Research Summary

The report discusses the launch of USDC settled options on three altcoins, SOL, XRP, and MATIC, by Deribit in March 2024. It explains the differences between these new options and the existing BTC and ETH options, particularly in terms of settlement currencies and contract multipliers. The report also provides a step-by-step guide on how to place trades on these new options.

Key Takeaways

Introduction of USDC Settled Options

- Launch of New Options: Deribit launched USDC settled options on three altcoins, SOL, XRP, and MATIC, in March 2024. These options are distinct from the existing BTC and ETH options.

Settlement Currencies

- Difference in Settlement Currencies: While BTC and ETH options use the base currency as the settlement currency, the new altcoin options use USDC as the settlement currency. This means that the price of each option is quoted as an amount of USDC, and any profit/loss payments are also made in USDC.

Contract Multipliers

- Variation in Contract Multipliers: The contract multiplier for the existing BTC and ETH options is 1, while the new altcoins have different multipliers due to their lower prices. SOL has a multiplier of 10, while XRP and MATIC have a multiplier of 1,000.

Trading on Deribit

- Trading Process: The report provides a detailed guide on how to place trades on these new options on the Deribit platform, highlighting the impact of the settlement currency and contract multiplier on trading.

Live Trades

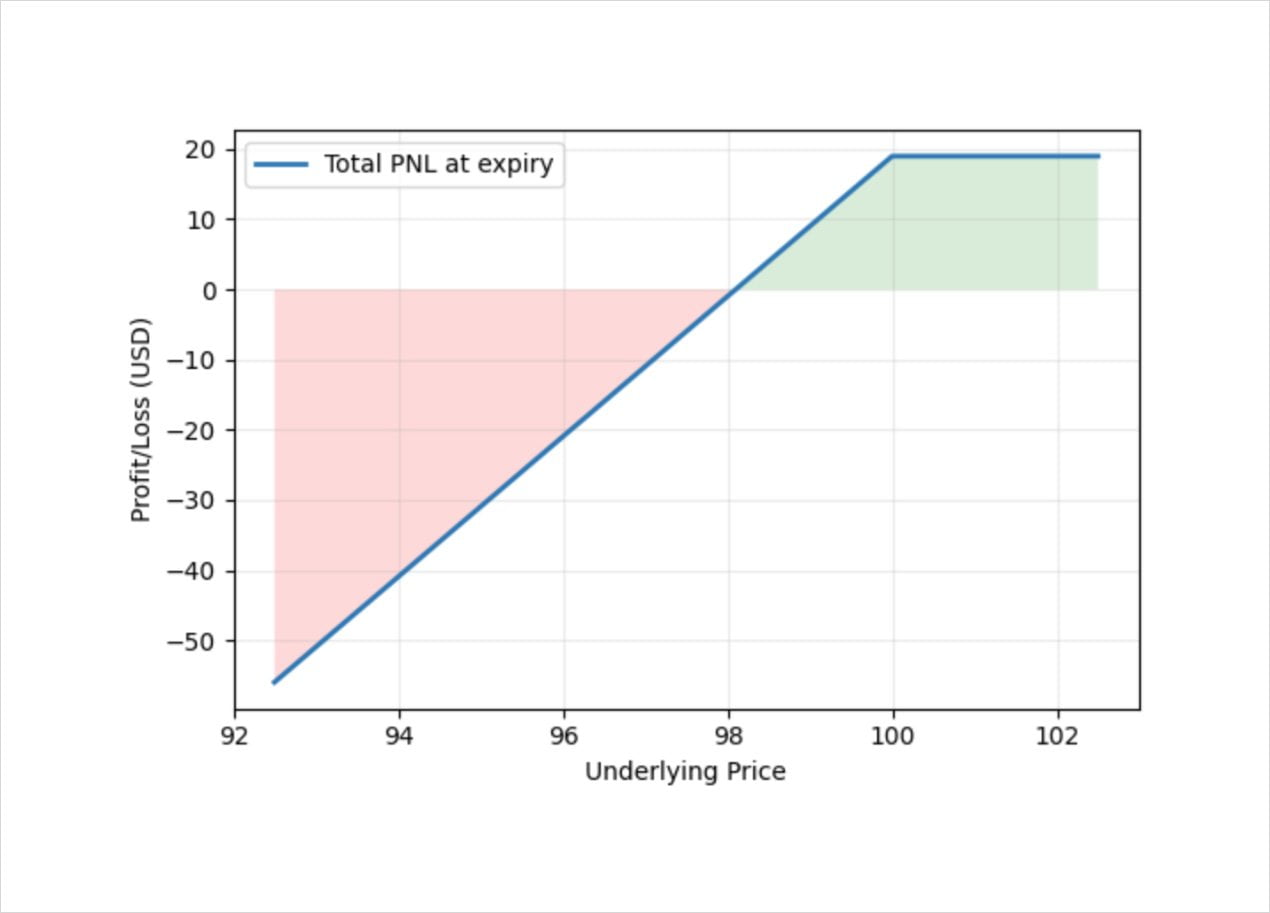

- Live Trading Examples: The report includes examples of live trades, including a short put on SOL and a bear put spread on XRP, demonstrating how to calculate the size and profit of positions.

Actionable Insights

- Understanding Settlement Currencies: Traders should familiarize themselves with the concept of settlement currencies and how it affects their trading strategies. The choice of settlement currency can significantly impact the profit/loss calculations.

- Importance of Contract Multipliers: Traders need to understand the role of contract multipliers in determining the notional size of their positions. This is particularly important when trading options on altcoins with lower prices.

- Adapting Trading Strategies: With the introduction of these new options, traders may need to adapt their strategies to account for the differences in settlement currencies and contract multipliers.