Research Summary

The report discusses a major sell signal triggered in the market, the current consensus, and a potential opportunity in Brazil. It also provides an analysis of the Trend Fragility index, equity fund flows, market internals, and the SPX trend. The report further discusses Bitcoin and the easing of financial conditions.

Key Takeaways

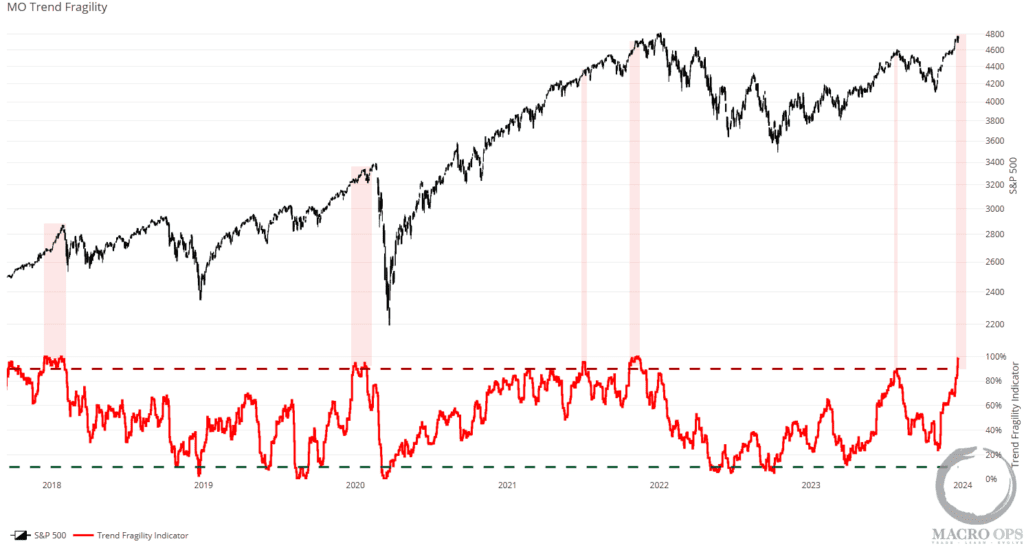

Trend Fragility Index

- High Trend Fragility Score: The Trend Fragility (TF) score ended the week at 99%, its highest reading since December 2021. This suggests that forward returns over the next 1-3 months could be significantly worse than average. However, the report advises against completely flattening books or plunging short, as there can be long lead times before a subsequent peak.

Market Internals

- Cracking Market Internals: The report notes that market internals have begun to show signs of cracking, with credit and the VIX curve starting to diverge lower from SPX. These are early signs and not yet ominous by themselves, but worth monitoring.

Bitcoin

- Bitcoin Positioning: The report mentions that they have been long on Bitcoin but have raised their stops as they are playing this trend tight. They will look to add again to the position should they see a daily close above the current consolidation.

Financial Conditions

- Easing Financial Conditions: The report highlights that financial conditions have eased significantly over the past six months, which could explain the recent bullish impulse in the market.

Brazilian Market

- Opportunity in Brazil: The report identifies Brazil as a potential opportunity due to its cheapness on both a relative and absolute basis. Brazil is the world’s largest net exporter of Agricultural commodities, and the report is turning constructive on the Ag space.

Actionable Insights

- Monitor Trend Fragility Index: Given the high TF score, it would be prudent to monitor this index closely for potential market downturns.

- Track Market Internals: With early signs of cracking market internals, tracking these metrics could provide valuable insights into market movements.

- Consider Bitcoin’s Position: Given the report’s strategy on Bitcoin, it might be worth considering similar strategies or monitoring Bitcoin’s performance closely.

- Assess Financial Conditions: The easing of financial conditions could have significant implications for various market sectors. Assessing these conditions could provide valuable insights.

- Research the Potential in Brazil: Given the report’s positive outlook on Brazil, it might be worth researching potential opportunities in this market, particularly in the Agricultural commodities sector.