Research Summary

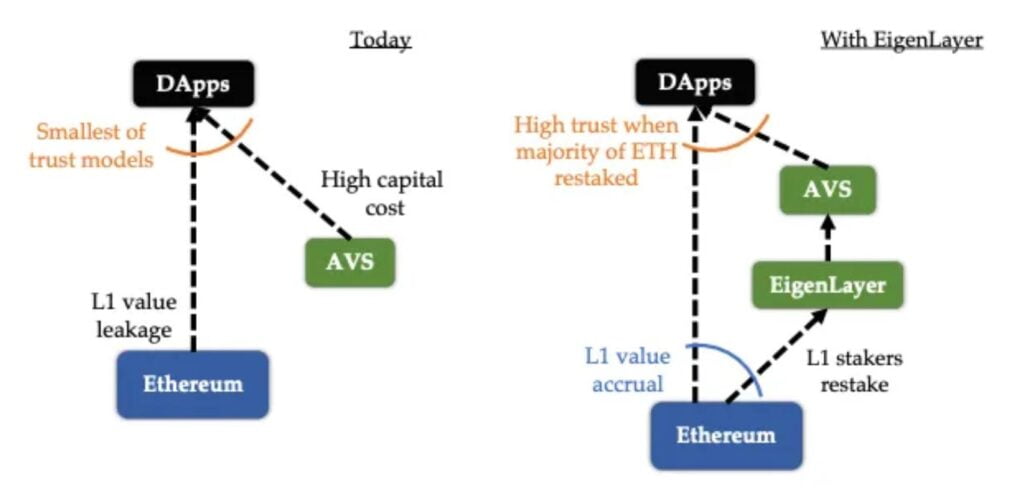

The research report discusses the surge in interest for liquid staking tokens since the Ethereum Shanghai upgrade. Lido’s stETH has emerged as the dominant player in this space, with the highest supply, liquidity, and network effects. The report also highlights a shift in the DeFi integration of liquid staking tokens, with a decline in value locked in liquidity pools as capital moves towards use as collateral in lending protocols. The report suggests that investors are leveraging stETH to maximize staking yields.

Actionable Insights

- Monitor the growth of Lido’s stETH: Lido’s stETH has established dominance in the liquid staking market. Its growth and adoption in the DeFi sector could have significant implications for Ethereum’s staking landscape.

- Observe shifts in DeFi capital allocation: The decline in value locked in liquidity pools and the increase in use of stETH as collateral in lending protocols indicates a shift in DeFi capital allocation. This could impact the strategies of DeFi investors and protocols.

- Consider the potential of yield maximization strategies: The report suggests that investors are leveraging stETH to maximize staking yields. Understanding these strategies could provide opportunities for yield optimization.