Research Summary

The report discusses Injective, a blockchain specifically built for finance applications. It highlights the platform’s features, use cases, adoption, revenue, tokenomics, and governance. The report also provides an overview of the team and investors, competitors, risks, and audits associated with Injective.

Key Takeaways

Injective’s Unique Features and Use Cases

- Fast and Interoperable: Injective is touted as the fastest L1 blockchain with a decentralized and modular order book. It offers instant transaction finality using the Tendermint and is interoperable across multiple chains.

- Focus on Traditional Finance: As the industry moves away from high DeFi yields from highly inflationary assets, Injective is ready to offer products often seen in traditional finance, such as spot and derivatives markets based on an order book model, combined with low gas fees.

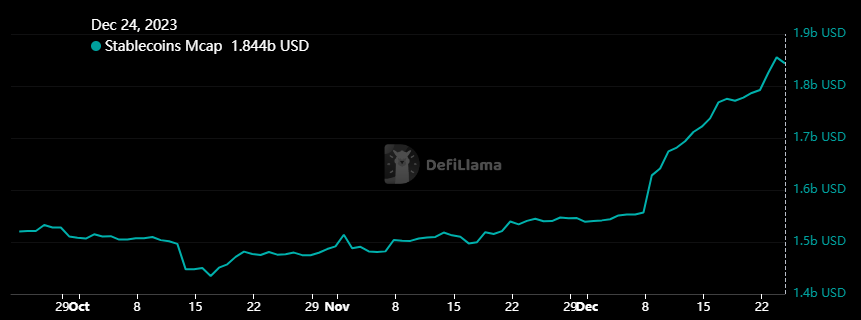

Revenue and Tokenomics

- Trading Fees: Injective charges 0.1% for makers and 0.2% for takers. 40% of fees from INJ dApps go to developer incentives, while 60% are auctioned off every week via a buyback and burn mechanism.

- Token Burns: Injective implements weekly token burns, with 60% of Protocol Revenue from exchange fees auctioned off in exchange for INJ, which is then burned. Over $5.8m INJ tokens have been burned to date.

Governance and Treasury

- Global DAO: Injective has established a global DAO to allow the community to participate in protocol upgrade proposals, validate the network, and participate in burn auctions.

- Treasury: The Injective Treasury comprises 15.2m INJ tokens, worth a total of 236m USD. However, the concentration in the native token poses a significant diversification risk.

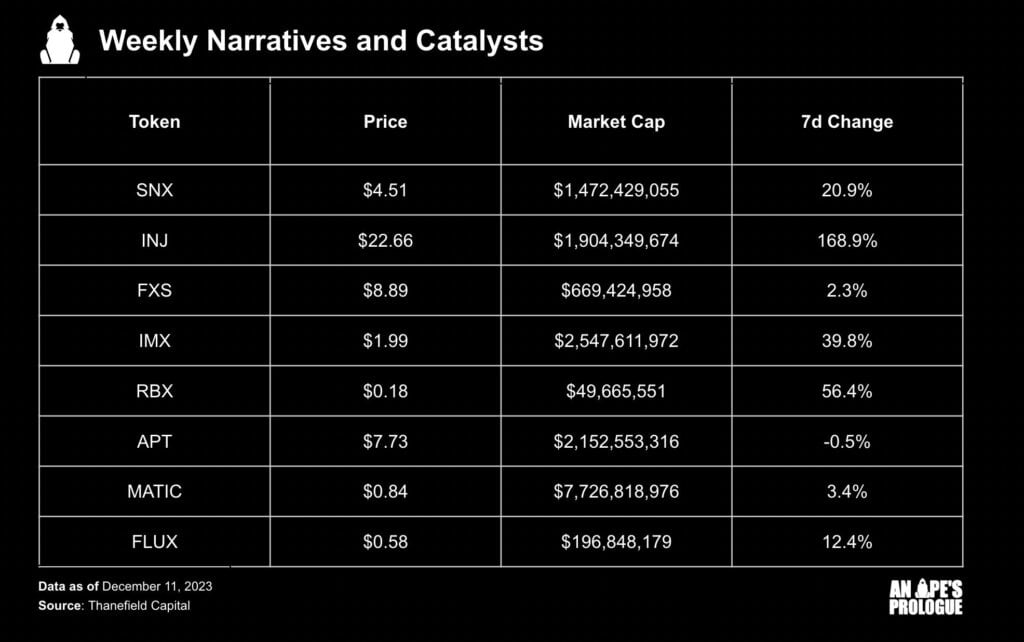

Team, Investors, and Competition

- Founding and Funding: Injective Labs was founded in 2018 and incubated by Binance Labs. It has raised around $56.7m over multiple funding rounds and has attracted impressive investors.

- Competition: Injective faces competition from traditional EVM-based Perpetuals protocols and new rivals that have developed their own custom app-chain. Despite strong competition, Injective has a large Treasury and hefty institutional backing.

Actionable Insights

- Investigate Injective’s Potential: With its unique features, focus on traditional finance, and strong institutional backing, Injective presents a compelling case for further investigation.

- Consider the Risks: While Injective has many strengths, it’s important to consider the risks, including its diversification risk due to the concentration of assets in the native token and competition from other protocols.

- Monitor the Market: Given Injective’s performance and potential, it would be prudent to keep a close eye on its market movements and developments.