Research Summary

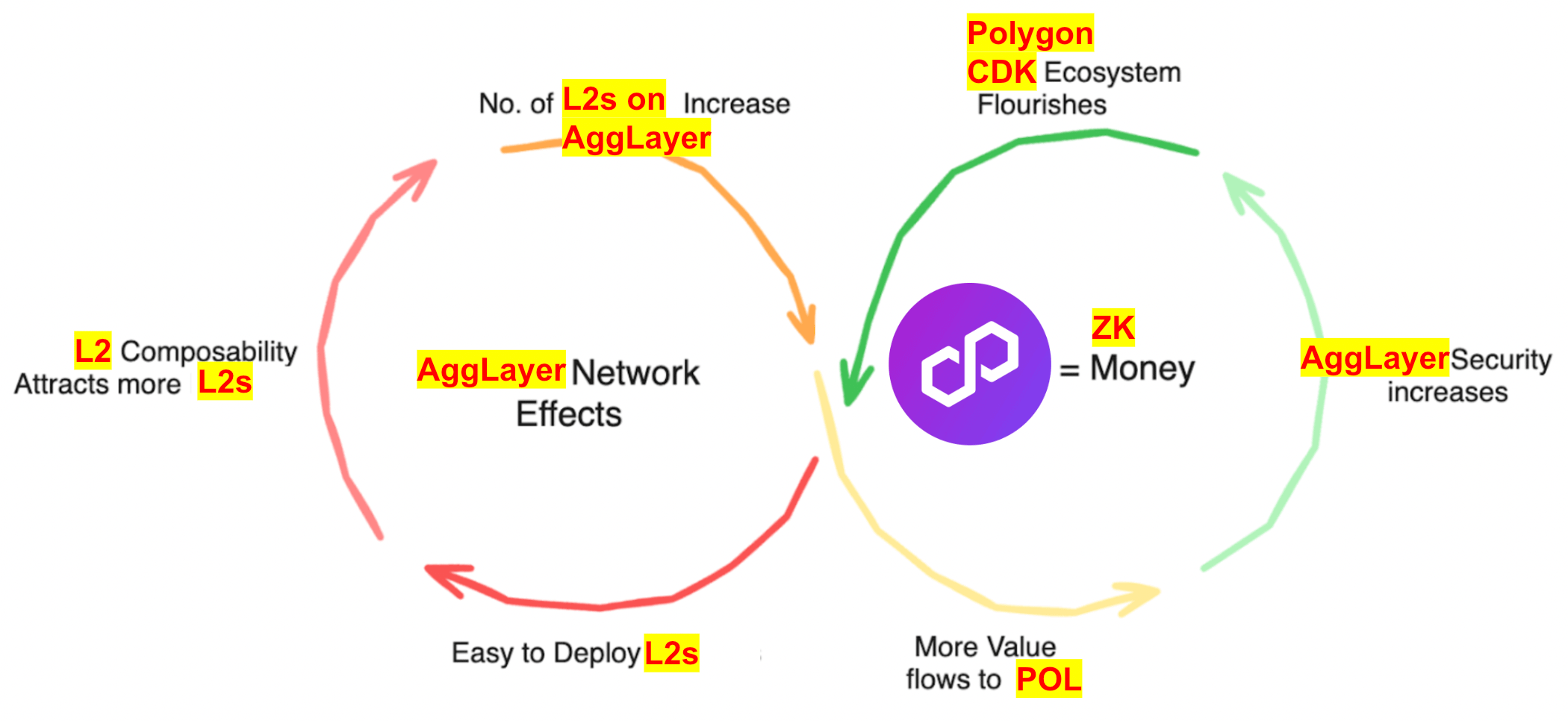

The report discusses the potential of Polygon’s new Aggregation Layer (AggLayer) and the rebranding of MATIC to POL. It also highlights the potential for a significant airdrop to POL stakers and the potential for increased value accrual to the token.

Key Takeaways

Polygon’s New AggLayer

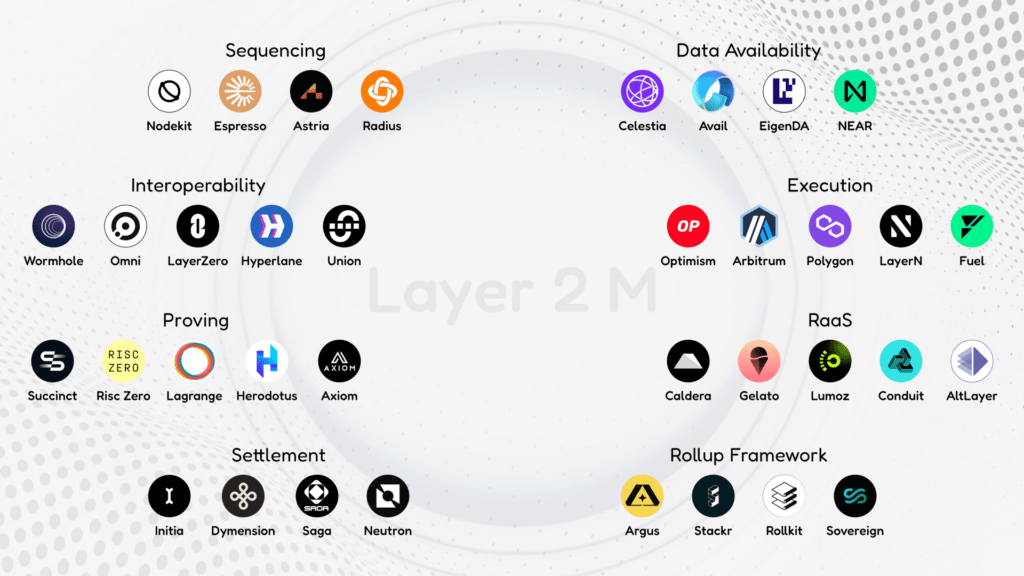

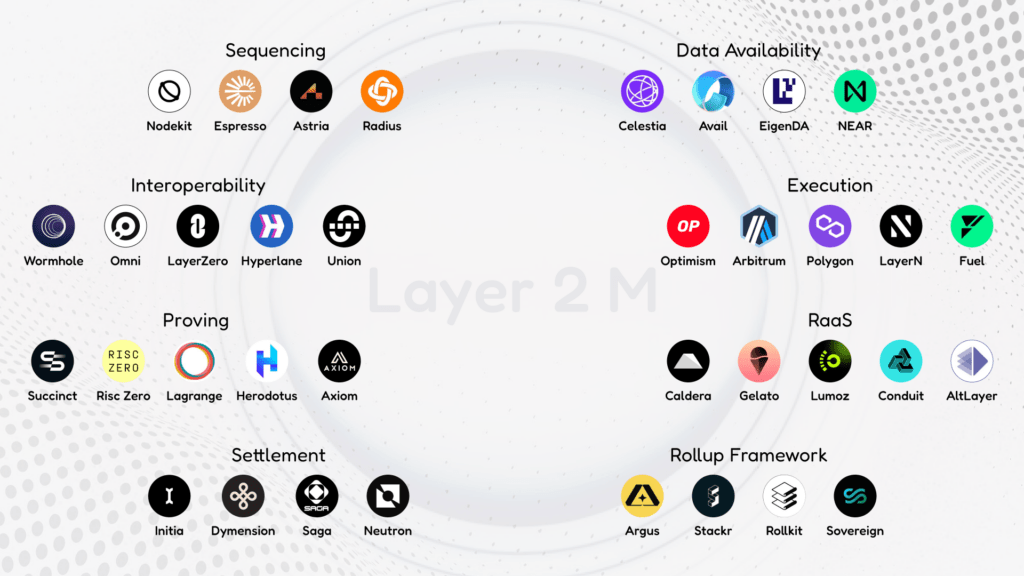

- Addressing Fragmented Liquidity: The report discusses the issue of fragmented liquidity in the Ethereum scaling roadmap. Polygon’s new AggLayer aims to solve this by allowing all Layer 2 (L2) solutions to post their proofs to the AggLayer, which can then aggregate these proofs and post them to a unified bridge contract. This could lead to unified liquidity across different L2 solutions, potentially creating more value accrual on the application layer.

MATIC Rebrand to POL

- Token Utility and Value Accrual: The report highlights the rebranding of MATIC to POL and the potential for increased value accrual to the token. POL can be used to secure the AggLayer, and as more teams tap into the AggLayer for its advantages, demand for POL should increase for economic security. This could lead to potential price upside for the token.

The POL Airdrop Narrative

- Indirect Value Accrual: The report discusses the potential for a significant airdrop to POL stakers. With regulatory fears preventing teams from introducing direct revenue-share, tokens are introducing “indirect value accrual” with the airdrop narrative. This could lead to increased value for POL stakers.

Staking MATIC

- Asymmetric Risk/Reward: The report suggests that staking MATIC has an asymmetric risk/reward to the upside. Staking MATIC with a validator has a ~5% APY with a 3-4 unbonding period, making it a potentially attractive airdrop play.

Upcoming AggLayer Launch

- Market Appreciation: The report suggests that there could be potential price upside for MATIC stakers if the market starts to appreciate the upcoming AggLayer launch.

Actionable Insights

- Consider the Potential of Polygon’s AggLayer: The report suggests that Polygon’s new AggLayer could potentially solve the issue of fragmented liquidity in the Ethereum scaling roadmap. This could lead to increased value accrual on the application layer and increased demand for POL.

- Assess the Impact of MATIC’s Rebrand to POL: The rebranding of MATIC to POL and the potential for increased value accrival to the token could have significant implications for investors. The report suggests that as more teams tap into the AggLayer, demand for POL should increase for economic security.

- Monitor the POL Airdrop Narrative: The potential for a significant airdrop to POL stakers could lead to increased value for these investors. The report suggests that this could be a significant factor in the future performance of POL.