Podcast Summary

This episode of the Block Crunch podcast features hosts Jason Choi and Darryl Wang, founders of Tangent, discussing their investment strategies, market predictions, and insights into the crypto space. They delve into their successful trades, such as Solana, and their investment in innovative projects like Arweave and Amino.

Key Takeaways

Tangent’s Investment Strategy

- Evergreen Fund: Tangent operates as an evergreen fund, investing across every lifecycle of a crypto company, from idea generation to the liquid markets. This structure allows them to provide comprehensive support to different protocols.

- Investment Focus: Tangent focuses on three main categories of investments: zero to one opportunities, market for everything, and supporting fund managers in specific verticals. They believe in investing in both venture rounds and liquid markets.

- Employee-Owned Structure: The fund is 100% employee-owned, aligning incentives and ensuring that the team is fully exposed to the risks and enjoys the upside of crypto investments.

Investment Insights and Predictions

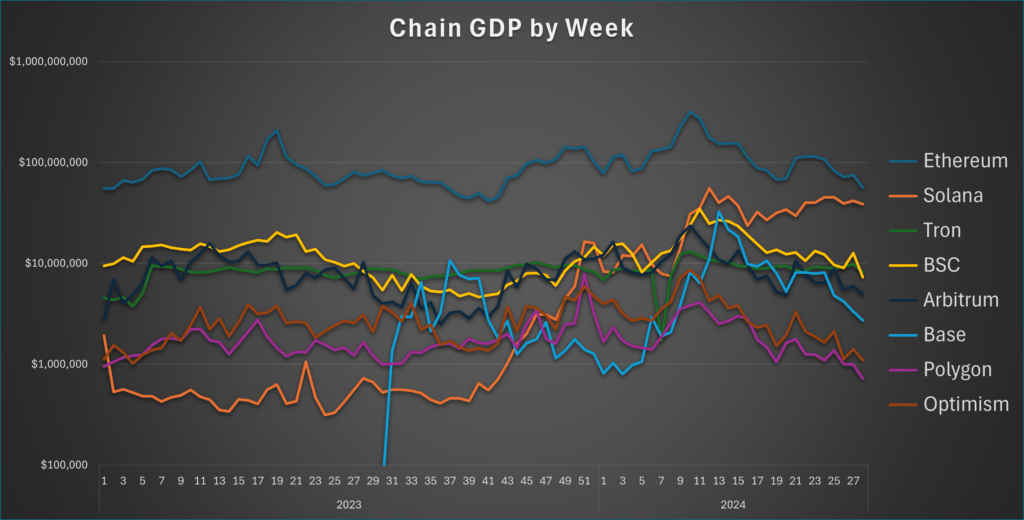

- Solana Trade: The hosts made a successful long position on Solana, predicting a push to $200 based on strong fundamental drivers. They eventually took off the position at $190.

- ETH/BTC Trade: The hosts took advantage of poor sentiment towards ETH and the potential upside if the ETF got approved. They acknowledge that they got lucky with the ETF approval.

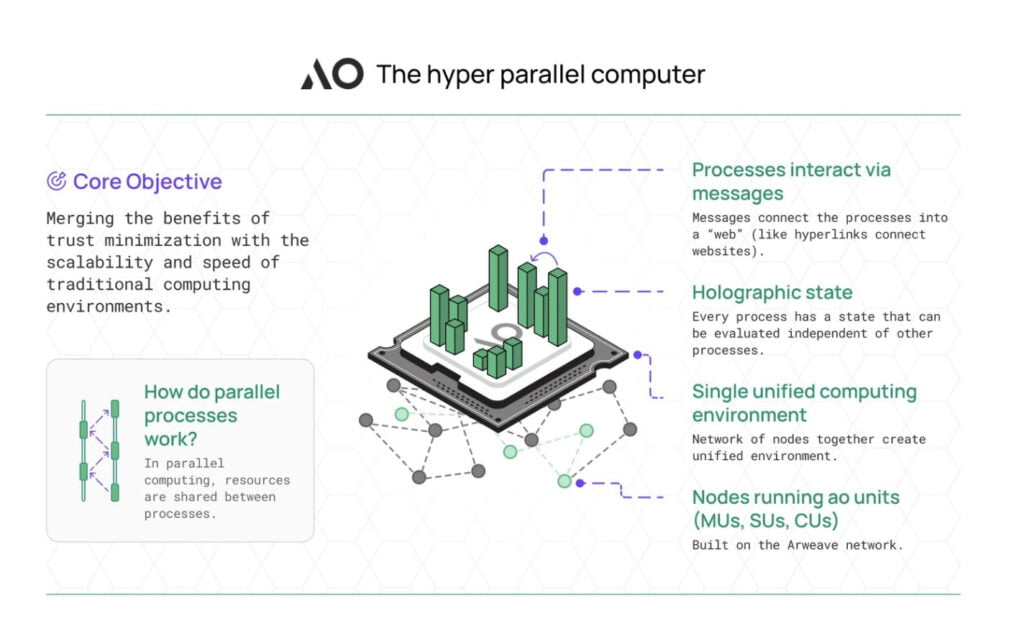

- Arweave Investment: The hosts express excitement about Arweave, a new L1 developed by the RWE team, which allows AI agents to work on-chain and had a fair launch with no allocation for investors or the team.

Team Dynamics and Learning

- Team Structure: The Tangent team is structured to have different personalities and skill sets, allowing for diverse perspectives and thoughtful disagreements. They use a quiz and radar chart system to assess team members’ strengths and weaknesses.

- Continuous Learning: The hosts emphasize the importance of continuous education and growth, such as investing in funds unrelated to crypto and conducting internal knowledge sessions.

Sentiment Analysis

- Bullish: The hosts express a bullish sentiment towards Solana, predicting a push to $200 based on strong fundamental drivers. They also express excitement about Arweave, a new L1 developed by the RWE team, which they believe can provide a new and innovative solution in the market.

- Bearish: Despite being a long-term focused venture investor, one host admits to often being bearish on things, while the other host is more naturally bullish. This balance of perspectives contributes to their thoughtful decision-making process.

- Neutral: The current view on Bitcoin is that it is in a wide chopping range between $56,000 and $71,000, with no conviction on when it will break out. This neutral sentiment is influenced by factors such as the correlation with equities, stable coin inflows, and the potential impact of ETF flows.