Podcast Summary

In this podcast, Mike Dudas and Karl Vogel from 6th Man Ventures discuss their journey into the crypto space, their investment strategies, and the dynamics of the Solana ecosystem. They also delve into the challenges and considerations of investing in Layer 1 and Layer 2 solutions, the importance of infrastructure investments, and the insights from their research on airdrops and tokenomics.

Key Takeaways

Investment Focus and Strategy

- Application Layer Projects: 6th Man Ventures primarily invests in application layer projects across multiple blockchain ecosystems. They believe in the potential of these projects to drive blockchain adoption and use.

- Startup Mindset: The team approaches their work with a startup mindset, focusing on data-driven decisions and real-world applications as key indicators of ecosystem activity.

- Investing in Emerging Ecosystems: While emerging ecosystems present higher risks, the team values passionate founders and a clear culture. They evaluate ecosystems based on metrics such as the number of transactions, ease of building, and availability of developer tools.

Solana Ecosystem

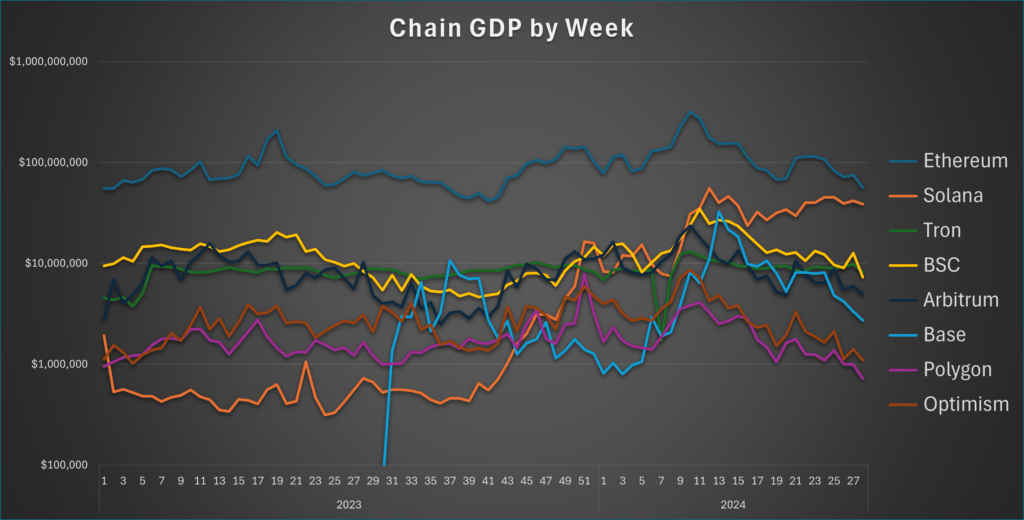

- Resilience and Growth: Despite regulatory challenges, the Solana ecosystem has shown resilience and success in terms of transactions, value exchanged, and industry partnerships. Its rapid growth and development have attracted interest from financial investors.

- Real Technology and Infrastructure: The strength of the Solana ecosystem lies in its real technology and infrastructure, rather than developer statistics.

Infrastructure Investments

- Enabling Infrastructure: While the fund invests in enabling infrastructure like wallets, its primary focus is on early-stage applications. They prefer investing in founders with strong product and engineering DNA and a native understanding of crypto ecosystems.

- Specific Projects: Infrastructure investments are made with a focus on specific projects that have a strong track record and purpose, rather than investing in infrastructure for the sake of it.

Research on Airdrops and Tokenomics

- Airdrop Insights: Their research showed that airdropping to core cohorts resulted in higher price performance, while airdropping to widespread audiences led to more selling. They recommend biasing airdrops towards core users and favoring smaller airdrops over larger ones.

- Token Vesting: The team also provided insights on token vesting, suggesting to start vesting one year afterwards to reduce sell pressure and to limit the size of increases in circulating supply to less than 1% to avoid downward cycles of selling.

Sentiment Analysis

- Bullish: The podcast presents a bullish sentiment towards the Solana ecosystem, highlighting its resilience, rapid growth, and real technology and infrastructure. The hosts also express optimism about the potential of application layer projects and the opportunities in emerging ecosystems.

- Neutral: While the hosts acknowledge the risks and challenges in investing in Layer 1 and Layer 2 solutions and the volatile crypto market, they emphasize the importance of data-driven decisions, a clear focus, and long-term orientation. This reflects a balanced and pragmatic view of the crypto space.