Research Summary

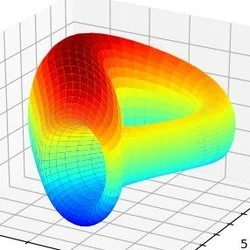

The report is a detailed explanation of the LLAMMA (Lending-Liquidating AMM Algorithm) mechanism used by Curve Finance in its lending protocol. The mechanism aims to improve the overcollateralized DeFi lending process by introducing “soft liquidation” which gradually liquidates collateral over a price range instead of a sudden liquidation at a specific price. Borrowers deposit collateral into a LLAMMA and receive debt in Curve’s stablecoin, crvUSD. The collateral is spread across a user-specific set of “bands,” creating the “liquidation range.” The design creates arbitrage opportunities to incentivize third parties to interact with the pool, which in turn operates the soft liquidation process.

Actionable Insights

- Understanding LLAMMA: LLAMMA is a novel mechanism that improves the overcollateralized DeFi lending process by introducing “soft liquidation”.

- Role of Arbitrageurs: The design of LLAMMA creates arbitrage opportunities which incentivize third parties to interact with the pool, thereby operating the soft liquidation process.

- Use of crvUSD: To open a loan, borrowers deposit collateral into a LLAMMA and receive debt in Curve’s stablecoin, crvUSD.

- Understanding Liquidation Range: The collateral is spread across a user-specific set of “bands,” creating the “liquidation range.” The number of bands controls the spread of collateral across the range.