Research Summary

The report discusses the importance of attention in the valuation of cryptocurrencies. It argues that the value of most tokens is driven by the level of attention they receive, rather than their intrinsic value or fundamentals. The report uses examples of tokens like INJ and TIA/Celestia to illustrate this point.

Key Takeaways

Attention as a Key Driver of Token Value

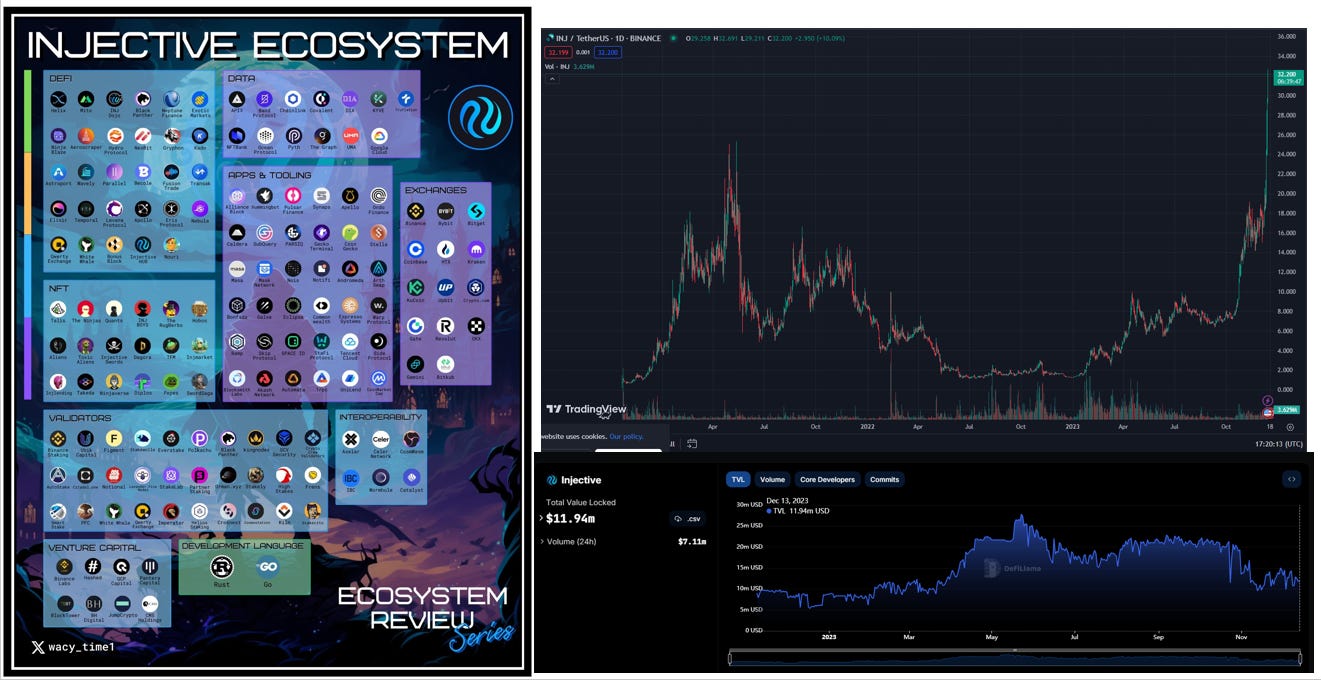

- Attention Over Fundamentals: The report argues that the value of most cryptocurrencies is driven by the level of attention they receive, rather than their intrinsic value or fundamentals. It uses the example of the INJ token, which saw a 32x increase in value despite flat TVL and falling core developers.

- Price as a Measure of Project Success: The report suggests that a rising token price is often seen as an indicator of a successful project, regardless of the project’s actual performance or fundamentals.

Trading Based on Attention

- Trading Strategy: The report suggests that traders should focus on the level of attention a token is receiving when deciding whether to buy or sell. It argues that tokens that are trending on platforms like Dexscreener are likely to see their value increase.

- Attention Cycles: The report introduces the concept of “attention cycles”, suggesting that traders should try to identify where a token is in its attention cycle when deciding whether to buy or sell.

Examples of Attention-Driven Token Value

- INJ Token: The report uses the example of the INJ token to illustrate how attention can drive token value. Despite flat TVL and falling core developers, the INJ token saw a 32x increase in value due to increased attention.

- TIA/Celestia: The report also uses the example of TIA/Celestia, which saw its value increase after executing a successful airdrop and attracting the attention of Crypto Twitter.

Actionable Insights

- Monitor Attention Levels: Traders should monitor the level of attention a token is receiving when deciding whether to buy or sell. Platforms like Dexscreener can be useful for identifying trending tokens.

- Consider Attention Cycles: Traders should consider where a token is in its attention cycle when making trading decisions. Tokens that are at the peak of their attention cycle may be overvalued, while those at the start of a new attention cycle may be undervalued.

- Look Beyond Fundamentals: While fundamentals can be important, the report suggests that attention is often a more important driver of token value. Traders should therefore not rely solely on fundamentals when making trading decisions.