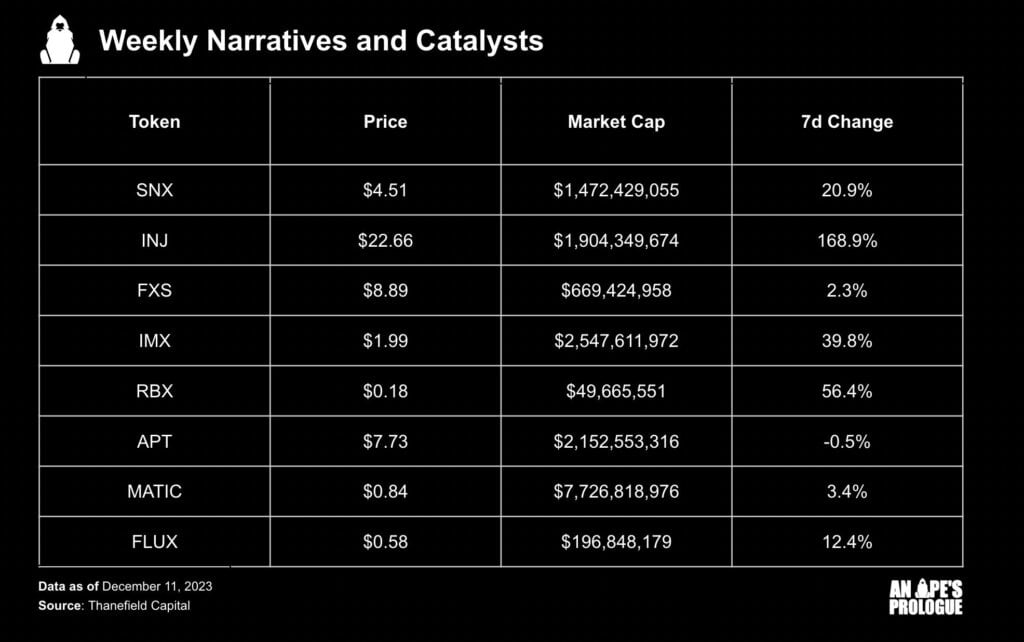

Research Summary

The report provides a comprehensive analysis of Synthetix, a leading DeFi protocol for synthetic assets and perpetual futures trading. It covers various aspects of the platform including revenue generation, perps market, user metrics, and the SNX token. The report highlights that Synthetix’s primary revenue comes from trading fees for perpetual futures and their liquidations. The perps market has seen significant adoption since March, with Kwenta being the primary frontend. However, atomic swaps have not seen much adoption lately. The report also provides insights into user retention, debt pool, and liquidations within Synthetix.

Actionable Insights

- Monitor User Retention: Synthetix’s one-week retention rate is around 15%, indicating the need for strategies to improve user retention.

- Focus on Perps Market: The perps market has shown product-market fit with significant adoption since March. This area should be the focus for further development and marketing efforts.

- Understand Liquidations: There are two types of liquidations within Synthetix – perps liquidation and SNX stakers. Understanding these can help in better risk management.

- Track SNX Token Metrics: Monitoring various metrics surrounding the SNX token, including price, supply on both the L1 and L2, and vesting events can provide valuable insights for investment decisions.