Research Summary

This research report provides an in-depth analysis of the Liquid Staking Derivatives (LSDs) and their role in the DeFi sector. The report discusses the various categories of LSDfi protocols, including DEXes, Lending markets, Stablecoins, Index LSDs, and Yield Strategies. It also highlights the growth potential of the LSDfi sector, driven by the increasing staking of Ethereum and the low penetration of LSDfi. However, the report also warns of potential risks such as slashing risks, LSD price risks, smart contract risks, third-party risks, and regulatory risks.

Actionable Insights

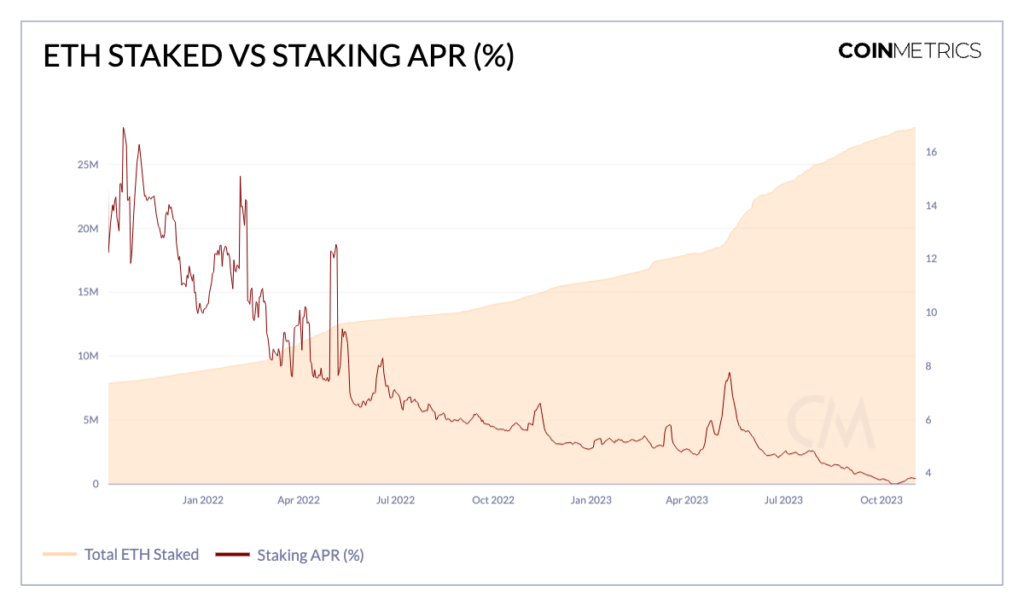

- Consider the growth potential of LSDfi: The report suggests that the LSDfi sector is poised for growth due to the increasing staking of Ethereum and the low penetration of LSDfi.

- Understand the categories of LSDfi protocols: The report categorizes LSDfi protocols into five major categories: DEXes, Lending markets, Stablecoins, Index LSDs, and Yield Strategies. Understanding these categories can provide insights into the diverse applications of LSDs.

- Be aware of the risks: The report warns of potential risks associated with LSDfi, including slashing risks, LSD price risks, smart contract risks, third-party risks, and regulatory risks. These risks should be taken into account when considering investments in the LSDfi sector.

- Explore innovative LSDfi protocols: The report highlights several innovative LSDfi protocols such as eUSD from Lybra Finance, $R from Raft, and unshETH. These protocols offer unique features and could present interesting investment opportunities.