Research Summary

The report discusses the resurgence of DeFi, highlighting the launch of Prisma Finance’s PRISMA token and the growth of Solana DeFi. It also covers the rise of crypto casinos, with a focus on Rollbit and WINR Protocol. The report further discusses the distribution of Arbitrum DAO’s ARB grants and provides on-chain analysis of Arbitrum net flows and ThorChain volume. Lastly, it introduces ChainEDGE, a tool for tracking top DEX traders.

Key Takeaways

DeFi Resurgence

- Prisma Finance’s PRISMA Token: Prisma Finance has launched the PRISMA token, its governance token, which has created high rates on blue-chip assets. This could potentially trigger a yield competition on LSTs.

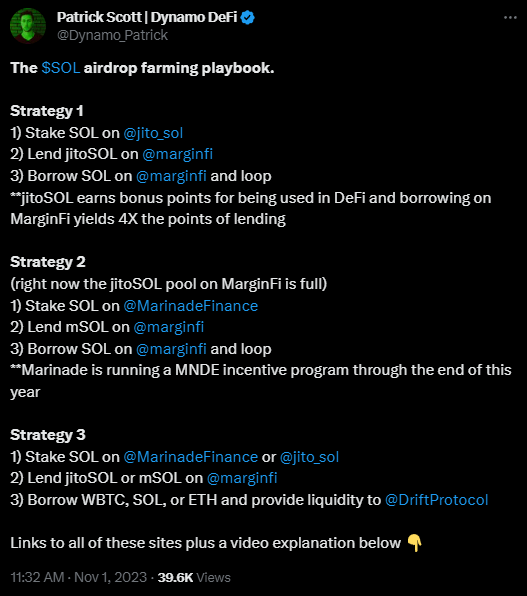

- Solana DeFi Growth: Solana DeFi has been experiencing significant growth, with opportunities to pre-farm several future ecosystem primitives.

Crypto Casinos

- Rollbit’s Performance: Rollbit has performed exceptionally well over the past month, renewing interest in the GambleFi narrative.

- WINR Protocol: WINR Protocol is developing a Layer 3 chain on Arbitrum for GambleFi infrastructure and has already launched several dapps. Infrastructure plays like this can benefit from network effects, potentially offering greater upward potential than individual dapps.

Arbitrum DAO’s ARB Grants

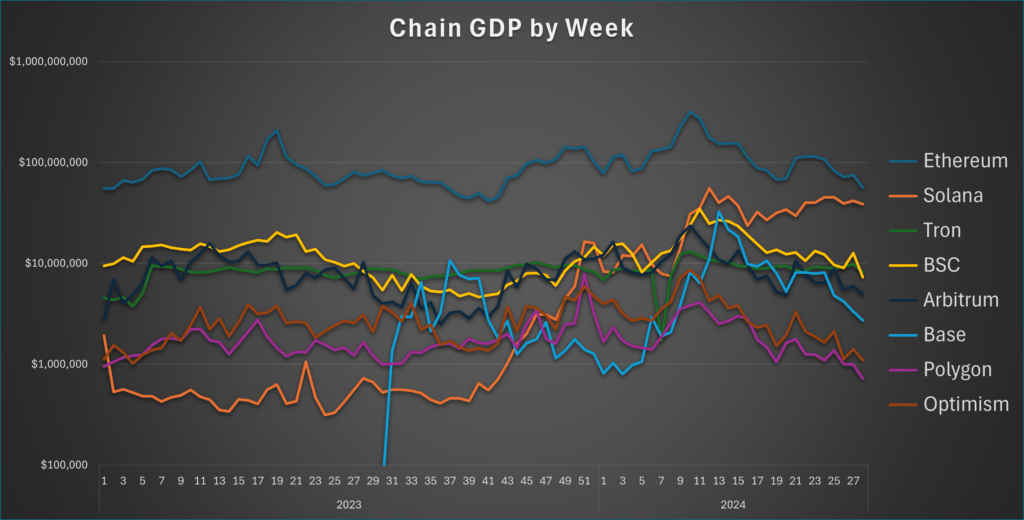

- ARB Grants Distribution: The Arbitrum DAO is distributing ARB grants to 29 projects, which has led to $75M flowing into Arbitrum this week, the most of any chain. This indicates that new money is entering the ecosystem.

On-Chain Analysis

- ThorChain Volume: ThorChain’s volume has been growing week over week, reaching its second-highest point in the past year. ThorChain is currently the 6th largest DEX by volume, and it’s worth watching to see if it can break into the top 3.

Tool Spotlight

- ChainEDGE: ChainEDGE is a tool that tracks the top token inflows for a pool of top 0.01% DEX traders, providing valuable insights into smart money movements.

Actionable Insights

- Monitor DeFi Developments: Keep an eye on the developments in DeFi, particularly the performance of Prisma Finance’s PRISMA token and the growth of Solana DeFi. These could provide insights into potential trends and opportunities in the DeFi space.

- Explore Crypto Casinos: Investigate the potential of crypto casinos, focusing on the performance of Rollbit and the infrastructure development by WINR Protocol. These could offer insights into the growth and potential of the GambleFi sector.

- Track Arbitrum DAO’s ARB Grants: Follow the distribution of Arbitrum DAO’s ARB grants and the impact on Arbitrum’s net flows. This could provide valuable information about the ecosystem’s growth and the potential of the projects receiving the grants.

- Analyze ThorChain Volume: Analyze the growth in ThorChain’s volume and its position in the DEX market. This could offer insights into the demand for cross-chain swaps and the potential of ThorChain.

- Utilize ChainEDGE: Consider using ChainEDGE to track top DEX traders and gain insights into smart money movements. This could help in making informed decisions based on the actions of top traders.