Research Summary

The report discusses five promising DeFi farming platforms: Ambient Finance, Ekubo, Maverick Protocol, GMX, and Pendle. These platforms offer lucrative yields and potential airdrops, with some operating across multiple chains and ecosystems such as Ethereum, zkSync, and BNB.

Key Takeaways

Ambient Finance: Hybrid Liquidity and Gas Optimizations

- Ambient’s Unique Approach: Ambient Finance, a decentralized exchange (DEX), uses a hybrid liquidity model and gas optimizations through a single smart contract. This approach aims to address the liquidity fragmentation and gas inefficiency issues prevalent in major DEXs.

- Anticipated Airdrop: Ambient, which raised funds at an $80M valuation earlier this year, is expected to conduct an airdrop in the near future. The platform has also recently launched on Scroll, allowing users to farm two airdrops simultaneously.

Ekubo: Concentrated Liquidity DEX within Starknet Ecosystem

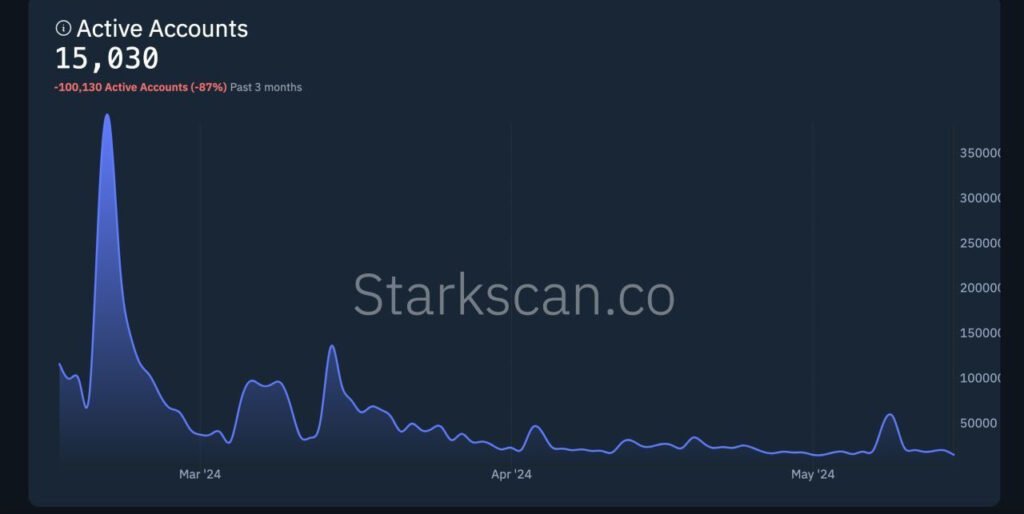

- Ekubo’s Position: Ekubo is a premier concentrated liquidity DEX within the Starknet ecosystem. Despite deciding not to proceed with their raise from the Uniswap DAO, Ekubo is still worth considering for a potential airdrop.

- Lucrative Yields: The volume these pools are receiving makes this platform quite lucrative, and these yields are expected to improve once $STARK is released.

Maverick Protocol: Capital-Efficient AMMs

- Maverick’s Performance: Maverick Protocol has emerged as one of the most capital-efficient automated market makers (AMMs) recently. The platform offers numerous yield opportunities across Ethereum mainnet, zkSync, and BNB.

- Season 2 Airdrop: Maverick is currently in the middle of their Season 2 airdrop, and liquidity providers (LPs) can earn lucrative yields across various chains. Users can potentially double up on their airdrop by providing liquidity on zkSync or Base.

GMX: Leading Perps Exchange on Arbitrum

- GMX’s Position: GMX is the leading perpetuals exchange on Arbitrum. The platform has secured a substantial STIP ARB grant, which is being used to incentivize liquidity on the V2 pools.

- Lucrative Pools: With ARB incentives live and market volatility starting to re-emerge, the GM pools are extremely lucrative at the moment, offering APYs and APRs ranging from 27% to 70% on various pairs.

Pendle: Attractive Yields and Growing Integrations

- Pendle’s Offerings: Pendle remains a favorite place to park capital for attractive yields. The platform continues to grow with more integrations and features, becoming a liquidity black hole.

- Yield Opportunities: While there are plenty of chains to farm on Pendle, the report highlights the most attractive pairs residing on Arbitrum, offering APRs ranging from 29% to 46%.

Actionable Insights

- Consider Diversified Farming: The report suggests that DeFi enthusiasts could consider farming on multiple platforms and chains to maximize yield opportunities and potential airdrops.

- Stay Updated on Airdrop Announcements: Platforms like Ambient Finance and Maverick Protocol are expected to conduct airdrops in the near future. Staying updated on these announcements could provide additional yield opportunities.

- Explore Emerging Platforms: Newer platforms like Ekubo and GMX are offering lucrative yields and have potential for growth. Exploring these platforms could provide early entry benefits.