Research Summary

The report discusses the rise of Liquid Staking Tokens (LSTs) in the DeFi space. LSTs allow users to access the yields associated with staking while leveraging the liquidity of their assets. The report identifies five major use cases for LSTs: leverage farming, liquidity providing, LST baskets, stablecoin collateral, and interest rate derivatives. The report also highlights the growth of LSTs, with a 17% increase since Shapella, led by Frax.

Actionable Insights

- Leverage Farming: LSTs can be used to loop leverage positions to maximize yield. Platforms like Aave and Gearbox facilitate this process.

- Liquidity Providing: LSTs can be used to provide liquidity for AMMs, allowing users to collect fees and additional incentives on top of traditional staking rewards. Uniswap has seen some adoption of LST liquidity provision.

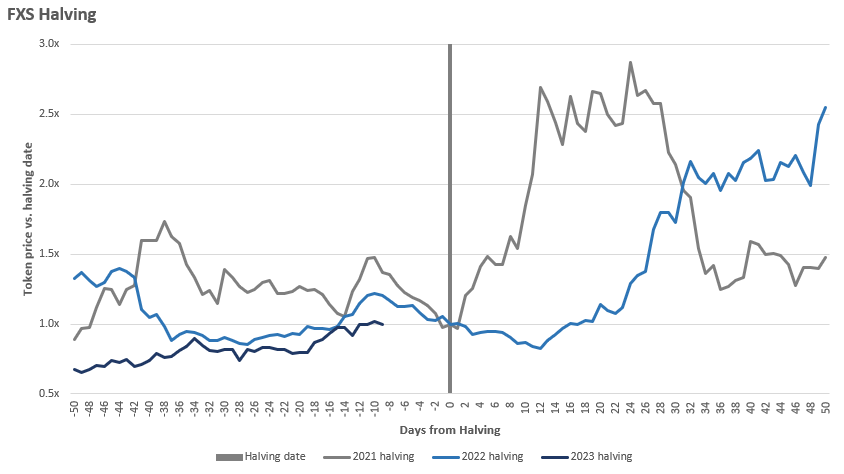

- Growth of LSTs: LSTs have seen a 17% growth since Shapella, with Frax leading the pack. This growth indicates a rising interest and trust in LSTs within the DeFi space.