Research Summary

The report provides an in-depth analysis of LI.FI, a middleware solution that connects multiple EVM chains and Solana, and its products such as Jumper.exchange. It also discusses other protocols like Socket Tech, Across Protocol, Axelar, Synapse Protocol, and Hop Protocol. The report highlights the performance of these protocols in terms of volume, transactions, and user base. It also provides insights into the Cross-Chain Interoperability Protocol (CCIP) and the movement of assets across different blockchains.

Key Takeaways

LI.FI’s Performance and Integration

- LI.FI’s Reach: LI.FI has integrated with over 120 protocols and enterprises, including 7 of the top 10 wallets, for swaps and bridging transactions. It has achieved $1.9 billion in volume since inception.

- Jumper.exchange’s Success: Jumper.exchange, a product by LI.FI, has facilitated over $1.4 billion in volume and 1.6 million transactions from 300,000 users in a year.

Performance of Other Protocols

- Socket Tech’s Bridging: Socket Tech has facilitated over $1.3 billion worth of bridging assets and provides an interoperability protocol for seamless asset and data transfers across blockchains.

- Across Protocol’s Market Share: Across Protocol, a cross-chain bridge for L2s and mainnet Ethereum, has gained a 50% increase in market share over 2 months and processed $405 million in volume.

- Axelar’s Interchain Transfers: Axelar has facilitated 904k interchain transfers, connecting over 50 EVM and Cosmos chains, with more than 200K unique users bridging nearly $6.65B across chains.

- Synapse Protocol’s User Base: Synapse Protocol has crossed $25.5M in fees and has 1.8M users, with 1.87M users bridging $42B in volume and 2.8M NFTs.

- Hop Protocol’s Transfers: Hop Protocol has facilitated over $4B of transfers from over 1 million wallets, accounting for 2.5+ million transfers across all chains.

Cross-Chain Interoperability Protocol (CCIP)

- CCIP Transactions: In October, there were 4,048 Cross-Chain Interoperability Protocol (CCIP) transactions, a 52% decrease from the previous month. Ethereum accounted for 44% of CCIP transactions.

- CCIP Revenue: Monthly CCIP revenue in October was $14,062, a 59% decrease from the previous month.

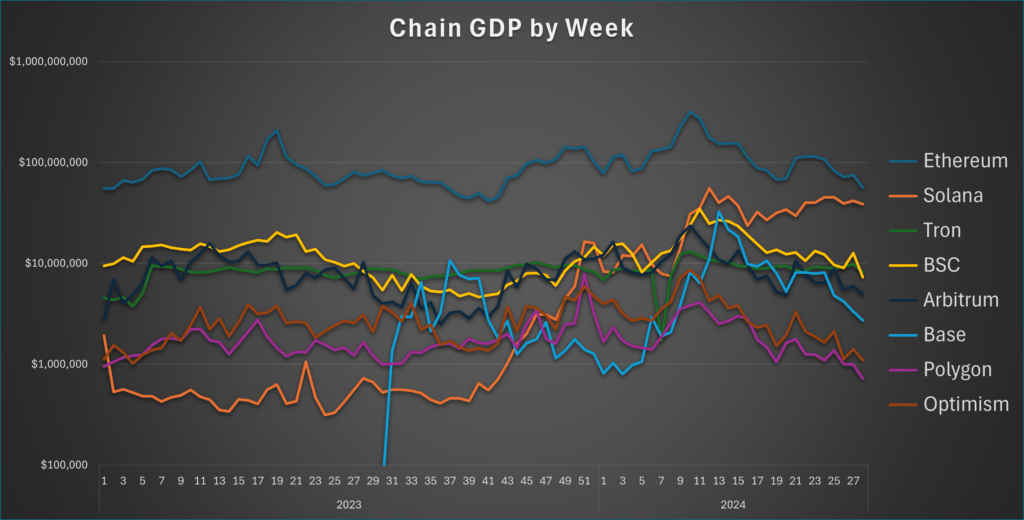

Asset Movement Across Blockchains

- Chainlink Labs’ Asset Movement: Chainlink Labs moved 6,949,999 LINK from a noncirculating supply wallet to its Binance deposit address, indicating a sale of the LINK.

- Value Bridged to Arbitrum: The total value bridged to Arbitrum on Ethereum Layer2 reached 3 million ETH, with zkSync bridging over 2.2 million ETH and Optimism bridging 632k ETH.

Actionable Insights

- Investigate the Potential of LI.FI: Given LI.FI’s extensive integration and high volume, it may be worth exploring its middleware solution and products like Jumper.exchange for potential opportunities.

- Consider the Performance of Other Protocols: The performance of protocols like Socket Tech, Across Protocol, Axelar, Synapse Protocol, and Hop Protocol in terms of volume, transactions, and user base could provide valuable insights for decision-making.

- Assess the Impact of CCIP: The trends in CCIP transactions and revenue could have implications for cross-chain interoperability and should be considered in strategic planning.

- Monitor Asset Movement Across Blockchains: The movement of assets across different blockchains, such as Chainlink Labs’ sale of LINK and the value bridged to Arbitrum, could influence market dynamics and should be closely monitored.