Research Summary

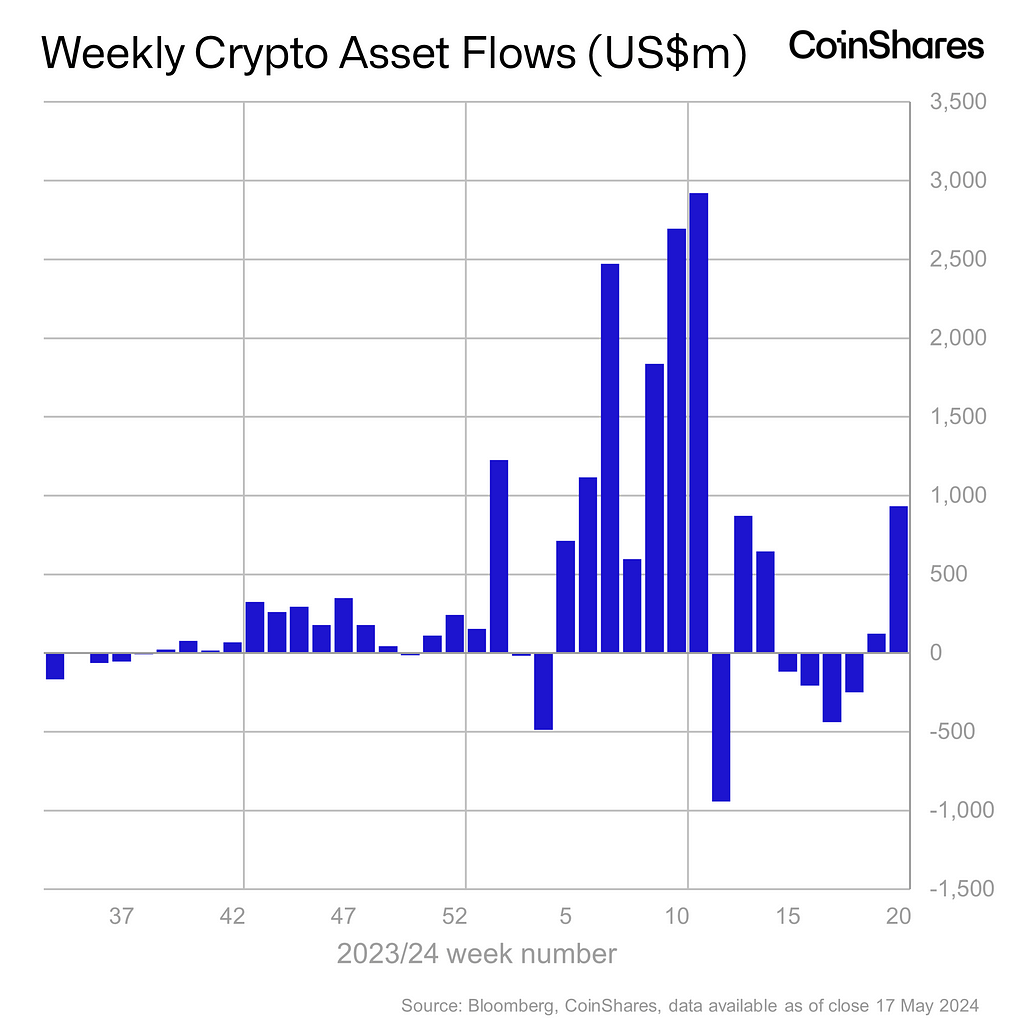

The report analyzes the recent inflows into digital asset investment products, which totaled US$932m for the second week. The inflows were primarily driven by the lower-than-expected CPI report and the prospect of interest rate cuts. The report also provides a detailed breakdown of the inflows by provider, asset, and country.

Key Takeaways

Significant Inflows into Digital Asset Investment Products

- Increased Investment: Digital asset investment products saw inflows for the second week, totaling US$932m. This was a response to the lower-than-expected CPI report, with the last three trading days of the week making up 89% of the total flows.

Grayscale Sees Inflows for the First Time Since January

- Reversal of Trend: Grayscale, which has suffered US$16.6bn of outflows since the January ETF launch, saw minor inflows for the first time, totaling US$18m.

Bitcoin Dominates Inflows

- Bitcoin’s Popularity: Bitcoin saw US$942m of inflows, with virtually no flows into short Bitcoin, implying a positive outlook amongst investors.

Ethereum Continues to Suffer Outflows

- Bearish Outlook: Ethereum continues to suffer from bearishness over the prospects for an SEC approval of a spot-based ETF this week with further outflows of US$23m.

US Dominates Inflows

- Regional Dominance: The US dominated the inflows, seeing US$1,002m last week. Switzerland and Germany also saw minor inflows, while Hong Kong and Canada saw outflows.

Actionable Insights

- Monitor Bitcoin’s Performance: Given the significant inflows into Bitcoin and the positive outlook amongst investors, it would be prudent to closely monitor Bitcoin’s performance in the coming weeks.

- Assess Ethereum’s Prospects: With Ethereum continuing to suffer outflows due to bearishness over the prospects for an SEC approval of a spot-based ETF, it would be worthwhile to assess the potential impact of the SEC’s decision on Ethereum’s performance.

- Consider Regional Trends: The dominance of the US in inflows and the outflows from Hong Kong and Canada suggest regional trends that could influence investment strategies. It would be beneficial to consider these trends when making investment decisions.