Research Summary

The report covers a range of topics including the potential swap of $ARB tokens into USDC by 1inch, the launch of ether.fi’s liquid staking token eETH, Uniswap Labs’ earnings, Grayscale’s Solana Trust (GSOL) trading at a premium, Ondo Finance’s partnership with Axelar, Ryan Wyatt joining Optimism, Crypto Fund inflows, and the rise in spot crypto trading volumes. It also discusses Vertex Protocol’s tokenomics, ZachXBT’s revelation about the GROK token, a proposal to backfund successful Arbitrum STIP proposals, and a fake BlackRock iShares XRP Trust Entity filing.

Key Takeaways

1inch’s Potential Swap and eETH’s Launch

- 1inch’s ARB-USDC Swap: A proposal to swap $3 million of $ARB tokens into USDC has been published for vote via 1inch’s Snapshot. The $ARB tokens were received by 1inch as part of Arbitrum’s airdrop in March 2023.

- eETH Goes Live: ether.fi’s liquid staking token, eETH, has gone live on mainnet. Currently, only whitelisted users can mint eETH, with more users to be whitelisted in the coming days.

Uniswap Labs’ Earnings and GSOL’s Premium

- Uniswap Labs’ Million-Dollar Earnings: Uniswap Labs has made over $1 million in the 27 days since turning on the 0.15% fee switch for the Uniswap Protocol last month.

- GSOL’s Trading Premium: Grayscale’s Solana Trust (GSOL) is trading at a 283% premium compared to the spot SOL price. GSOL’s volume was $1.45 million, with a 30-day average volume of 2868 shares ($456,012 at $159 a share).

Ondo-Axelar Partnership and Wyatt’s Move to Optimism

- Ondo Finance Partners with Axelar: Ondo Finance has partnered with Axelar to make their short-term US treasury bill backed and yield-bearing stablecoin, USDY, bridgeable across chains. Initially, bridging for the token will only be available between Ethereum and Mantle.

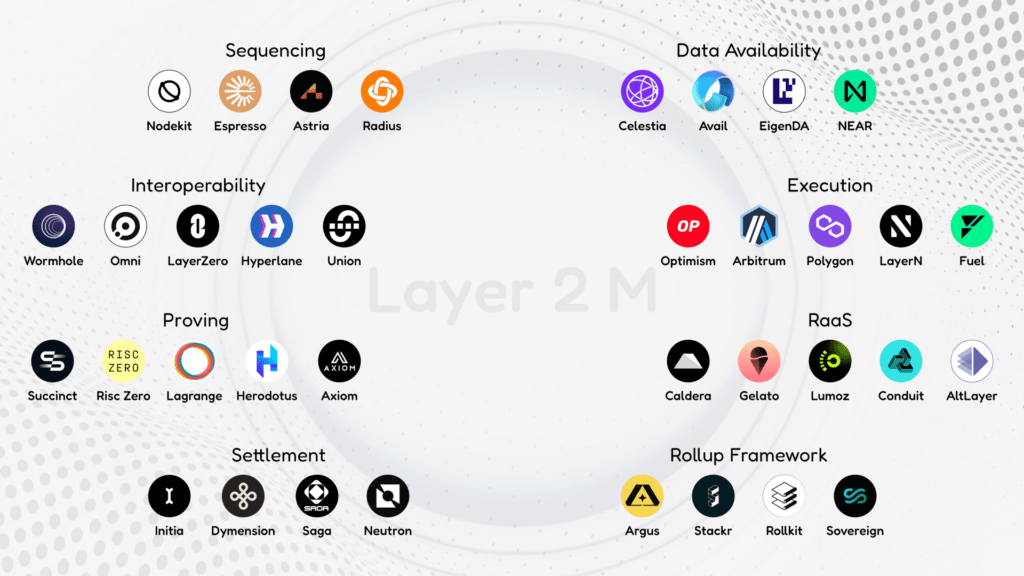

- Ryan Wyatt Joins Optimism: Ryan Wyatt, former president at Polygon Labs and previously head of gaming for 7 years at Youtube, has joined Optimism as their Chief Growth Officer. He will lead business development, marketing and partnerships strategies among other initiatives.

Crypto Fund Inflows and Trading Volumes

- Weekly Crypto Fund Inflows: Last week, weekly Crypto Fund inflows reached $293 million. Bitcoin inflows accounted for $240 million (81%) of that sum and Ethereum took second place with $49m million of total inflows. The year-to-date inflows have also totalled to $1.14 billion, the third highest yearly inflows on record.

- Rise in Spot Crypto Trading Volumes: Spot crypto trading volumes rose by 57.5% in October compared to September’s volumes.

Actionable Insights

- Investigate the Potential of eETH: With the launch of ether.fi’s liquid staking token eETH, it may be worth exploring the potential of this token as more users are whitelisted to mint it.

- Monitor GSOL’s Trading Activity: Given the significant premium at which GSOL is trading compared to the spot SOL price, it could be beneficial to keep a close eye on its trading activity.

- Consider the Impact of Partnerships: The partnership between Ondo Finance and Axelar to make USDY bridgeable across chains could have implications for the cross-chain interoperability of other tokens.

- Assess the Influence of Key Industry Moves: Ryan Wyatt’s move to Optimism as their Chief Growth Officer could potentially impact the company’s growth and development strategies.

- Track Crypto Fund Inflows: The significant inflows into Crypto Funds, particularly into Bitcoin and Ethereum, could indicate market sentiment and potential trends.