Research Summary

The report discusses the current state of the market, suggesting it is overbought and investors are fully invested. It highlights the potential for a recession, with signs of deflation and a weakening consumer market. The report also points out the overvaluation of stocks compared to Treasury bonds and the collapse of tech stocks and oil prices.

Key Takeaways

Market Overbought and Investors Fully Invested

- Market Peak: The report suggests that the market has peaked too early for an end-of-year rally, indicating that it is overbought and investors are fully invested.

Recession and Deflation Indicators

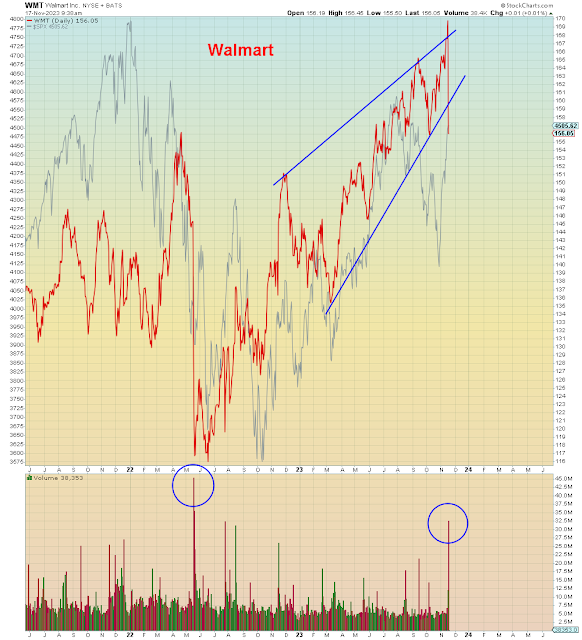

- Recession Indicators: The report points out signs of a potential recession, including lower prices and cautious consumer spending. It also mentions a warning from Walmart’s CEO about imminent deflation due to a weakening consumer market.

- Deflation Signs: The report highlights the collapse of oil prices and Walmart’s stock as signs of deflation.

Overvaluation of Stocks

- Stock Overvaluation: The report suggests that under a recession scenario, stocks are massively overvalued compared to Treasury bonds.

Tech Stocks and Oil Prices Collapse

- Tech Stocks Collapse: The report points out that tech stocks are completing the fifth wave blow-off top that started in the fourth quarter of the previous year, indicating a potential collapse.

- Oil Prices Collapse: The report also highlights the collapse of oil prices, which it suggests has come as a shock to oil analysts on Wall Street.

End of Cycle

- End of Cycle: The report concludes by suggesting that the market is facing the end of the cycle, with the potential for a bank run and tech collapse at the end of the year.

Actionable Insights

- Monitor Market Conditions: Given the report’s suggestion of an overbought market and potential recession, it would be prudent to closely monitor market conditions and economic indicators.

- Assess Investment Portfolio: Investors may want to assess their portfolios in light of the report’s findings, particularly the potential overvaluation of stocks and the collapse of tech stocks and oil prices.

- Investigate the Potential of Treasury Bonds: With the report suggesting that stocks are overvalued compared to Treasury bonds, it may be worth investigating the potential of Treasury bonds as an investment.