Podcast Summary

The podcast is the first episode of Season 5 of Bell Curve. In this episode, Mike and Myles explore the end game for liquid staking. They discuss the history of proof-of-stake and liquid staking, how LSTs are a network effects game, why LST protocol governance is a highly debated topic, the risks of restaking, and the LST competitive landscape.

Key Takeaways

- The History of PoS and LSTs: The podcast begins with a discussion on the history of proof-of-stake and liquid staking. The hosts discuss the evolution of these concepts and their impact on the cryptocurrency landscape.

- A Market Structure Dominated by Network Effects: The hosts discuss how liquid staking tokens (LSTs) are a network effects game, with the success of a particular LST often dependent on its adoption and use within the network.

- LST Protocol Governance: The governance of LST protocols is a highly debated topic. The hosts discuss the importance of governance in ensuring the security and integrity of the network.

- The Principal-Agent Problem: The hosts discuss the principal-agent problem in the context of liquid staking, where the interests of the staker (the principal) and the validator (the agent) may not always align.

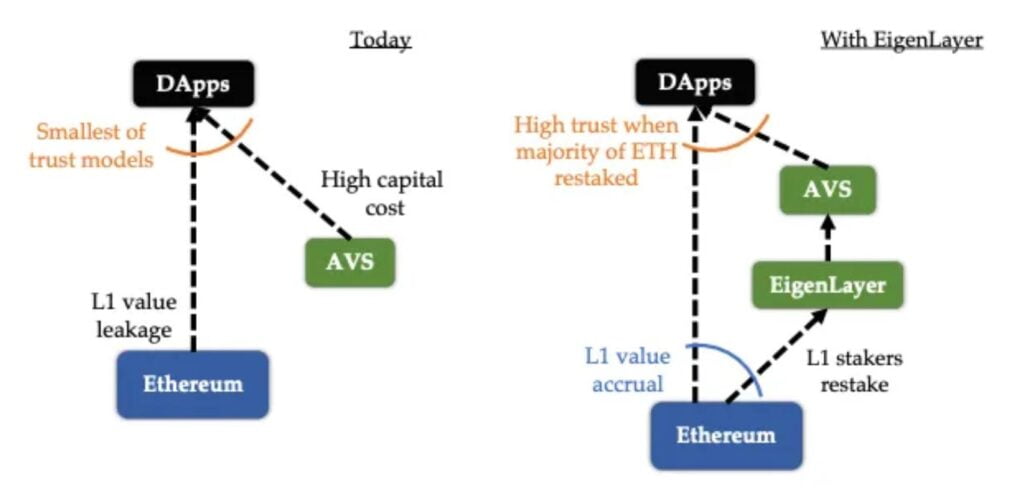

- Restaking: The Design and Risks: The podcast explores the concept of restaking, where staking vouchers are redelegated to operators of other protocols. The hosts discuss the potential benefits and risks associated with restaking, including the risk of double slashing.

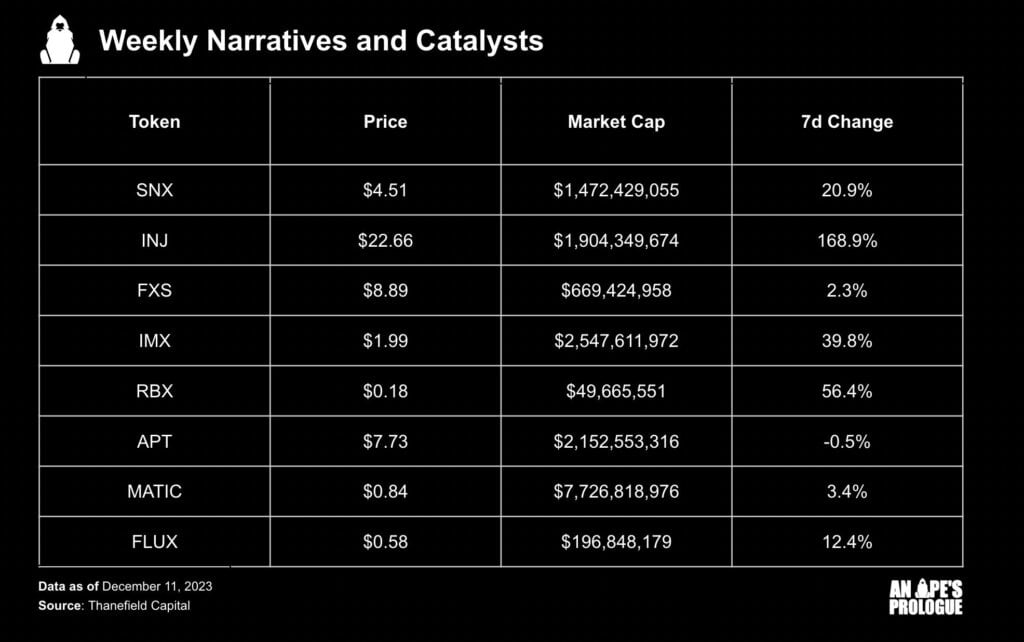

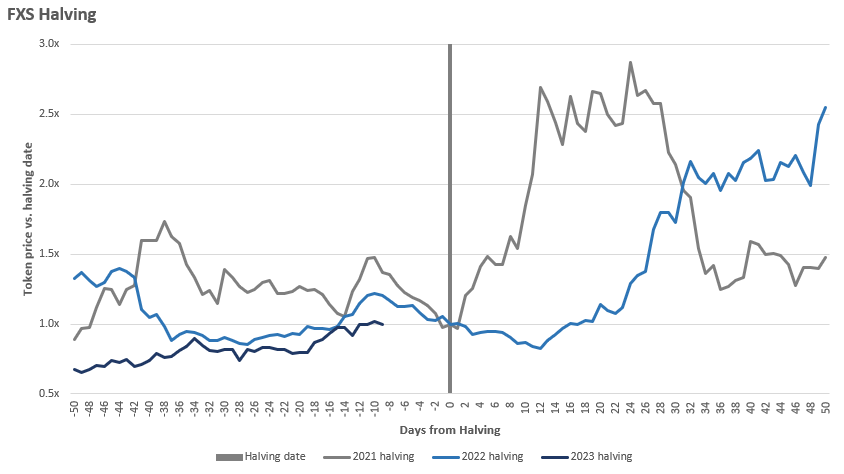

- The LST Competitive Landscape: The hosts discuss the competitive landscape of liquid staking, mentioning several competitors to Lido, such as CBE, Frax, and Rocket Pool. They discuss the different strategies these competitors are using to gain market share.

Sentiment Analysis

- Bullish: The hosts express a bullish sentiment towards the concept of liquid staking and its potential to unlock capital and secure various protocols on the network. They also express optimism about the potential for restaking to increase the scalability of Ethereum.

- Bearish: The hosts express concerns about the risks associated with restaking, including the risk of double slashing and the potential for adverse selection where less careful protocols might attract retail investors with higher yields. They also express concerns about the potential for a blow-up in the next bull run due to superfluid restaking operations.

- Neutral: The hosts maintain a neutral stance on the governance of LST protocols, acknowledging its importance but also noting the ongoing debates in this area.