Research Summary

The report provides an update on the Canto project, focusing on its Neofinance strategy. It discusses the use of USYC as collateral on the Canto Lending Market (CLM), the increase in the NOTE rate, and the modest uptrend in TVL on Canto. The report also looks ahead to the launch of FortunaFi’s “Tokenized Asset Protocol” and the rollout of additional RWA products. It also discusses the role of Vivacity in the Neofinance architecture.

Key Takeaways

Neofinance Strategy in Motion

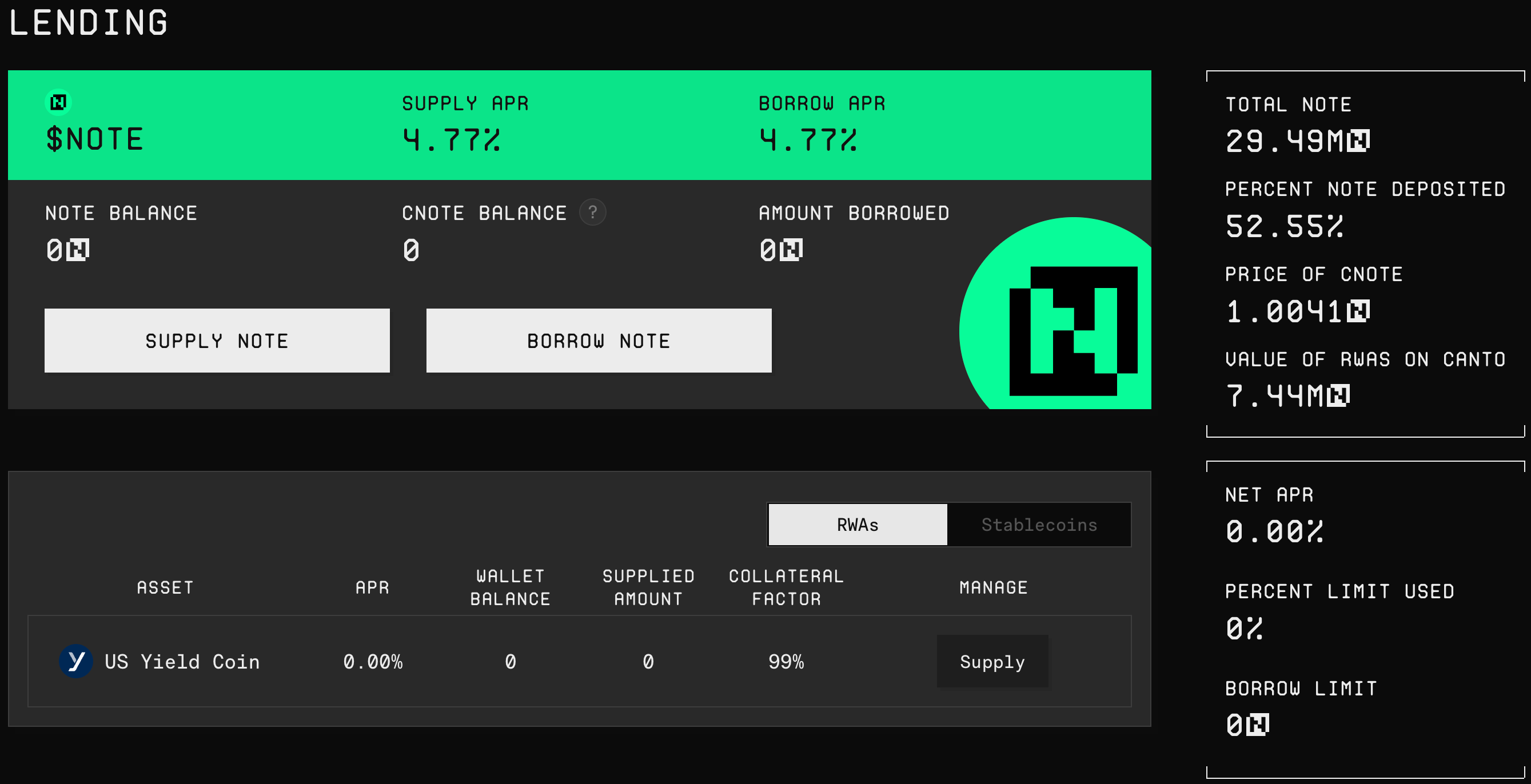

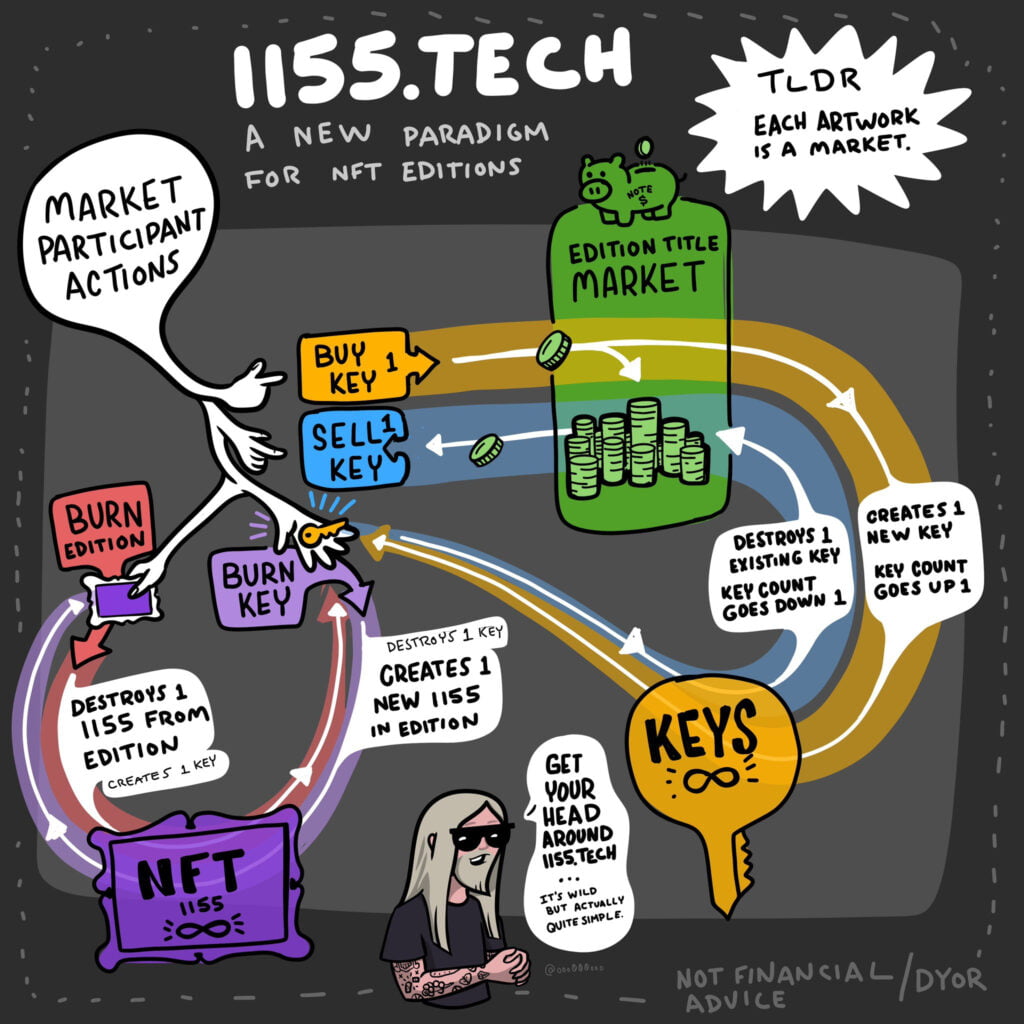

- USYC as Collateral: The report highlights that Canto’s Neofinance strategy is now in motion with the first RWA live. USYC, a tokenised short-duration yield fund, can be used as collateral on the Canto Lending Market (CLM). Approximately $7.5 million has been supplied on the CLM.

- NOTE Rate Increase: The flow of USYC depositors borrowing NOTE, swapping it for USDC, buying and depositing USYC has increased the NOTE rate to 4.77%. This rate can be accessed by any user in a permissionless fashion and with any size.

TVL on Canto

- Modest Uptrend: The report notes a modest uptrend in TVL on Canto, although it is not yet parabolic. The TVL calculation on DefiLlama does not count USYC or NOTE deposited into the CLM as cNOTE, which understates the real growth seen over the past 1.5 months.

Upcoming Developments

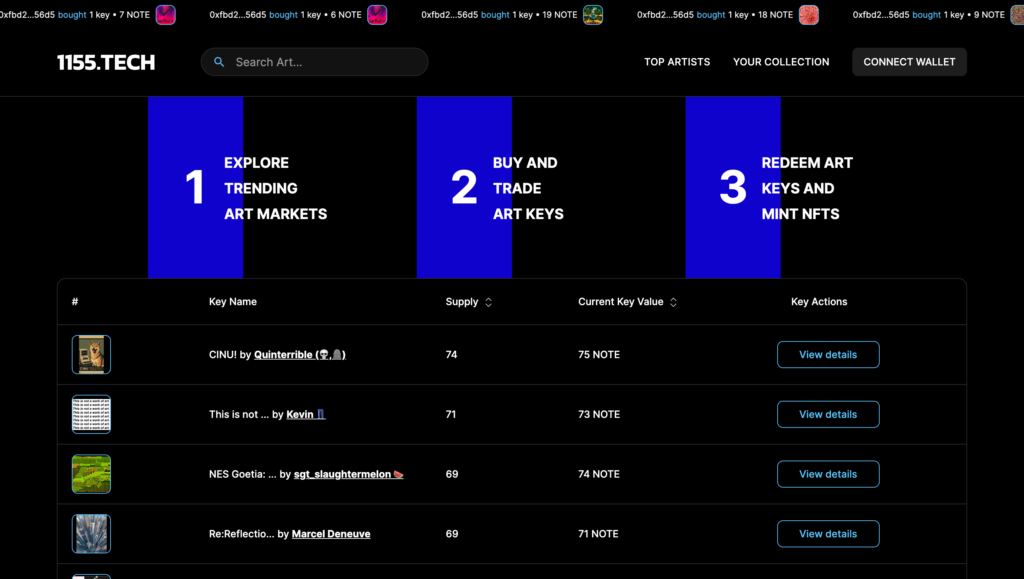

- Launch of FortunaFi’s “Tokenized Asset Protocol”: The report anticipates the launch of FortunaFi’s “Tokenized Asset Protocol” on Canto and the CLM. The fBILL product is expected to have lower fees than USYC, which should marginally push up NOTE rates.

- Rollout of Additional RWA Products: The report also anticipates the rollout of additional RWA products covering High Yield Corporate Debt and Private Credit by HiYield and Anzen respectively. These RWAs will be rolled out alongside a new lending market built on Canto called vivacity.finance.

Role of Vivacity in Neofinance Architecture

- Isolation of Risk: The report explains that Vivacity allows users to leverage riskier real world assets without increasing the risk of NOTE. In a bad debt scenario, the risk is isolated to cNOTE lenders in the relevant lending market and does not risk the solvency of NOTE backing.

Actionable Insights

- Investigate the Potential of Neofinance: The report suggests that the Neofinance strategy of Canto, which allows users to access rates close to the underlying rates on a variety of RWAs across the risk spectrum, could be a promising area for further exploration.

- Monitor Upcoming Developments: The upcoming launch of FortunaFi’s “Tokenized Asset Protocol” and the rollout of additional RWA products could have significant implications for Canto and the CLM. These developments should be closely monitored.

- Consider the Role of Vivacity: The role of Vivacity in the Neofinance architecture, particularly in isolating risk, could be an important factor to consider when evaluating the potential of Canto and its associated projects.