Research Summary

The report discusses the incentive structures behind financial products and complex crypto schemes. It focuses on the dynamics of crypto markets, particularly the actions of retail investors, venture capitalists, and developers. The report also delves into the tokenomics of specific projects like LooksRare and Kasta, highlighting the importance of understanding the incentives of all market participants.

Key Takeaways

Understanding Incentives in Crypto Markets

- Importance of Incentives: The report emphasizes the importance of understanding the incentives behind financial products and crypto schemes. These incentives often drive the actions of market participants.

- Role of Retail Investors: Retail investors in crypto markets often react to the actions of teams and venture capitalists, such as selling tokens or disagreeing with proposals. Understanding these reactions requires a deep understanding of the incentives at play.

- Complexity of Crypto Schemes: The report highlights the complexity of crypto schemes, using the example of LooksRare, a competitor of OpenSea. It discusses the drama surrounding LooksRare’s token incentives and the reactions of market participants.

Case Study: LooksRare

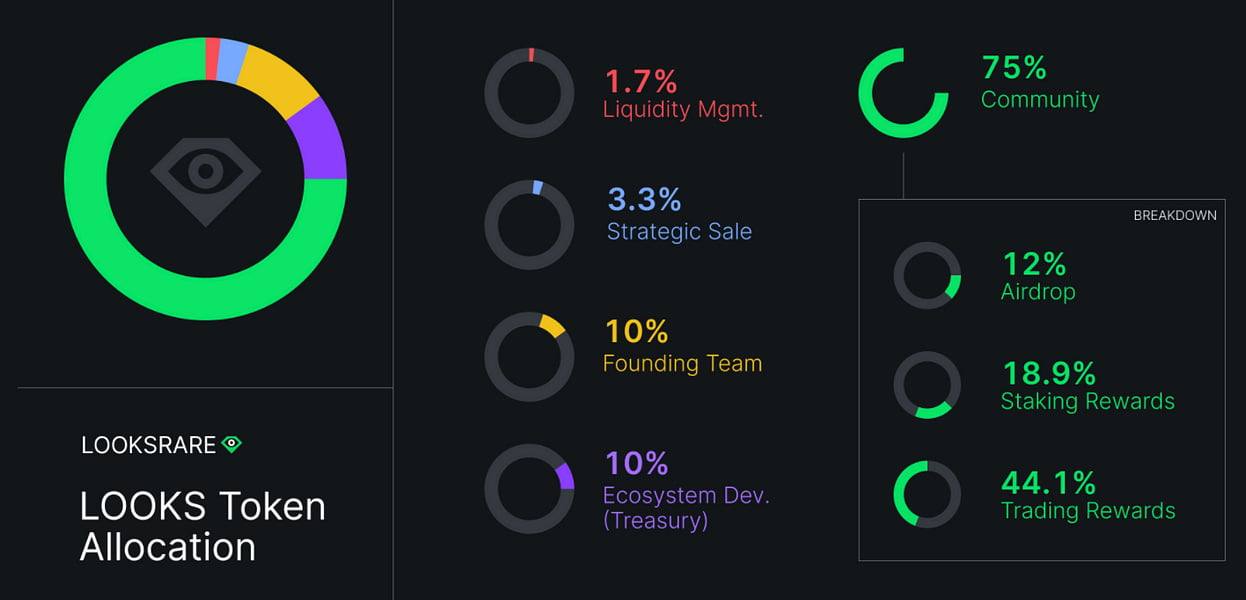

- Token Incentives: The report provides a detailed analysis of LooksRare’s token incentives. It explains how the team earned 10,000 WETH through staking and how the tokenomics were public since day one.

- Market Reactions: The report discusses the market’s reactions to LooksRare’s actions, highlighting the importance of understanding the incentives of all market participants.

- Future Implications: The report suggests that LooksRare could become an interesting community-owned alternative to OpenSea if it can sustain real volume. It also notes that the fees are already distributing mostly to the community, and their share will only increase over time.

Case Study: Kasta

- Token Launch: The report analyzes the launch of Kasta, a token released by popular crypto YouTuber ‘TheMoonCarl’. It discusses the incentive structure of the project and the subsequent market reactions.

- Market Participants: The report identifies the different market participants in Kasta’s launch, including investors, the team/company, retail traders, and market makers. It explains their respective incentives and how these influenced the market dynamics.

- Market Dynamics: The report explains why Kasta’s market only went down after its launch. It attributes this to the introduction of new sellers (investors and team members) without the introduction of new buyers.

Actionable Insights

- Understanding Incentives: Investors and market participants should strive to understand the incentives behind financial products and crypto schemes. This understanding can help predict market dynamics and make informed decisions.

- Considering All Market Participants: When analyzing a crypto scheme, it’s crucial to consider the incentives of all market participants, not just retail investors. This includes the team, venture capitalists, and developers.

- Learning from Case Studies: Case studies like LooksRare and Kasta provide valuable insights into the dynamics of crypto markets. Investors can learn from these examples to better understand the potential outcomes of different incentive structures.