Research Summary

The report provides a comprehensive guide and strategies for tokenless protocols for the years 2023/2024. It covers a range of Layer 2 blockchains including Scroll, Kroma, Manta Pacific, Linea, Base, Mantle, zkSync, and Zora. The report also discusses various airdrops, EVM chains, and point-based systems like Aevo, Hyperliquid, and ether.fi. It further outlines strategies for each blockchain, detailing how to bridge, swap, and withdraw assets.

Key Takeaways

Layer 2 Blockchains and Their Strategies

- Scroll, Kroma, and Manta Pacific: The report provides strategies for these Layer 2 blockchains, which involve gathering mainnet Ethereum ($ETH), bridging $ETH to the respective blockchain using their native bridges, making swaps using specific finance platforms, and withdrawing $ETH using certain finance platforms.

- Linea and Base: Similar strategies are outlined for these blockchains, with the addition of advanced strategies that involve using Collateralized Debt Positions (CDPs), lending and borrowing protocols, and trading on derivatives.

- Mantle and zkSync: These blockchains also follow similar strategies, with Mantle already having a token but a potential for an airdrop. Advanced strategies include using lending and borrowing platforms, derivatives, and Asset Under Management (AUM) protocols.

- Zora: The strategy for Zora involves gathering mainnet $ETH, bridging using the Zora Native Bridge, minting some NFTs, and withdrawing using Orbiter Finance.

Airdrops and Point-Based Systems

- Aevo: The report mentions Aevo’s confirmed airdrop and highlights that $RBN holds the record for one of DeFi’s largest airdrops.

- Hyperliquid and ether.fi: These platforms use a points-based system where users can trade, add liquidity, and refer to increase points. Ether.fi also offers the chance to get $EIGEN and $EGI through staking.

Staking Derivatives

- Swell, MEV Protocol, and ether.fi: The report discusses strategies for these platforms, which involve staking $ETH to get respective tokens like $swETH and $mevETH.

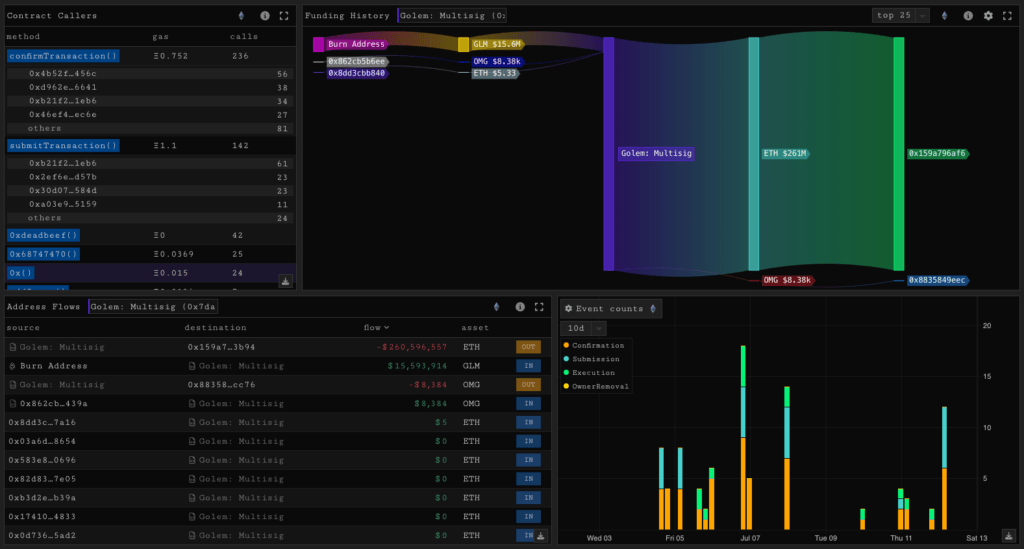

Cross-Chain Bridges

- RhinoFI, Squid, deBridge, and Orbiter: The report advises frequent use of these cross-chain bridges.

Derivatives and DEXes

- Aevo, Paradex, Hyperliquid, and Derivio: These platforms allow users to trade perps and options, with Hyperliquid also allowing users to add liquidity.

- Swaap, Ambient, and Mangrove: These decentralized exchanges (DEXes) allow users to make swaps and/or add liquidity.

Actionable Insights

- Exploring Layer 2 Blockchains: The report suggests that investors could explore the mentioned Layer 2 blockchains and their respective strategies for potential opportunities.

- Engaging with Airdrops and Point-Based Systems: Investors could consider engaging with the mentioned airdrops and point-based systems to potentially increase their crypto holdings.

- Considering Staking Derivatives: The report suggests that investors could consider staking derivatives as a potential strategy to earn tokens.

- Utilizing Cross-Chain Bridges: The report advises frequent use of the mentioned cross-chain bridges, which could be a potential strategy for investors to consider.

- Trading on Derivatives and DEXes: The report suggests that investors could consider trading on the mentioned derivatives and DEXes for potential opportunities.