Research Summary

The report discusses the upcoming launch of nine Ether spot ETFs on July 23rd, sponsored by traditional asset managers and crypto-native firms. It explores the potential impact of these ETFs on Ethereum’s market dynamics, considering factors such as Ethereum’s market cap, daily spot trading volumes, and the amount of ETH staked or locked in smart contracts.

Key Takeaways

Ethereum’s Market Position

- Ethereum’s Market Cap: Ethereum’s market cap stands at $420 billion, about one-third of Bitcoin’s $1.3 trillion market cap. Daily spot trading volumes for ETH are approximately half of BTC’s volumes across Coin Metrics’ Trusted Exchanges.

- ETH Supply Dynamics: 33.2 million ETH (28% of supply) is staked on the Ethereum consensus layer, with 13.5 million ETH (11% of supply) locked in smart contracts and 12.5 million ETH (10% of supply) currently on exchanges. This suggests a high utilization of the asset.

Impact of Ether ETFs

- ETF Launch: Nine Ethereum ETFs are set to debut on July 23rd, expanding the universe of crypto-based financial products. These products will track the spot price of Ether (ETH) and will be listed on public exchanges like the CBOE, NYSE, and Nasdaq.

- ETF Management Fees: Management fees for these funds range from 0.15% for the newly introduced Grayscale Ethereum Mini Trust (ETH) to 2.50% for Grayscale’s Ethereum Trust (ETHE), which will convert from its current trust structure to an ETF upon launch.

Grayscale’s Ethereum Trust

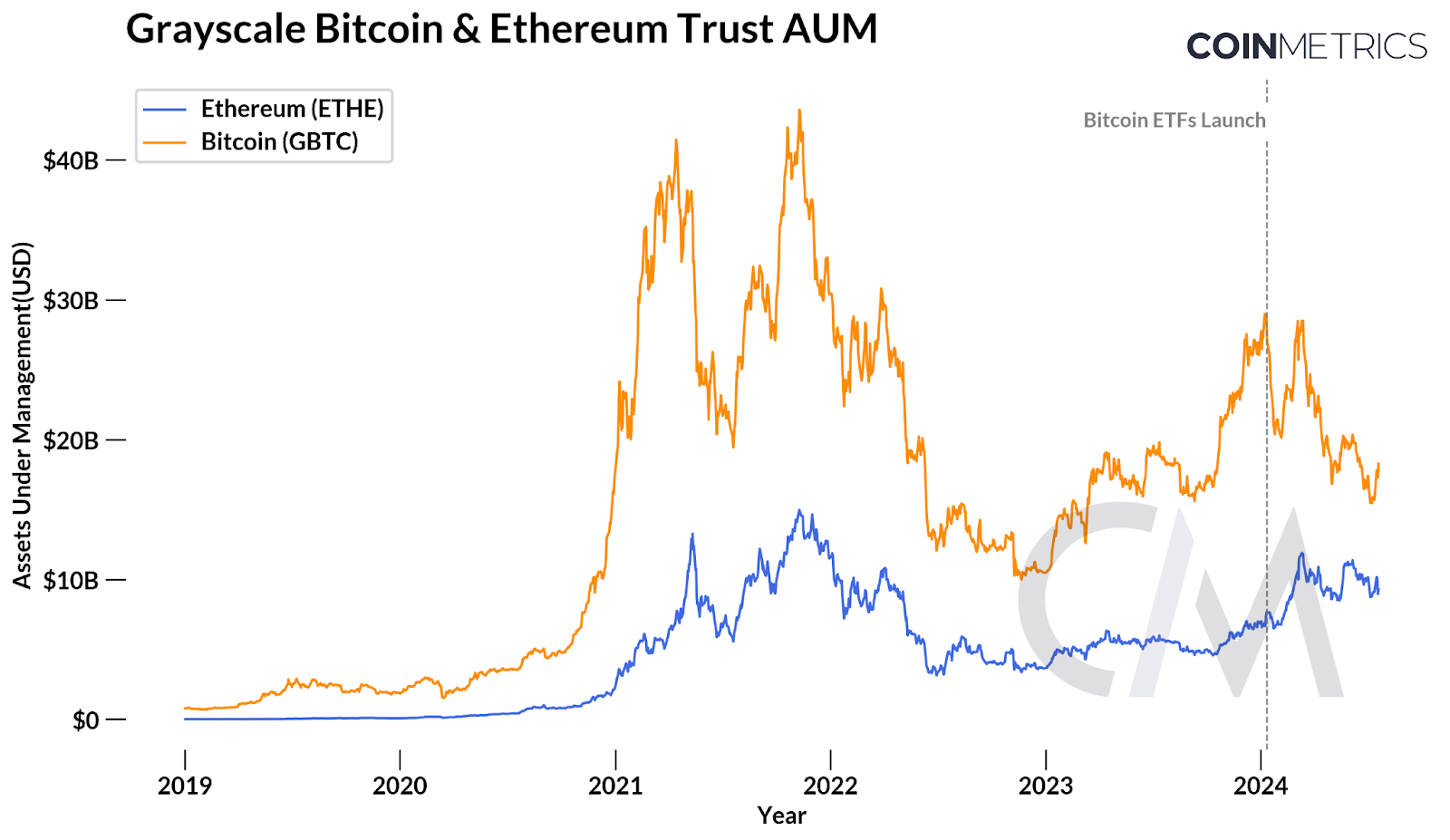

- Trust to ETF Conversion: Grayscale’s Ethereum Trust (ETHE) will convert from a trust structure into an exchange-traded fund (ETF) upon launch. This could potentially lead to outflows from the product, similar to what happened with Grayscale’s Bitcoin Trust (GBTC) during its conversion.

- ETHE Holdings: ETHE holds ~$10B in AUM pre-launch, comprising 3M ETH (2.5% of ETH supply). The report suggests that the distinct timeline of events leading up to the ETH ETF launch and the introduction of Grayscale’s Ethereum Mini Trust (ETH) may mitigate the extent of these outflows.

Actionable Insights

- Monitor ETF Adoption: The adoption rate of the newly launched ETFs will be crucial in determining their impact on Ethereum’s market dynamics. Investors and market participants should closely monitor these developments.

- Assess Impact on ETH Supply: The launch of Ether ETFs could further constrain the available market supply of ETH. Understanding the interaction between ETH’s constrained supply and potential ETF inflows could provide valuable insights into future price movements.

- Consider Fee Structures: The varying management fees of the different Ether ETFs could influence investor preferences. Those interested in these products should consider the fee structures in their decision-making process.