Research Summary

The report discusses the recent price movements of various tokens, including OX, ENS, DYM, and STRD. It highlights the factors influencing these changes, such as the abrupt shutdown of OPNX, Ethereum Name Service’s partnership with GoDaddy, Dymension’s problematic mainnet launch, and Stride’s successful fundraising round.

Key Takeaways

OPNX Shutdown and OX Price Increase

- OPNX Shutdown: The exchange OPNX, started by the founders of Three Arrows Capital, announced its abrupt shutdown, advising users to close all positions by February 7 and withdraw all assets by February 14. This announcement led to a 6.2% increase in the price of OX.

Ethereum Name Service’s Partnership with GoDaddy

- ENS and GoDaddy Partnership: Ethereum Name Service (ENS), which allows users to buy and use a “.eth” address in place of a public wallet, announced a partnership with GoDaddy. This partnership allows users to link their Ethereum address to web domains for free, leading to a 16% increase in the price of ENS.

Dymension’s Troubled Mainnet Launch

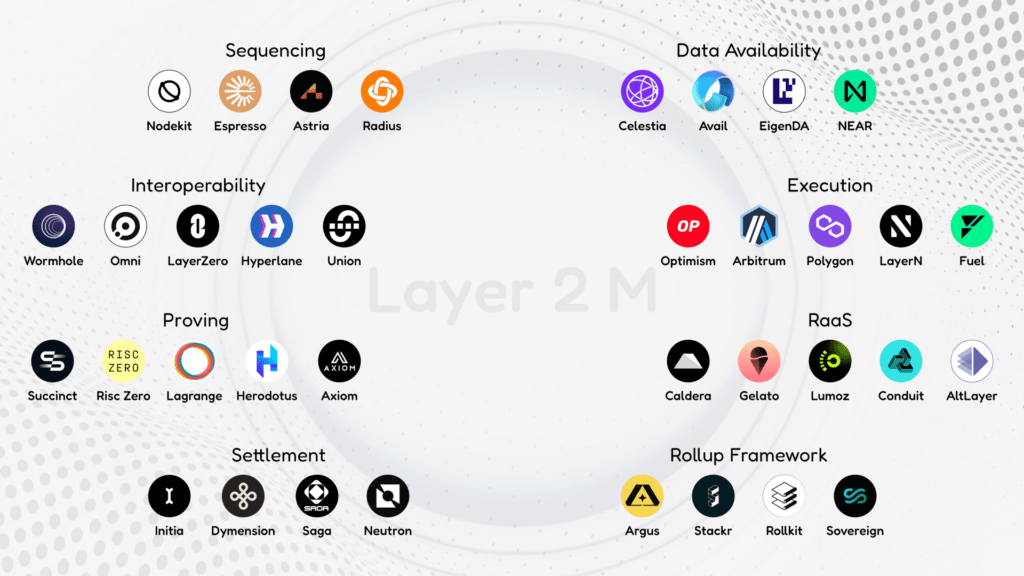

- Dymension’s Mainnet Launch: Dymension, a rollup-as-a-service provider, launched its mainnet and airdropped its token, leading to a 50% increase in the price of DYM. However, the launch was marred by technical issues, including a bad validator and problems with the Cosmos messaging system.

Stride’s Successful Fundraising Round

- Stride’s Fundraising: Stride, a Cosmos liquid staking protocol, announced that it raised a $4M strategic round from investors including 1confirmation, Modular Capital, Chorus One, and Road Capital. This announcement followed the launch of stTIA, a liquid staking token for Celestia, which has already gained $29M in TVL, leading to a 63% increase in the price of STRD.

Actionable Insights

- Monitor the Impact of Partnerships: The partnership between ENS and GoDaddy demonstrates the potential impact of collaborations between crypto and traditional tech companies on token prices. Investors should keep an eye on similar partnerships in the future.

- Consider the Effects of Technical Issues: Dymension’s problematic mainnet launch shows how technical issues can influence token prices. Investors should consider the technical robustness of crypto projects when making investment decisions.

- Assess the Influence of Fundraising Rounds: Stride’s successful fundraising round and the subsequent increase in the price of STRD highlight the potential impact of successful fundraising on token prices. Investors should monitor fundraising activities of crypto projects.