Research Summary

The report discusses the emerging trends in the crypto restaking sector, focusing on the launch of Symbiotic, a major competitor to Eigenlayer. It also highlights the differences between the two protocols and the implications of these differences for investors. The report further explores the partnerships and investments surrounding these protocols, including the role of venture firms like Andreessen Horowitz and Paradigm.

Key Takeaways

Symbiotic’s Launch and Rapid Growth

- Successful Launch: Symbiotic, a competitor to Eigenlayer, launched with deposit caps of $200 million nearly reached within a day. This rapid growth indicates high interest and potential in the protocol.

- Major Backers: Symbiotic raised $5.8 million in seed funding from venture giants Paradigm and cyber•Fund, demonstrating significant institutional support.

Comparing Symbiotic and Eigenlayer

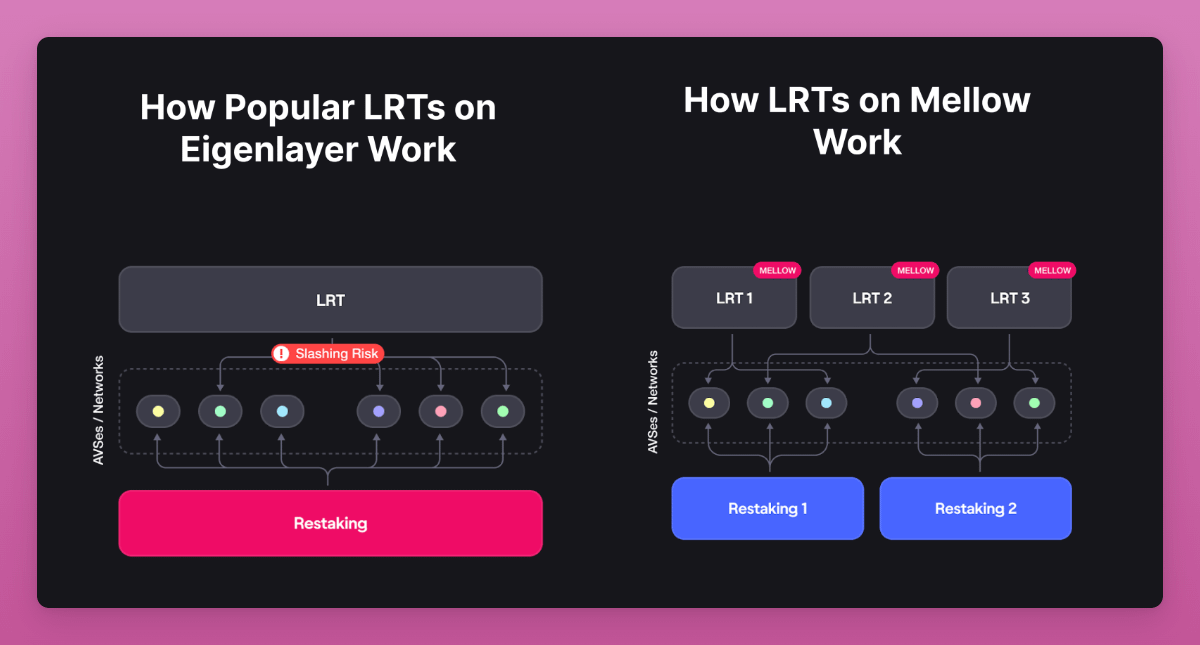

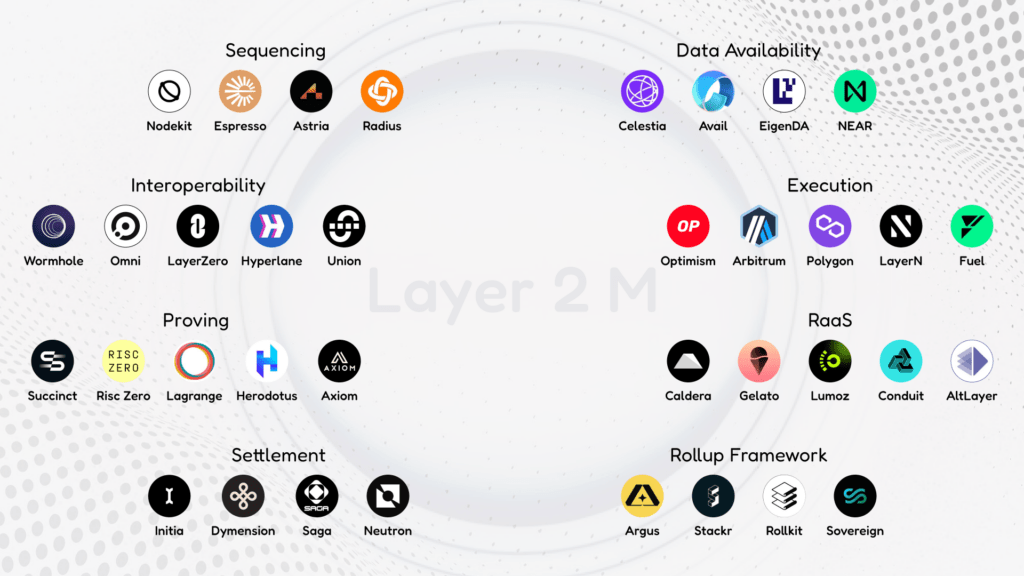

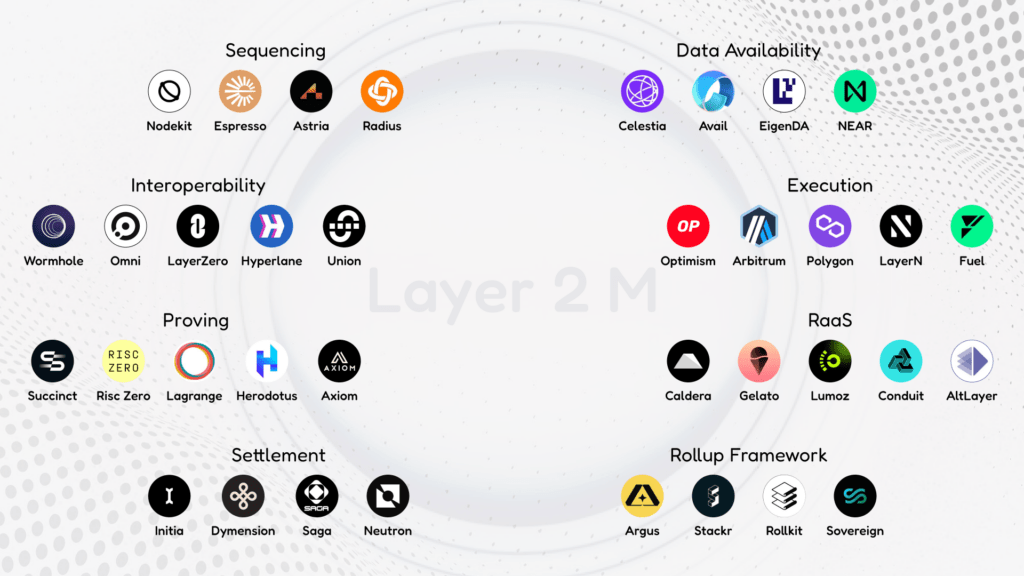

- Different Approaches: Symbiotic distinguishes itself with a permissionless and modular design, offering more flexibility and control. In contrast, Eigenlayer uses a more managed and consolidated approach, focusing on leveraging the security of Ethereum’s ETH stakers to support various dApps.

- Competitive Landscape: The competition between Symbiotic and Eigenlayer is expected to intensify, with both protocols vying for dominance in the restaking market.

Partnerships and Investments

- Strategic Partnerships: Symbiotic has formed partnerships with several protocols, including Mellow and Ethena. These partnerships could help Symbiotic expand its reach and influence in the crypto market.

- Investment Decisions: The report mentions that Sreeram Kannan, co-founder of Eigenlayer, opted for investment from Andreessen Horowitz over Paradigm, leading to a rivalry between the two venture firms.

Implications for Investors

- Investment Opportunities: The launch of Symbiotic and the growth of the restaking market present potential investment opportunities. However, investors should carefully consider the risks and rewards associated with each protocol.

- Future Developments: The report suggests that Symbiotic’s token might launch even before Eigenlayer’s, which could have implications for investors’ strategies.

Actionable Insights

- Monitor Developments in Restaking Market: Investors should keep a close eye on the restaking market, particularly the competition between Symbiotic and Eigenlayer, as it could influence investment decisions.

- Consider Diversification: Given the differences between Symbiotic and Eigenlayer, investors might consider diversifying their investments across both protocols to spread risk.

- Stay Informed About Partnerships: The partnerships formed by Symbiotic and Eigenlayer could impact their growth and success. Investors should stay informed about these partnerships and how they might affect the protocols’ prospects.