Research Summary

- The report highlights notable token activity over the past week and provides insights into the market events driving these price movements.

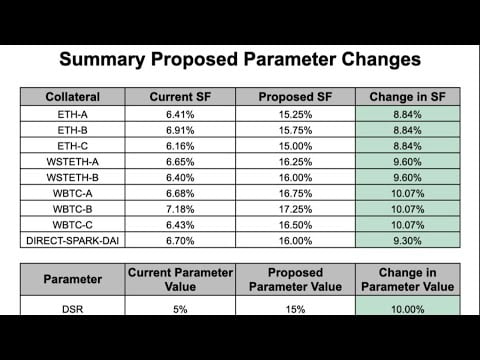

- MakerDao experienced an influx of deposits into its Dai Savings Rate product (DSR) due to the introduction of a new rate (EDSR) offering an 8% yield on DAI deposits. This move aims to increase the circulating supply of DAI and raise funds for purchasing more RWA assets.

- Goldfinch, a decentralized lending/borrowing protocol, faced its first default on a $5M loan, which is approximately 4% of its Total Value Locked (TVL).

- GMX, a decentralized perpetual swap trading platform, launched its v2 version to address various issues from its v1 and to compete more effectively with platforms like dydx.

- Curve, following a hack, saw two additional OTC deals where its founder sold around 106M CRV tokens at a discounted rate. A proposal from Aave governance is also under discussion to purchase CRV for its treasury.

Actionable Insights

- Monitor MakerDao’s DSR: With the introduction of the EDSR, it’s essential to track the inflow of DAI and the potential changes in interest rates.

- Assess Goldfinch’s Risk Management: Given the recent default, it’s crucial to evaluate Goldfinch’s risk management strategies and its impact on TVL.

- Stay Updated on GMX’s Upgrades: With the launch of GMX’s v2, monitor its performance and potential market share gains from competitors like dydx.

- Track Curve’s Recovery Efforts: Following the hack and subsequent OTC deals, keep an eye on Curve’s recovery strategies and potential impacts on its token price.