Podcast Summary

This podcast episode delves into the world of stablecoins, focusing on Ethena, a company aiming to create the first internet-native bond. The discussion covers the regulatory landscape, the design and functionality of Ethena’s stablecoin, and the challenges and opportunities in the crypto market. The guest is the founder of Ethena, who brings a wealth of experience from the financial services sector.

Key Takeaways

Ethena’s Unique Stablecoin Design

- Ethena’s Stablecoin: Ethena aims to create a unique stablecoin that does not rely on banking for treasury yields and avoids unsustainable practices. The design is based on a synthetic dollar using long ETH positions and shorting perpetual contracts.

- Yield Potential: The combination of funding rates for being long on ETH and the liquid state yield can result in a yield of 15% to 20% for holding Ethena’s stablecoin.

Regulatory Landscape and Challenges

- Regulatory Compliance: The next 12 to 24 months will test the boundaries of regulatory compliance in the web 3 space. Stablecoins like Ethena’s face a choice between regulatory compliance and pushing boundaries.

- Regulatory Challenges: Projects focusing on real-world asset-backed stablecoins face regulatory challenges and may struggle to extract value beyond delivering beta.

Market Dynamics and Opportunities

- Market Demand: There is a greater demand for long positions in the crypto market, which is reflected in the funding rates of contracts. This assumption underpins Ethena’s stablecoin model.

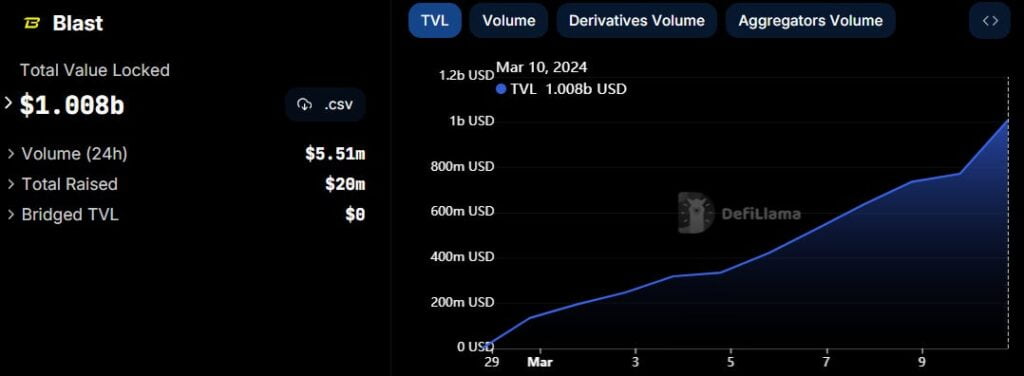

- Market Growth: The growth of the derivative market, such as ETH and ATX, is important for the success of Ethena’s stablecoin.

Future Plans and Potential

- Expansion Plans: Timing the launch of Ethena on different assets is crucial. Bitcoin and Solana are potential additions due to their larger derivative markets.

- Product Development: There are plans to build on top of Ethena’s stablecoin, including the use of perpetuals and structured products to lock in yields and leverage positions.

Sentiment Analysis

- Bullish: The podcast presents a bullish sentiment towards Ethena’s stablecoin and its potential in the crypto market. The unique design, high yield potential, and plans for future expansion contribute to this optimism.

- Bearish: There is a bearish sentiment towards the regulatory challenges that stablecoin projects face. The podcast suggests that these challenges could hinder the growth and adoption of stablecoins.

- Neutral: The podcast maintains a neutral stance on the overall crypto market, acknowledging both the opportunities and risks present. It emphasizes the importance of market dynamics and regulatory compliance in determining the success of stablecoins.