Research Summary

This week’s report offers a deep dive into various market phenomena, from the surge in retail theft and the performance of quick-serve restaurants to the dynamics of the money supply. It also touches on the tech sector’s valuation, the state of the housing market, and the implications of rising interest rates. The report provides a multi-faceted look at the current economic landscape.

Key Takeaways

Retail Theft on the Rise

- Alarming Trends: Retail theft has more than doubled since 2015, posing a significant concern for investors.

- Policy Impact: Some states have reduced theft law enforcement, exacerbating the issue.

- Economic Factors: Inflation and the cost of living crisis in the US are likely contributing to the problem.

Quick Serve Restaurants Thriving

- Standout Performers: McDonald’s and Chick-fil-A are leading in sales per store.

- IPO Potential: The strong performance raises questions about potential IPOs in this sector.

- Consumer Behavior: The data suggests a shift in consumer dining preferences.

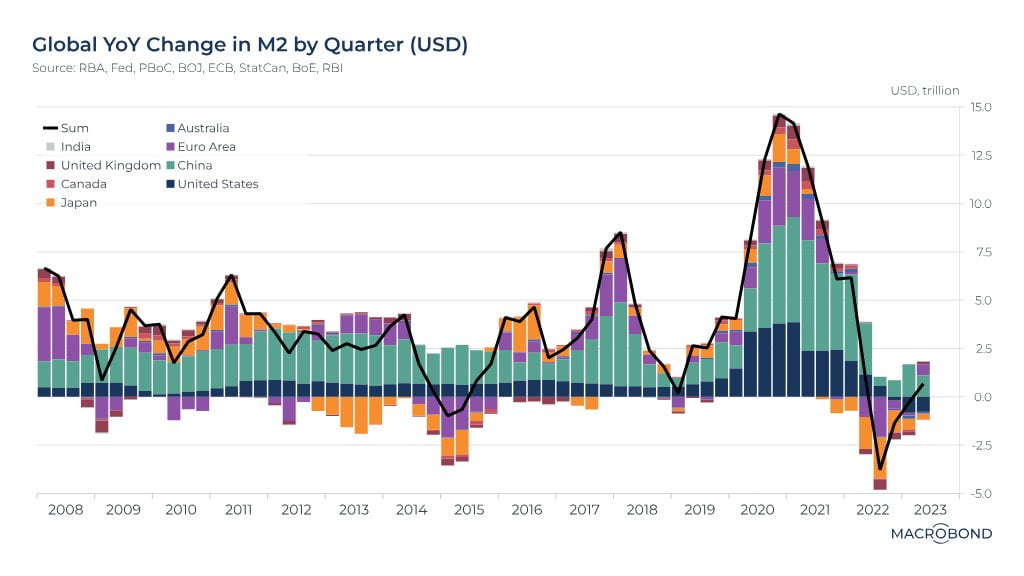

Money Supply and Economic Activity

- Rising Global M2: An increase in money supply from major economies is buoying economic activity.

- Broken Correlation: Despite the rise in money supply, it does not account for the gains in US stocks.

- Risk Appetite: The rise in money supply has also increased the appetite for risk in the market.

Actionable Insights

- Investor Caution: Given the rise in retail theft, investors should exercise caution in retail stocks.

- Food Sector Opportunities: The strong performance of quick-serve restaurants suggests potential investment opportunities.

- Monitor Money Supply: Keep an eye on global money supply metrics as they could influence market trends.