Research Summary

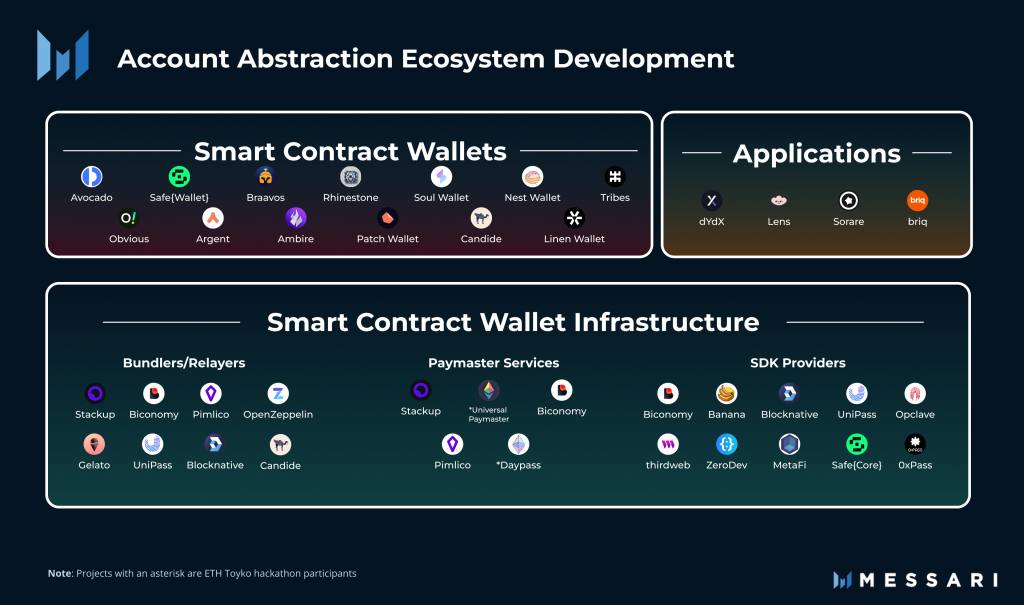

The report provides an in-depth analysis of the multi-chain smart contract wallets, focusing on their growth, features, and the financial backing they have received. It highlights the increasing number of active accounts and transactions, and the spread of UserOps across different chains. The report also reviews several smart contract wallets, including ZeroDev Kernel, Biconomy, CyberAccount, Alchemy Account Factory, and Echooo Wallet, among others.

Key Takeaways

Surge in Multi-Chain Smart Contract Wallets

- Record-breaking growth: In August, the number of active accounts for multi-chain smart contract wallets reached 443,600, setting a new historical high. The number of multi-chain smart contract wallet accounts accumulated over 840,000 successful transactions, a month-on-month increase of 45.6%.

- Diversification of UserOps: Unlike July, where 96% of UserOps were concentrated on Polygon, August saw UserOps spread across chains like Optimism, Arbitrum, Polygon, Avalanche, and Base.

ZeroDev Kernel: A Widely Deployed Smart Contract Wallet

- Leading the pack: ZeroDev Kernel is the most widely deployed smart contract wallet on the major EVM networks, with over 580,000 accounts deployed across multiple chains.

- Feature-rich: ZeroDev offers features such as Gas sponsorship, transaction batching, session keys, social recovery, automatic transactions, and multi-signature. It also allows developers to build DIY smart contract wallet plugins to extend wallet features.

Biconomy: A Modular SDK for Building dApps

- Smart Contract Wallet as a System Component: Biconomy offers a modular SDK, introducing the smart contract wallet as a fundamental component of the system. It’s specifically designed for building dApps socially around the ERC-4337 account abstraction.

- Financial Backing: In 2021, Biconomy raised $10.5 million from investors including Coinbase Ventures, Binance Labs, Fenbushi Capital, and Huobi Ventures. They have also launched the BICO Token with a market cap of approximately $138 million.

CyberAccount: A Smart Contract Wallet by CyberConnect

- Significant Traffic: CyberAccount, launched by the decentralized social network CyberConnect, brought significant traffic to the smart contract wallet accounts for the Polygon and Optimism networks around the end of July and the beginning of August.

- Funding and Market Cap: Between 2021–2023, CyberConnect raised $30.4 million from investors such as Animoca Brands, IOSG, Delphi Digital, and Protocol Labs. They have also launched the CYBER Token with a market cap of approximately $66 million.

Alchemy Account Factory: A Web3 Development Platform

- Leading Deployer on Arbitrum: Nearly 250,000 smart accounts deployed using the Alchemy API belong to Account Factory, with 237,000 on Arbitrum, making it the largest smart contract wallet deployer on Arbitrum.

- Investment Received: Between 2019–2022, Alchemy raised $545 million from investors including Coinbase Ventures, a16z, Pantera Capital, and Redpoint Ventures.

Actionable Insights

- Investigate the Potential of Multi-Chain Smart Contract Wallets: With the surge in the number of active accounts and transactions, multi-chain smart contract wallets are gaining traction. Stakeholders should explore the potential of these wallets and their impact on the blockchain ecosystem.

- Consider the Features of Different Wallets: Each smart contract wallet offers unique features. Stakeholders should consider these features when choosing a wallet for their needs.

- Assess the Financial Backing of Wallets: The financial backing a wallet has received can indicate its potential for growth and development. Stakeholders should assess this when considering investment or partnership opportunities.