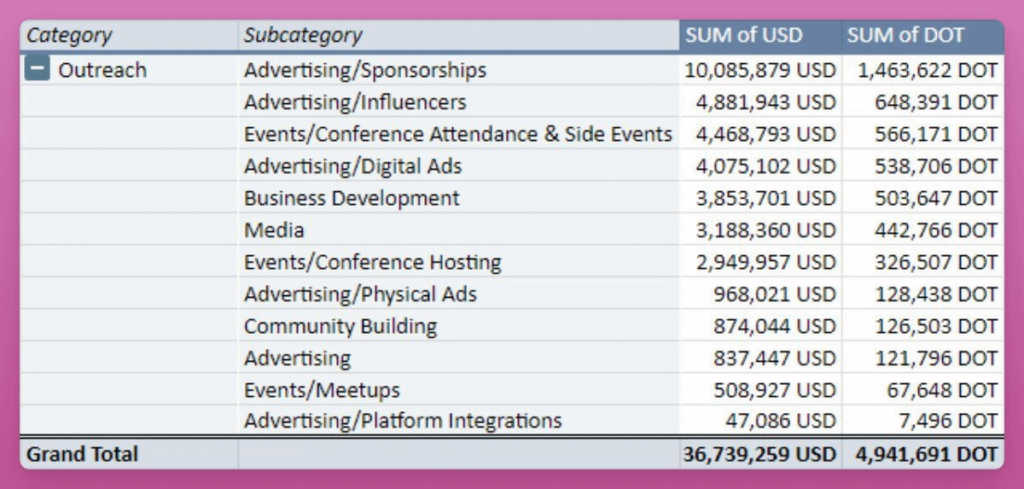

Unlocking of $DOT Tokens

- Significant Token Release: Nearly $400M worth of $DOT tokens will enter circulation on October 24. These tokens were locked by holders for almost two years to participate in Polkadot’s Parachain Auctions. The total DOT amount contributed to the auctions is around 10% of the circulating supply.

FTX’s Potential Liquidation

- Impending Sell Pressure: FTX has received court approval to liquidate its $3.4B crypto portfolio. Assets most likely to be negatively impacted include SOL, APT, and TRX. However, FTX is expected to liquidate its holdings over a long period to minimize price impact.

Chainlink’s CCIP Success

- Interoperability Achievement: One of Australia’s largest institutional banks has successfully used Chainlink’s Cross-Chain Interoperability Protocol (CCIP). As CCIP nears its final development stage, the Chainlink team plans to share the revenue from CCIP transaction fees with LINK holders.

Growth of On-chain Real-World Assets

- Continued Expansion: The market cap of on-chain real-world assets (RWAs) has reached a new all-time high, demonstrating the sector’s high upside potential.

Increase in NEAR Activity

- Surge in Active Addresses: NEAR Protocol’s daily active addresses have increased significantly, primarily due to Cosmose AI moving its payments system from Stripe to Near.

Actionable Insights

- Monitor DOT Market Impact: Keep an eye on the market impact of the unlocking of $DOT tokens, as it represents a significant portion of the circulating supply.

- Assess FTX Liquidation Effects: Evaluate the potential effects of FTX’s liquidation on the market, particularly on SOL, APT, and TRX.

- Investigate Chainlink’s CCIP: Consider the potential of Chainlink’s CCIP, especially as it nears its final development stage and begins sharing transaction fee revenue with LINK holders.

- Explore RWA Sector: Look into the on-chain real-world assets sector, given its continued growth and high upside potential.

- Consider NEAR Protocol: Pay attention to the NEAR Protocol, especially in light of the recent surge in its daily active addresses.