Podcast Summary

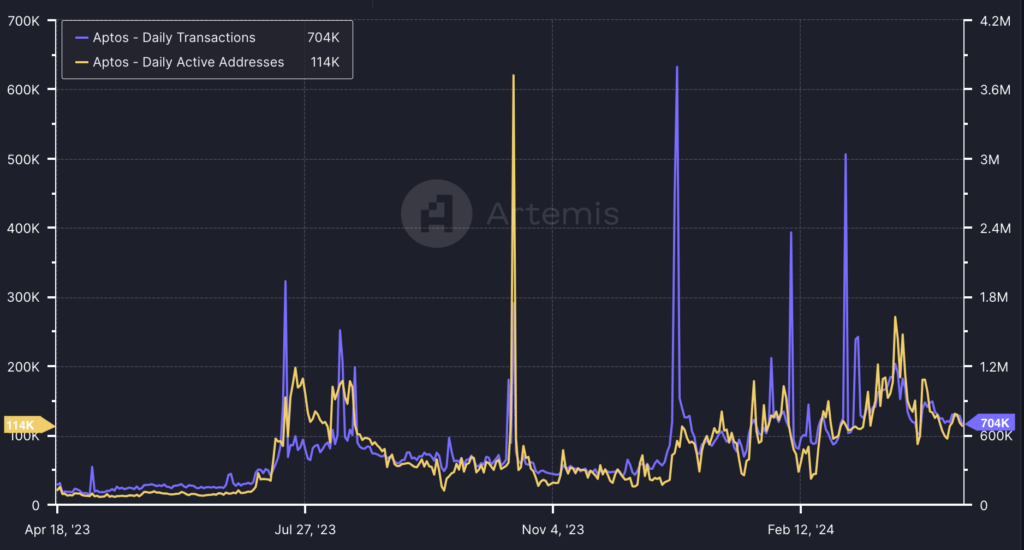

In this episode, the hosts discuss a range of topics from market manipulation in the crypto space, the role of exchanges and whales in preventing such practices, to the growth of DeFi platforms. They also delve into the concept of restaking and its potential to attract more Total Value Locked (TVL) to DeFi. The episode concludes with a discussion on the use of DAI without staking, the upcoming launch of “Shibarium” by Shiba Inu, and the recent pump in Aptos due to its partnership with Microsoft.

Key Takeaways

Market Manipulation in Crypto Space

- Market Manipulation: The hosts discuss the issue of market manipulation in the crypto space, particularly in illiquid markets. They highlight the role of individuals who artificially inflate the price of certain tokens, leading to market instability.

- Role of Exchanges: The hosts emphasize the importance of exchanges in controlling market manipulation, suggesting that platforms like Binance should take responsibility for monitoring and preventing such practices.

- Regulation Challenges: The international nature of the crypto market and the ability to operate in jurisdictions with lax regulations make this type of manipulation difficult to regulate.

Growth of DeFi Platforms

- Decentralized Nature: The hosts discuss the decentralized nature of DeFi platforms, suggesting that users need to take personal responsibility and avoid engaging in manipulative practices.

- Predatory Practices: The hosts mention the predatory nature of some decentralized platforms, such as offering high leverage and listing meme coins.

- Open Exchange: The unique position of Open Exchange, which uses Roll Bit tokens as collateral and lists meme coins, is discussed. The hosts highlight the growth and volume of Open Exchange, comparing it to decentralized perps.

Concept of Restaking

- Restaking Popularity: The hosts discuss the growing popularity of restaking, where users can deposit staked ETH tokens into platforms like Eigenlayer and earn additional yield by validating other chains or conditions.

- Impact on ETH: The introduction of liquid restaking and higher yields for staked ETH can potentially increase the baseline rate for ETH, making it more attractive for users to stake their ETH rather than deploy it in other smart contracts.

- Competition Among Tokenized TV Projects: The hosts discuss the competition among tokenized TV projects, like Eigenlayer and Ondo Finance, offering high yields on stablecoins. They suggest that this competition can benefit the entire crypto space by attracting more capital and improving DeFi products.

Sentiment Analysis

- Bullish: The hosts express bullishness on Microsoft and its ability to create hype with its partnerships. They also show optimism about the growth of DeFi platforms and the potential of restaking to attract more TVL to DeFi.

- Bearish: The hosts express concerns about market manipulation in the crypto space and the challenges in regulating such practices. They also question the decision of Shiba Inu to launch “Shibarium” and its potential impact on the token’s value.

- Neutral: The hosts maintain a neutral stance on the use of DAI without staking, expressing uncertainty about the motivations of these holders. They also show neutrality towards the rebranding decision of Maker and DAI tokens.