Research Summary

The report discusses the evolution of the Ethereum network towards a Proof-of-Stake (PoS) blockchain, focusing on the emergence of staking as a key component of Ethereum consensus. It delves into the role of Lido, the largest player in the staking economy, and its liquid staking token (stETH), governance token (LDO), and underlying node-operator composition. The report also explores the state of Ethereum staking against the backdrop of monetary tightening and rising interest rates.

Key Takeaways

Ethereum’s Shift to Proof-of-Stake and the Rise of Staking

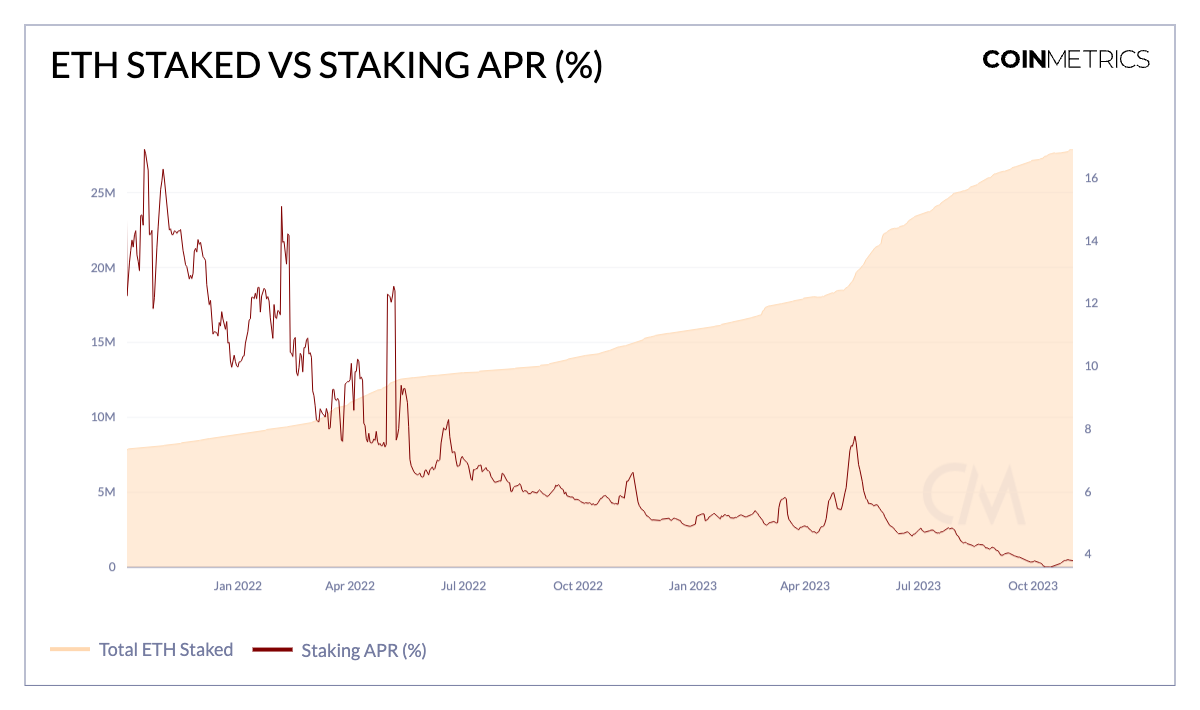

- Ethereum’s PoS Transition: The Ethereum network’s transition to a PoS blockchain has led to the emergence of staking as a crucial part of Ethereum consensus. The successful completion of “The Merge” and the “Shapella” upgrade has resulted in an industry around staking, with approximately $40B assets staked.

- Lido’s Role in Staking: Lido plays a significant role in the staking economy, allowing democratized access to staking. It enables users to deposit any amount of ETH, rather than the 32 ETH required to be a validator. Lido has 8.9M ETH or $16.8B in total value locked, making it the largest liquid staking and decentralized finance (DeFi) protocol.

- Concerns Over Centralization: Lido’s market share, which hovers around one-third of all ETH staked, has raised concerns about centralization. If a liquid staking protocol or its underlying node-operators exceed critical thresholds of total ETH staked, it could lead to undesirable outcomes for the Ethereum network due to increased centralization.

- stETH’s Role in the Lido Ecosystem: stETH, Lido’s liquid staking token, allows users to delegate their Ether to secure the network in exchange for a tokenized representation of their underlying stake. stETH has grown to be the largest form of collateral backing loans on several DeFi platforms.

- Governance Concerns: The Lido DAO, governed by LDO token-holders, has root access to certain critical aspects of the protocol. The highly concentrated nature of LDO token holders has led to worries about the Lido governance layer as a potential attack vector.

Actionable Insights

- Monitor the Evolution of Ethereum’s PoS Transition: Stakeholders should keep a close eye on the ongoing evolution of Ethereum’s transition to a PoS blockchain, particularly the role of staking and the influence of major players like Lido.

- Investigate the Potential of Lido: Given Lido’s significant role in the staking economy, stakeholders should explore the potential of Lido’s liquid staking token (stETH) and governance token (LDO).

- Assess the Risks of Centralization: Stakeholders should assess the risks associated with potential centralization in the staking economy, particularly in relation to Lido’s market share.

- Understand the Implications of stETH: Stakeholders should understand the implications of stETH’s role in the Lido ecosystem, particularly its use as collateral in DeFi platforms.

- Consider Governance Concerns: Stakeholders should consider the potential risks associated with the Lido DAO’s governance structure and the concentration of LDO token holders.