Research Summary

This report provides an in-depth analysis of Lybra Finance, a platform that aims to maximize the utility of Liquid Staking Tokens (LSTs) in the decentralized finance (DeFi) sector. Lybra’s primary mission is to create an interest-bearing stablecoin, eUSD, which is secure, decentralized, and delivers real yield to its holders. The report also discusses the introduction of peUSD, a version of eUSD with wider utility for DeFi applications, and the potential of the largely untapped LST market.

Key Takeaways

Lybra’s Mission and Offerings

- Interest-bearing stablecoin: Lybra’s primary mission is to create an interest-bearing stablecoin, eUSD, which is secure, decentralized, and delivers real yield to its holders. This is achieved by allowing users to mint eUSD by depositing their ETH and other supported LSTs as collateral.

- Introduction of peUSD: Lybra V2 introduces an Omnichain version of eUSD, called peUSD (pegged eUSD), which represents the underlying DeFi-utility of eUSD, unlocking wider utility for DeFi applications. Both eUSD and peUSD can be converted at a ratio of 1:1 through the protocol.

- Stability and Confidence: eUSD, an over-collateralized asset, offers users much-needed stability in the volatile cryptocurrency market. Meanwhile, peUSD provides users the confidence for transacting in DeFi, with its wide-ranging use cases.

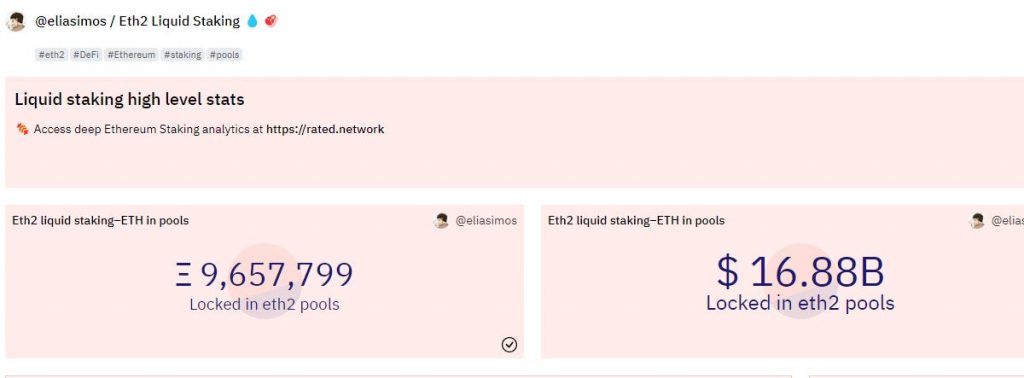

Untapped Potential of the LST Market

- Current Market Status: Despite the ongoing excitement around LSTs, only 17.9% of ETH is staked, leading to an astounding $17 billion worth of ETH lying idle. This suggests considerable untapped potential in the LST market.

- Increasing the TVL of staked ETH: To increase the total value locked (TVL) of staked ETH, it’s crucial to augment the utility of LSTs. Lybra Finance aims to address this by creating the crucial profit-generating utility that LST’s require to fully realize their enormous potential.

Lybra’s Innovative Approach

- Addressing the Stablecoin Challenge: Traditional stablecoins do not offer any interest, leaving them susceptible to persistent devaluation due to USD inflation. Lybra Finance’s interest-bearing stablecoin, eUSD, addresses this challenge.

- Utilizing LSTs as Collateral: Lybra Finance allows users to utilize LSTs as collateral to mint the interest-bearing stablecoin, eUSD. Users can deposit either ETH or LSTs, and borrow against it to obtain eUSD, repaying their debt at a later time.

- Stable Income: Unlike traditional stablecoins, simply holding eUSD produces a stable income with an annual percentage yield (APY) of approximately 8%. This approach perfectly leverages the liquidity offered by LSTs.

Actionable Insights

- Exploring the Potential of LSTs: Given the untapped potential of the LST market, it may be beneficial to explore the opportunities offered by platforms like Lybra Finance that aim to maximize the utility of LSTs in the DeFi sector.

- Considering the Benefits of eUSD: For those seeking stability in the volatile cryptocurrency market, considering the use of eUSD, an over-collateralized asset that offers much-needed stability and delivers real yield to its holders, could be a viable option.

- Understanding the Utility of peUSD: With its wide-ranging use cases, peUSD provides users the confidence for transacting in DeFi. Understanding its utility and how it can be converted at a ratio of 1:1 with eUSD through the protocol could be beneficial.