Research Summary

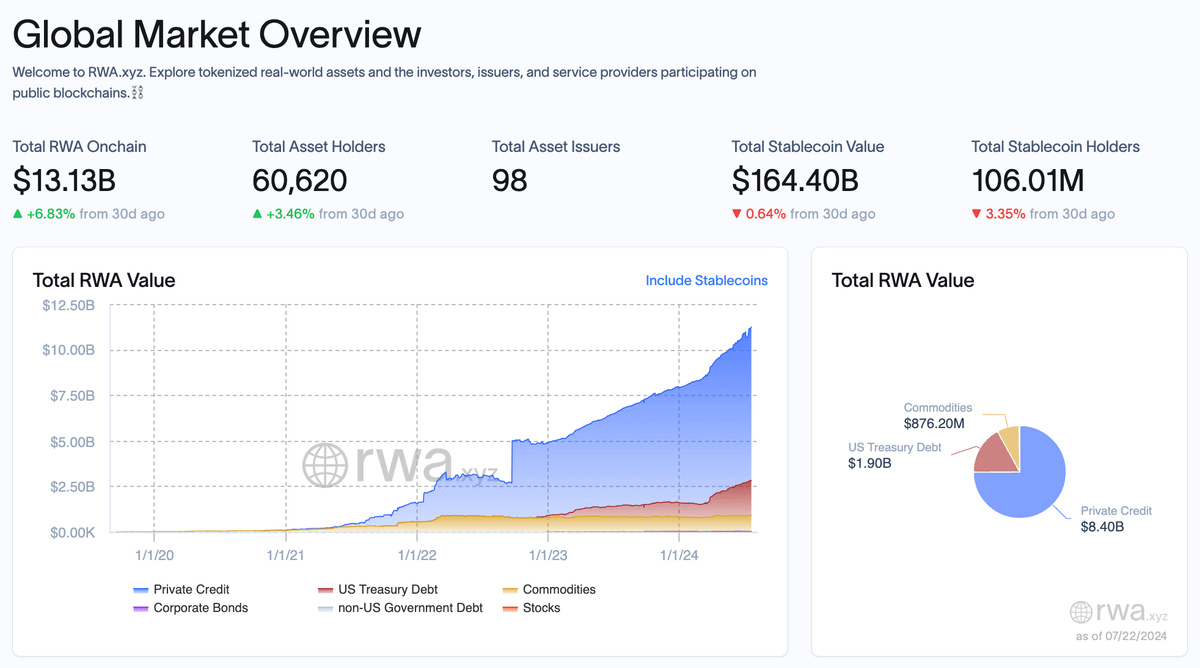

The report discusses the importance of regulatory, legal, and financial considerations in Real-World Asset (RWA) tokenization projects. It provides a step-by-step guide to navigate the complex landscape of RWA tokenization, emphasizing the need for understanding regulatory restrictions, selecting an offshore hub, incorporating a Special Purpose Vehicle (SPV), and managing cashflows and reporting. The report also mentions several RWA projects that show promise.

Key Takeaways

Importance of Regulatory, Legal, and Financial Aspects in RWA Tokenization

- Regulatory Oversight: The report highlights the importance of understanding regulatory restrictions in RWA tokenization. It warns that neglecting these aspects can lead to significant consequences, such as regulatory clampdowns by bodies like the SEC.

- Legal and Financial Structuring: The report emphasizes the need for careful legal and financial structuring of RWA tokenization. It suggests that these aspects are often overlooked due to the focus on potential financial gains.

Guide to Navigating RWA Tokenization

- Offshore Hub Selection: The report advises selecting a reliable offshore hub for the SPV, which should allow the SPV to buy the RWA as a local investor and offer tax benefits. The hub’s credit rating should be at least AA.

- SPV Incorporation: The report recommends forming a limited liability company or renting a cell for the SPV, and giving its shares to an orphan trust. This ensures the SPV stays out of the sponsor’s bankruptcy estate.

- RWA Acquisition and Tokenization: The report suggests acquiring the RWA through a forward agreement to match the incoming cash flow from investors. It also advises issuing tokenized financial instruments with a full recourse legal pledge on the RWA.

- Investor Funds Management: The report stresses the importance of managing investor funds effectively. If not using stablecoins, it recommends converting investor funds and using them to buy the RWA into the SPV.

- Cashflows and Reporting Management: The report underscores the need for managing all cashflows based on the terms in the ownership token and regularly reporting and providing valuations to investors and regulators.

Promising RWA Projects

- RWA Projects: The report mentions several RWA projects that show promise, including Ink Finance, IxSwap, Plume Network, Chintai Nexus, Landx Finance, and Stobox Company.

Actionable Insights

- Understand Regulatory Restrictions: It is crucial to understand the rules about investing in RWAs off-chain. This includes knowing the limits for target investors in their respective countries.

- Select a Suitable Offshore Hub: Choosing a reliable offshore hub for the SPV is essential. The hub should allow the SPV to buy the RWA as a local investor and offer tax benefits.

- Properly Incorporate the SPV: When setting up the SPV, it is advisable to form a limited liability company or rent a cell, and give its shares to an orphan trust. This ensures the SPV stays out of the sponsor’s bankruptcy estate.

- Manage Investor Funds Effectively: If not using stablecoins, it is important to convert investor funds and use them to buy the RWA into the SPV.

- Regularly Report and Provide Valuations: It is essential to manage all cashflows based on the terms in the ownership token and regularly report and provide valuations to investors and regulators.