Podcast Summary

In this episode, the hosts delve into a variety of topics, including the ongoing SBF trial, the portrayal of FTX by author Michael Lewis, and the potential implications of the trial’s outcome. They also discuss the performance of Maverick Protocol, the case involving FTX and false pretenses, and the concept of the St. Petersburg Paradox. The hosts further explore the Ethereum protocol, the enshrinement debate in the Cosmos ecosystem, the launch of Ethereum futures, and the potential approval of spot Bitcoin ETFs. Lastly, they discuss the current state of the bond market and the implications of the Federal Reserve’s actions.

Key Takeaways

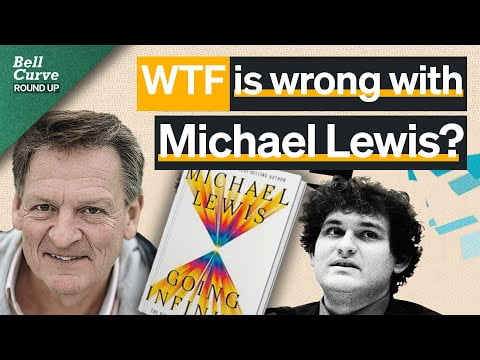

SBF Trial and Michael Lewis’s Portrayal of FTX

- SBF Trial: The hosts discuss the ongoing SBF trial, expressing surprise at some of the details revealed so far. They also question the motives behind Michael Lewis’s portrayal of FTX in his book.

- FTX’s Profitability: The hosts argue that FTX was not a profitable business, contrary to Lewis’s portrayal. They also criticize Lewis’s inclusion of unnecessary details in his book.

- Outcome of the Trial: The hosts speculate that the trial will challenge the narrative presented by Lewis and SBF, ultimately determining the truth about FTX’s operations.

Maverick Protocol’s Performance and the FTX Case

- Maverick Protocol: The hosts highlight Maverick Protocol’s innovative AMM and suite of tools for DeFi users and builders. They note its significant market share and high levels of capital efficiency.

- FTX Case: The hosts discuss the ongoing case involving FTX and false pretenses, raising questions about the amount of money raised and potential securities fraud.

- St. Petersburg Paradox: The hosts mention the concept of the St. Petersburg Paradox, which may have influenced the accused party’s risk management and trading style.

Ethereum Protocol and the Enshrinement Debate

- Ethereum Protocol: The hosts discuss Vitalik Buterin’s article on enshrining more things in the Ethereum protocol. They debate the pros and cons of enshrining each category, focusing on the challenges and potential benefits.

- Enshrinement Debate: The hosts draw parallels between the enshrinement debate in Cosmos and the ongoing Ethereum alignment debate. They express concerns about the lack of formal governance mechanisms in Ethereum.

- Ethereum Futures: The hosts mention the launch of Ethereum futures and address initial criticisms of low volume. They speculate on the effects of Ethereum futures on the underlying spot value.

Bitcoin ETFs and the Ripple Case

- Bitcoin ETFs: The hosts discuss the potential approval of spot Bitcoin ETFs in the next three to six months. They highlight the importance of access to these new products and anticipate increased buyer interest in the future.

- Ripple Case: The hosts discuss the recent minor win for XRP as the SEC’s appeal was struck down. They provide an explanation of the interlocutory appeal filed by the SEC and its denial by the judge.

- Entrepreneurship in the Digital Asset Space: The hosts emphasize the importance of new regulations in creating a framework for entrepreneurship in the digital asset space in the US.

Bond Market and the Federal Reserve’s Actions

- Bond Market: The hosts discuss the current state of the bond market and the implications of the Federal Reserve’s actions. They express concern about the potential negative consequences of continuously buying bonds to plug the leaks in the market.

- Federal Reserve’s Actions: The hosts highlight that the Federal Reserve may have to start buying bonds again due to a supply-demand imbalance in the bond market. They suggest that yield curve control, a form of quantitative easing, may be the endgame for the Federal Reserve.

- Implications of Bond Buying: The hosts mention a specific example of Silicon Valley Bank’s decision to not hedge their fixed income risk, which ultimately led to their downfall. They emphasize that the financial math only goes one way, and the Fed will likely continue to cut rates and buy bonds.

Sentiment Analysis

- Bullish: The hosts express a bullish sentiment towards Maverick Protocol, highlighting its innovative AMM and suite of tools for DeFi users and builders. They also show optimism about the potential approval of spot Bitcoin ETFs in the next three to six months, anticipating increased buyer interest in the future.

- Bearish: The hosts express a bearish sentiment towards the ongoing SBF trial and the portrayal of FTX by Michael Lewis. They also show concern about the current state of the bond market and the implications of the Federal Reserve’s actions.

- Neutral: The hosts maintain a neutral stance on the Ethereum protocol and the enshrinement debate. They also remain neutral on the Ripple case, noting that the recent minor win for XRP is not a definitive victory.