Research Summary

The report provides an analysis of Maker’s EDSR (Ethereum Dai Savings Rate) initiative, highlighting its impact on $DAI supply, TVL, and the system surplus buffer. It discusses the revised yield structure, borrow rates, and strategies to retain speculative capital and encourage regular $DAI users. The report also outlines upcoming revisions to optimize costs and reinforce market trust in the protocol.

Key Takeaways

EDSR’s Impact on $DAI Supply and TVL

- Quadrupled Deposits: A week after EDSR’s launch, $DAI in the DSR has quadrupled, with notable depositors contributing at least 9% of the TVL individually.

- Boosted Supply: The initiative has increased the $DAI supply by $1B within a week, marking a 20% increase and pushing the protocol past half of its 10B $DAI target.

- Utilization Rate: With the utilization rate surpassing 25%, the EDSR is set to decrease to 5.6%, mainly benefiting $ETH / $stETH whales and arbitrageurs.

System Surplus Buffer and Profit Projection

- Decreased Surplus: The System Surplus buffer has decreased by $20M this week, mainly due to EDSR payouts, projected to fall below $50M within a week.

- Profit Projection: Maker’s profit projection has sharply dropped from $84.9M to $11.1M, with a downtrend expected to continue while the EDSR is active.

- Potential Risks: The scenario could lead to FLOP auctions, posing a dilution risk for $MKR holders.

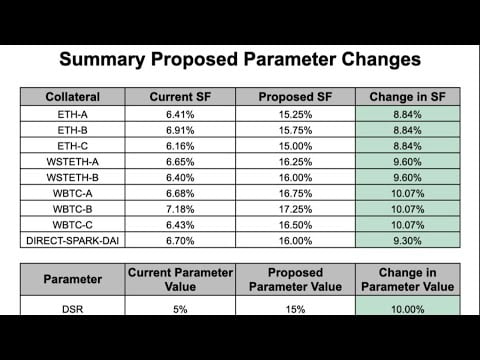

Revised Yield Structure and Borrow Rates

- Revised Yield Structure: MakerDAO’s founder, Rune, has proposed a revised yield structure of 5% for 0-35% utilization and 4.15% for 35-50% utilization.

- Aligning Borrow Rates: To address the overshadowing of regular $DAI users by whales, Rune suggests aligning borrow rates with the EDSR, excluding certain vaults.

- Strategy for Regular Users: An $SPK pre-farming airdrop for Spark Protocol borrowers is introduced to retain speculative capital and encourage regular $DAI users.

Upcoming Revisions and Market Trust

- Optimizing Costs: Upcoming revisions to the EDSR parameters aim to optimize the program’s costs for better efficiency.

- Reinforcing Trust: The strategy aims at reinforcing market trust in the protocol and its Lindy effect.

- Monitoring TVL: Observers will be watching closely how much of the current TVL will stay following these updates.

Actionable Insights

- Investment Opportunities: The quadrupling of $DAI in the DSR and the 20% increase in supply may present investment opportunities.

- Risk Management: The decrease in the System Surplus buffer and potential dilution risk for $MKR holders require careful risk assessment.

- Strategic Alignment: Aligning borrow rates with the EDSR and introducing an $SPK pre-farming airdrop may enhance user engagement and trust.

- Monitoring and Adaptation: Close monitoring of TVL and upcoming revisions to the EDSR parameters will be essential for stakeholders to adapt to changes in the protocol.