Research Summary

The report discusses various developments in the digital asset space, including the hacking of Platypus Finance, the launch of sFRAX, the mainnet launch of Scroll, the cooperation of the Stars Arena exploiter, and the exploit of the BH token. It also covers the FOMC meeting and its potential implications for interest rates, as well as the performance of various digital assets and the growth of total value locked (TVL) in different platforms.

Key Takeaways

Security Breaches in Digital Asset Platforms

- Platypus Finance Hacked: Platypus Finance, a decentralized exchange (DEX) on Avalanche, was exploited for $2 million, causing its total value locked (TVL) to drop by 25% from $12.05 million to $8.96 million. This is the second time the platform has been hacked, with a previous incident in February 2023 resulting in a loss of $8.5 million.

- BH Token Exploit: The BH token suffered a $1.2 million exploit via a flash loan attack that manipulated the token’s price, enabling the hacker to extract USDT from the liquidity pool.

Launches and Updates

- sFRAX Goes Live: Staked FRAX (sFRAX) is now live, offering users an estimated annual percentage yield (APY) of 7.7% on their FRAX. This is a decrease from its initial 10% yield offering after 34.85 million FRAX ($34.85 million) was staked by users in one day.

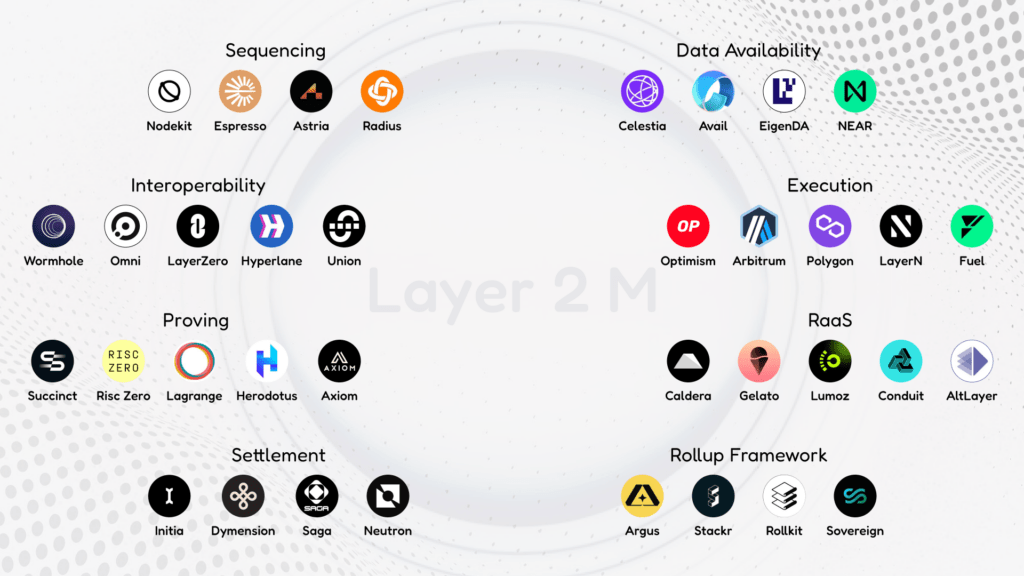

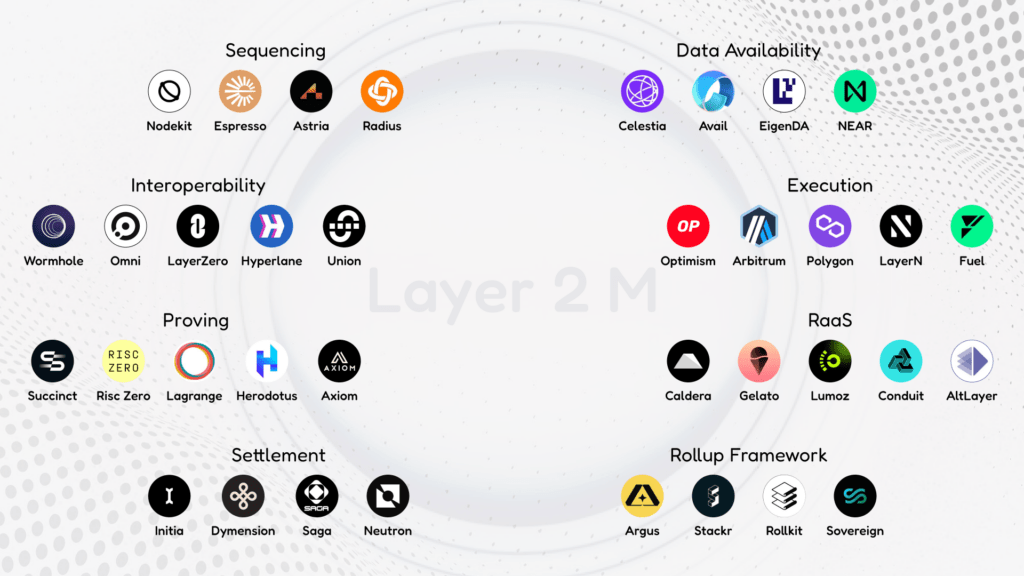

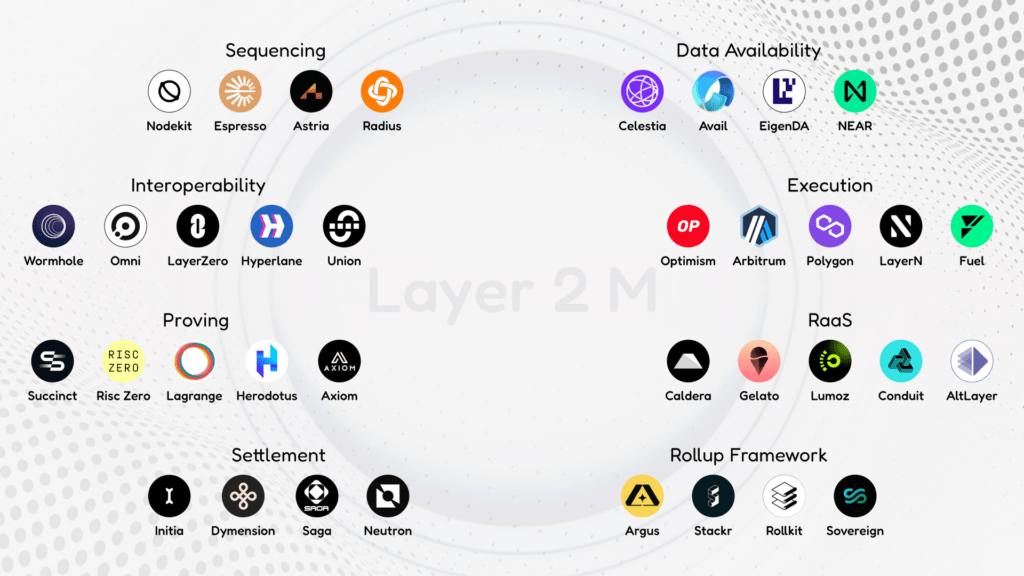

- Scroll Mainnet Launch: Scroll, a zero-knowledge EVM compatible Layer 2, has launched on mainnet. So far, 370 ETH ($570k) has been bridged to the chain, with a current TVL of almost $200,000.

Market Performance

- Performance of Tokens: YGG and PERP were the top performers for tokens below $100M market cap, with increases of 11.51% and 5.74% respectively. CANTO and FXS performed well among tokens with a market cap above $100M, with increases of 9.45% and 6.26% respectively.

- TVL Growth: Frax, Tranchess Ether, and Retro saw significant growth in their TVL, with increases of 15.46%, 14.42%, and 12.85% respectively.

FOMC Meeting and Economic Indicators

- FOMC Meeting: The Federal Open Market Committee (FOMC) meeting minutes indicated that rates may potentially be raised again in the future. Policymakers also expressed that high interest rates should be maintained for an extended period of time.

- Economic Indicators: The Consumer Price Index (CPI) for September was published at 3.7%, slightly higher than the forecasted 3.6%. The Core CPI was reported as forecasted at 4.1%.

Actionable Insights

- Security Measures: The repeated hacking of platforms like Platypus Finance and the exploit of the BH token highlight the need for robust security measures in the digital asset space. Stakeholders should prioritize security audits and risk management strategies to protect their assets.

- Monitoring Yield Opportunities: The launch of sFRAX and its yield offering presents an opportunity for users to earn returns on their FRAX. Stakeholders should monitor such yield opportunities and assess their potential benefits and risks.

- Tracking Market Performance: The performance of tokens like YGG, PERP, CANTO, and FXS, as well as the growth in TVL of platforms like Frax, Tranchess Ether, and Retro, indicate potential areas of interest in the digital asset market. Stakeholders should track market performance to identify trends and opportunities.

- Understanding Economic Indicators: The potential for future rate hikes and the reported CPI and Core CPI figures could have implications for the digital asset market. Stakeholders should understand these economic indicators and their potential impact on their investments.