Research Summary

The report discusses the performance of various markets, including the S&P 500, bonds, gold, and the DXY. It suggests that the S&P 500 is likely to reach new highs, while bonds may see more upside in the short term. Gold has broken out of a multi-year sideways range, indicating a potential rise in 2024. The DXY is at a key level, with a close below its recent breakout level potentially leading to further downside. The report also highlights the bullish setup in the Dow and the strong performance of Japan’s Nikkei.

Key Takeaways

Market Performance and Predictions

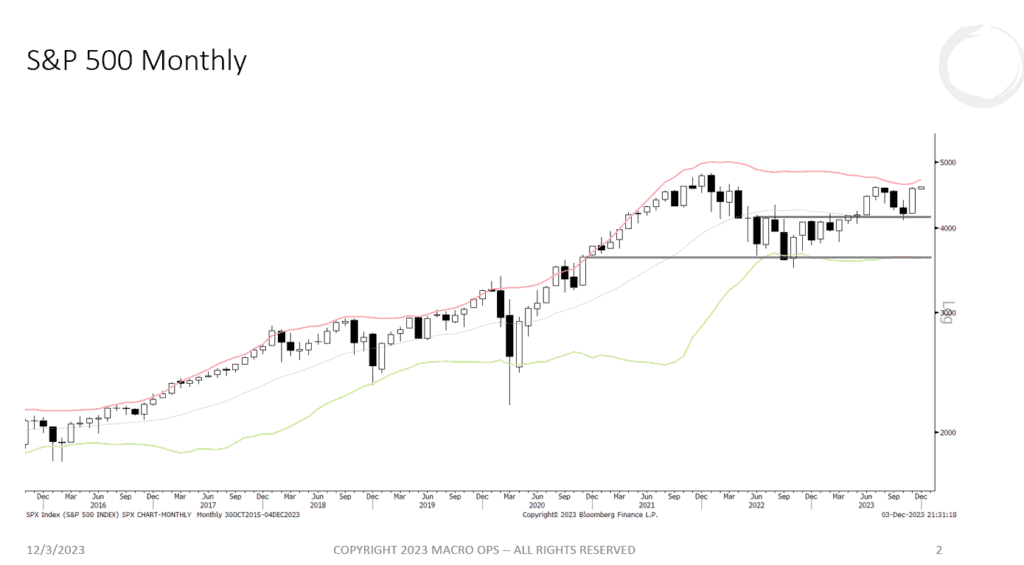

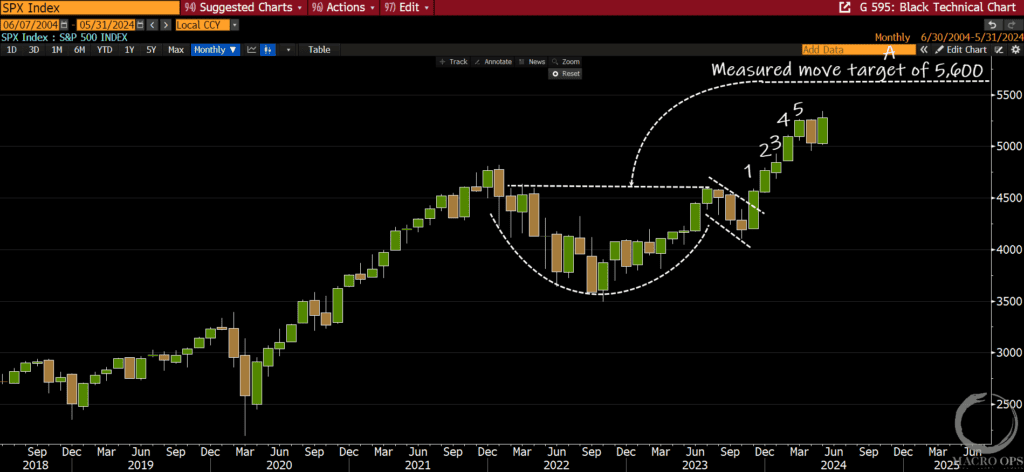

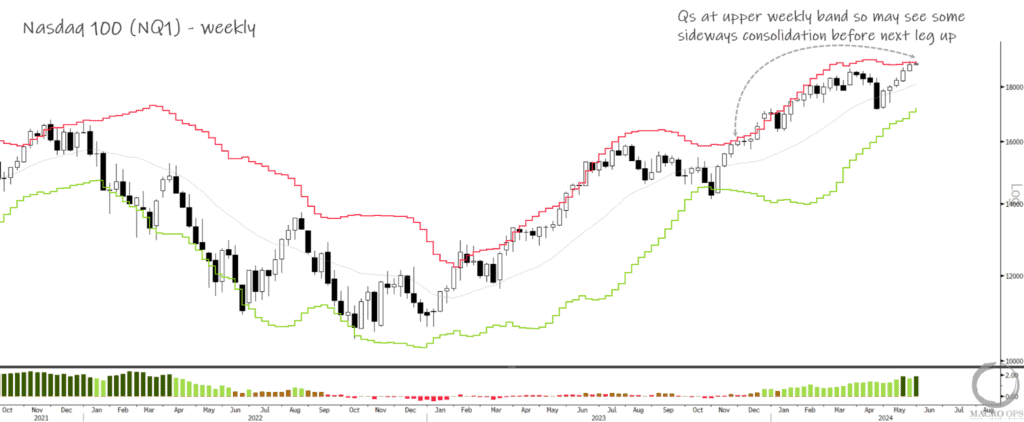

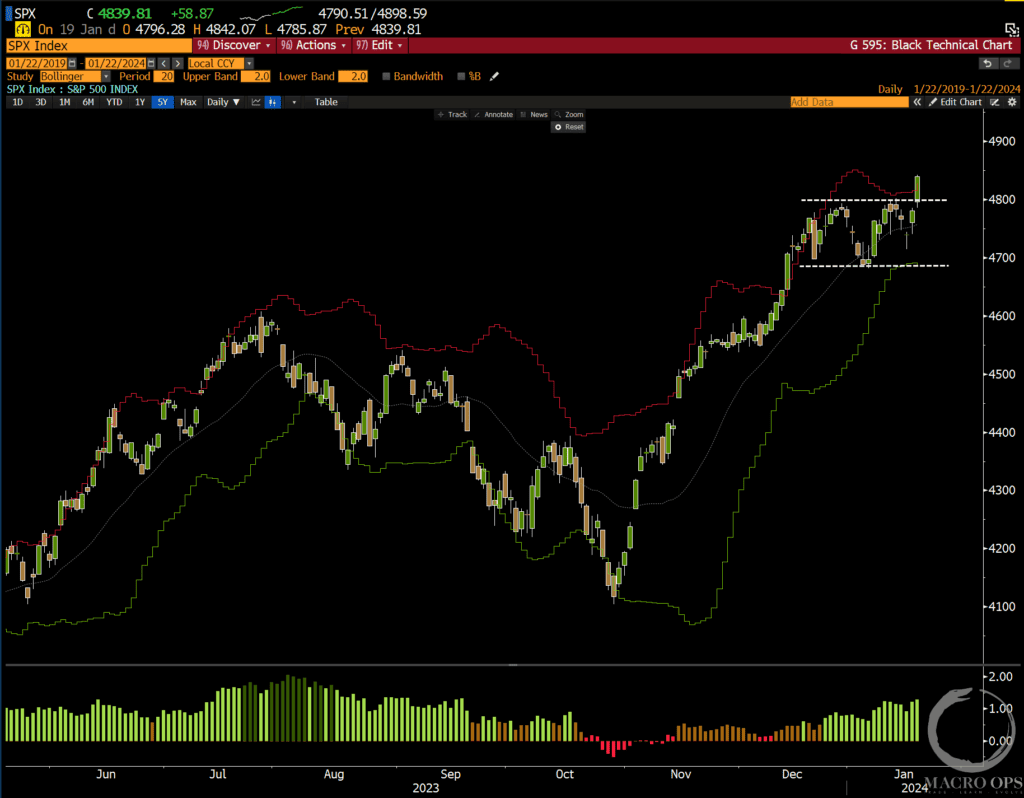

- S&P 500’s Potential Highs: The S&P 500 closed strongly in November and is now within 5% of its all-time high. The report suggests that the odds favor a breakthrough to new highs in the coming months.

- Bonds’ Reversal and Future Outlook: Bonds, which had a parabolic selloff down to their lower monthly Bollinger Band in October, are likely to see more upside in the short term. However, the report warns of potential renewed weakness.

- Gold’s Breakout: Gold has closed above its key $2,000 level, signaling a strong breakout from a multi-year sideways range. This suggests that gold prices could rise significantly in 2024.

- DXY’s Key Level: The DXY closed near its lows for the month and is now at a key level. A close below its recent breakout level could invalidate the move and increase the likelihood of further downside.

Specific Market Insights

- Bullish Setup in the Dow: The Dow has shown a bullish setup, with crowded short positioning and strong technicals. November saw the Dow complete an inverted head and shoulders continuation chart, with a measured move target for this breakout around 40,000.

- Market Internals Support Bullish Trend: Despite the market being stretched in the short term, the report suggests that the bull side is still favorable as liquidity continues to ease and market internals support the broader upward trend.

- Japan’s Nikkei Performance: Japan’s Nikkei saw a strong bullish thrust out of its 3-month pullback consolidation in November. The report suggests placing a buy stop above the recent daily consolidation area to confirm technical follow-through.

Actionable Insights

- Monitor Gold’s Performance: Given gold’s breakout from a multi-year sideways range, it could be beneficial to closely watch its performance and potential pullbacks for investment opportunities.

- Consider the DXY’s Position: With the DXY at a key level, it’s crucial to monitor its movement. A close below its recent breakout level could signal further downside, affecting investment decisions.

- Observe the Dow’s Bullish Setup: The Dow’s bullish setup and potential for a breakout around 40,000 suggest that investors should keep a close eye on its performance.

- Assess Japan’s Nikkei: The strong performance of Japan’s Nikkei indicates potential investment opportunities. Consider placing a buy stop above the recent daily consolidation area to confirm technical follow-through.