Research Summary

The report discusses the recent trends in the crypto market, focusing on the performance of Solana and Chainlink. It also highlights the stabilization of total stablecoins as a key market indicator and the growth of Tron’s on-chain activity. The report further introduces a tool, Pulsar, for tracking portfolios across any chain and mentions an upcoming research call and DeFi course.

Key Takeaways

Solana’s Market Rally

- Solana’s Performance: Solana broke above $30, and SOL/ETH hit its highest point in over a year. The report suggests that the best returns come from non-consensus assets like SOL that later become consensus assets.

- Nonlinear Growth: The report highlights that nonlinear growth in a single app can propel one ecosystem above others, as seen in the Solana ecosystem.

Chainlink’s Bullish Trend

- Chainlink’s Performance: Chainlink was one of the strongest performers among majors, with a 35% increase in 7 days. It has positioned itself at the apex of several ongoing narratives, including infrastructure for tokenizing real-world assets and the connection between traditional finance and DeFi.

Stablecoins Stabilize

- Stablecoin Trend: The total stablecoins in the crypto market have been flat for 3 months, a trend not seen since early 2022. As most stablecoins are backed by external collateral, they can be a proxy for capital in the crypto markets.

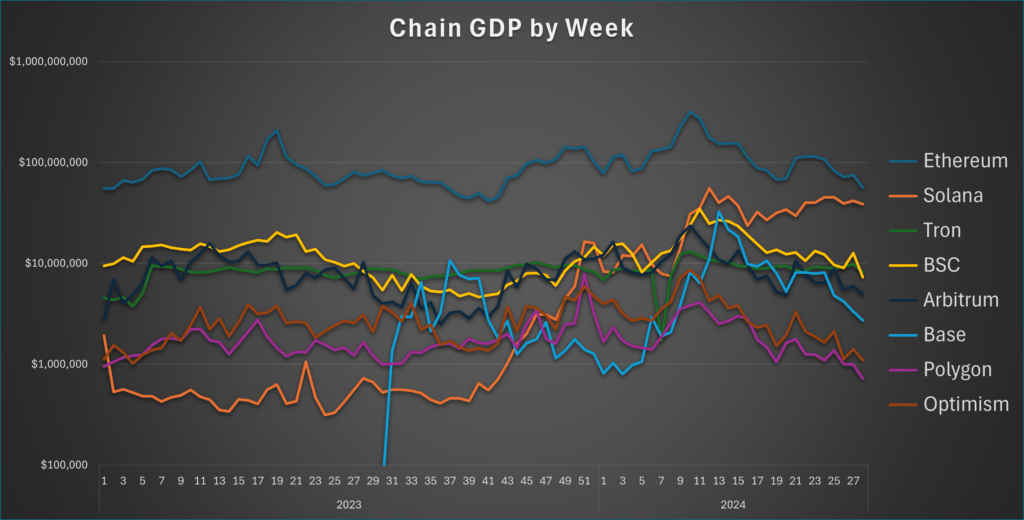

Tron’s On-Chain Growth

- Tron’s Performance: Tron’s on-chain activity has been growing over the past few years, with transfer volume of hot tokens on a long-term uptrend since 2019. Its TVL broke its all-time high from late 2021 last week, the only major chain to do so.

Pulsar: A Multi-Chain Portfolio Tracker

- Tool Spotlight: Pulsar is a portfolio tracker compatible with every chain, including Solana. It is useful for those venturing to non-EVM wallets.

Actionable Insights

- Investigate Solana’s Ecosystem: With Solana’s recent rally, it may be worth looking deeper into the Solana ecosystem and its potential for nonlinear growth.

- Consider Chainlink’s Position: Chainlink’s strong performance and its positioning at the apex of several ongoing narratives suggest it may be a key player in the crypto market.

- Monitor Stablecoin Trends: The stabilization of total stablecoins could be a significant indicator of capital in the crypto markets, and it’s worth keeping an eye on this trend.

- Explore Tron’s Growth: Tron’s on-chain activity has been growing, and its recent performance suggests it may be an under-the-radar opportunity in the crypto market.

- Utilize Pulsar: For those venturing into non-EVM wallets, Pulsar could be a useful tool for tracking portfolios across any chain.